National Tax Service Launches Tax Audit on 17 "Essential Goods Price Gouging Tax Evaders"

"Unfair Practices Lead to Overcharging Consumers"

Suspected Tax Evasion Amounts to 400 Billion KRW

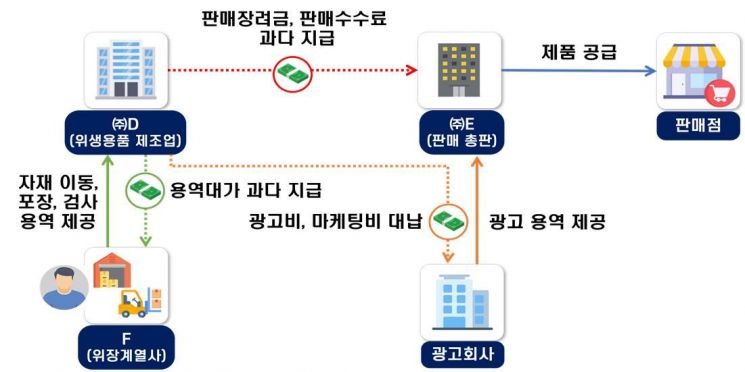

Sanitary product manufacturer D, which holds a monopoly or oligopoly in the domestic sanitary pad market, raised its prices by about 34%, citing "product premiumization." However, the National Tax Service believes that the price increase was due to D paying advertising expenses that should have been borne by its related-party distributor, and providing approximately 30 billion won in sales incentives, among other inflated costs. As a result, the National Tax Service has launched a rigorous tax investigation into the company for artificially inflating expenses to reduce profits from the price hike and evade taxes.

On January 27, the National Tax Service announced that it would conduct intensive tax investigations into "essential goods price gouging tax evaders" who drive up consumer prices through unfair practices and increase the burden on ordinary citizens. This is the agency's third price-related tax probe, following investigations into "industries closely tied to consumer prices" in September last year and "market-disrupting practices" in December.

Anduksoo, Director of the National Tax Service Investigation Bureau, is explaining about the 'Tax Investigation on Essential Goods Price Gouging Tax Evaders' at the Government Sejong Complex on the 27th. National Tax Service

Anduksoo, Director of the National Tax Service Investigation Bureau, is explaining about the 'Tax Investigation on Essential Goods Price Gouging Tax Evaders' at the Government Sejong Complex on the 27th. National Tax Service

Previously, President Lee Jaemyung criticized the high domestic sanitary pad prices compared to overseas during a Fair Trade Commission and Ministry of Gender Equality and Family work report in December last year. On January 20, he also instructed at a Cabinet meeting to "review ways to manufacture and distribute free, low-cost sanitary pads of basic quality."

Anduksoo, Director of the National Tax Service Investigation Bureau, stated, "Through analysis of reports from essential goods manufacturers and the structure of distribution transactions, we have confirmed that some companies are raising essential goods prices through various unfair practices. These companies abuse their dominant position in the market (monopoly or oligopoly) or collude to excessively increase prices of essential goods, and use irregular methods to avoid their legitimate tax obligations," he emphasized.

This investigation targets a total of 17 companies that raised prices of daily necessities while evading taxes: five monopoly or oligopoly companies involved in price collusion, six manufacturers or distributors of essential goods that inflated costs, and six food distribution companies that disrupted transaction order. According to the National Tax Service, the total amount of suspected tax evasion by these companies is about 400 billion won.

The first group under investigation consists of manufacturers and sellers of daily necessities who abused their monopoly or oligopoly status and the fact that their products are "everyday essentials" to raise prices. These companies inflated purchase prices by cross-buying raw materials from colluding firms at above-market rates, thereby increasing prices and reducing profits. They also excessively paid for the operation of local offices in the United States, unjustly supporting the living expenses of the owners' children residing there.

Cases where related parties were excessively paid sales incentives, sales commissions, and service fees to reduce profits and inflated expenses to evade taxes. National Tax Service

Cases where related parties were excessively paid sales incentives, sales commissions, and service fees to reduce profits and inflated expenses to evade taxes. National Tax Service

In particular, one sanitary product company with oligopolistic power marketed its price hikes as "product premiumization," selling sanitary pads domestically at prices tens of percent higher than in major foreign countries. This company paid advertising expenses that should have been borne by a related-party company, and, without any special reason, paid 5 billion won in sales commissions-twice the industry average-causing product prices to rise. It also transferred 50 billion won in profits from the price increase to the related-party company.

Manufacturers and distributors of other daily necessities, such as eyeglasses and wet wipes, who raised prices under the pretext of non-existent cost increases, are also subject to this investigation. These companies claimed, "There was no other choice due to rising raw material prices caused by high inflation and high exchange rates," but in reality, they inserted fictitious related-party companies into transactions or fabricated service contracts to inflate costs. They also provided luxury apartments worth about 2 billion won, purchased with company funds, to the owner's children for free, and used corporate credit cards for personal luxury and entertainment expenses at golf courses and nightclubs, thereby misappropriating corporate funds.

The National Tax Service also plans to investigate food distribution companies that created complex transaction structures to siphon off profits and unjustly raised prices by increasing distribution costs. According to the National Tax Service, one deep-sea fishing company inserted a single-person related-party company controlled by the owner's family into transactions to transfer profits to the family. It also disguised approximately 5 billion won in corporate funds as deep-sea fishing expenses and remitted them overseas, but in reality, the funds were used for the owner's children's overseas education and other personal expenses.

Director An said, "Through this tax investigation, we will thoroughly verify companies that abuse their dominant market position or excessively raise prices of daily necessities through unfair practices such as price collusion, and evade taxes they rightfully owe. If we uncover criminal acts such as tax evasion or issuance of false tax invoices during the investigation, we will take strict action, including criminal prosecution under the Punishment of Tax Offenses Act," he stated.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)