Food Companies Halt Price Hikes

Government's Price Stabilization Policy Leads to Industry Pause

Wait-and-See Approach Until June

The annual year-end and New Year "domino effect" of food price hikes has disappeared this year. Although food price increases are inevitable due to rising import raw material costs caused by the strong dollar since last year, the government has further strengthened its price stabilization policy ahead of the Lunar New Year holiday, prompting companies to take a wait-and-see approach. Industry insiders and observers predict that most companies will maintain a cautious stance and monitor the situation until the local elections conclude in June.

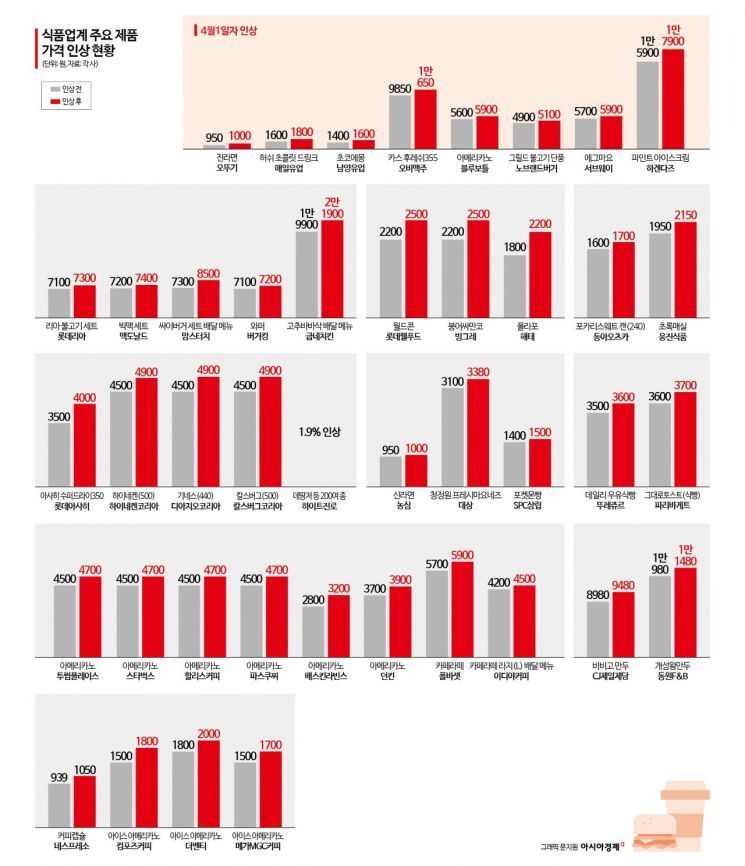

According to the food industry on January 27, there have been virtually no major food companies that have raised prices so far this year. Apart from a few coffee franchises such as The Coffee Bean that made price adjustments of 5-10%, no large food companies have increased prices since the beginning of the year. This contrasts sharply with the period from late 2024 to the first half of last year, when major food companies raised prices on around 60 products by up to 20%.

At that time, following the 12·3 Martial Law and the ensuing government vacuum, rising raw material costs and a sharp increase in the won-dollar exchange rate led to a series of price hikes across the food industry. However, the mood has shifted this year. Although cost pressures persist and profits are shrinking due to a consumption slowdown, companies have essentially been unable to resort to price increases.

The background to food companies halting their usual New Year price adjustments appears to be the government’s strengthened price control policy. With the government intensifying its pressure to stabilize prices ahead of the Lunar New Year and increasing market surveillance, there is a widespread perception in the industry that “now is not the time to make a move.”

Recently, the government emphasized the importance of stabilizing processed food prices ahead of the Lunar New Year and requested cooperation from the industry. On January 22, Kim Jonggu, Vice Minister of Agriculture, Food and Rural Affairs, held a meeting with executives from about 15 food companies to discuss price management measures for the holiday. At the meeting, the government requested that companies refrain from raising processed food prices.

Industry insiders say that “although it is formally a request, in reality, the pressure is significant.” One food industry official commented, “In the current climate, even considering a price increase is difficult,” adding, “Some are saying that we have effectively entered a period of price control.”

The fact that prosecutors are now scrutinizing the flour market in addition to sugar is also cited as a factor heightening industry tension. As investigations into potential price collusion continue, there is a growing sense that regulatory scrutiny across the food sector has intensified. A food industry representative stated, “It is practically impossible to raise prices when both collusion investigations and price controls are underway.”

The problem is that companies’ cost burdens continue to accumulate. With the won-dollar exchange rate remaining high, food companies with a large proportion of imported raw materials are still facing unrelenting cost pressures. On top of this, rising labor, logistics, and packaging costs are further squeezing profitability.

This burden is reflected in actual performance. Binggrae’s sales last year reached 1.4896 trillion won, up only 1.8% from the previous year. In contrast, operating profit fell 32.7% to 88.3 billion won. Binggrae explained, “The increase in sales was limited due to a consumption slowdown caused by weak domestic demand, and the rise in raw material prices and expanded scope of ordinary wages led to higher labor costs, which in turn reduced profits.” Other food companies awaiting earnings announcements are facing similar circumstances.

An executive at a food company said, “Government price controls are a burden, but the consumption slump is also a factor making us hesitate to raise prices. Although we raised prices over the past two years, sales did not increase as much as expected.” He added, “This year, we have no choice but to endure by cutting costs and improving management efficiency. If this situation persists long-term, the burden could become even heavier.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.