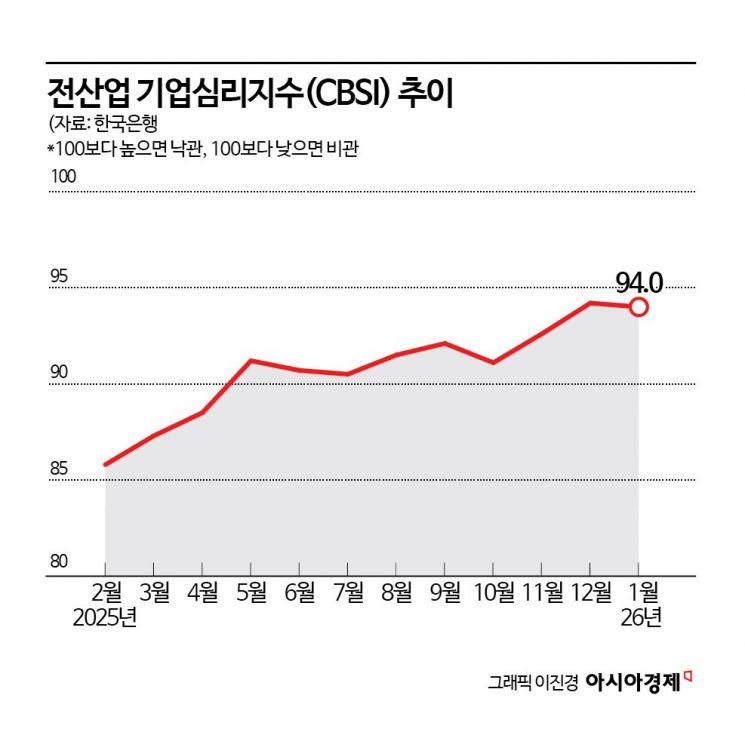

January All-Industry CBSI at 94.0, Down 0.2 Points

"Export Expansion" Drives Manufacturing Improvement, But Non-Manufacturing Worsens

10.0-Point Gap Between Large and Small Manufacturers, Largest Since September 2023

Improvements Led by Export-Or

In January, business sentiment among companies turned downward for the first time in three months. Despite improvements in the manufacturing sector driven by expanded exports, the non-manufacturing sector deteriorated due to the disappearance of year-end seasonal factors. Even within manufacturing, large corporations showed a clear improvement, with their index exceeding the baseline of 100 for the first time in about three and a half years, while small and medium-sized enterprises remained in the low 90s, highlighting a pronounced gap.

According to the “January 2026 Business Survey and Economic Sentiment Index (ESI)” released by the Bank of Korea on the 27th, the Composite Business Sentiment Index (CBSI) for all industries this month stood at 94.0, down 0.2 points from the previous month. The CBSI is a business sentiment indicator calculated using key indices from the Business Survey Index (BSI). With the long-term average (from January 2003 to December 2025) set as the baseline value of 100, a reading above 100 indicates that companies’ expectations for the economy are more optimistic than the long-term average, while a reading below 100 is interpreted as pessimistic. Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, stated, “Although manufacturing improved due to expanded exports in primary metals and other machinery and equipment sectors, the non-manufacturing sector worsened due to the disappearance of year-end seasonal factors, resulting in this outcome.”

This month, the manufacturing CBSI rose by 2.8 points from the previous month to 97.5, marking the highest level since June 2024 (98.1). In manufacturing, production (up 1.1 points) and new orders (up 1.0 points) were the main drivers of growth. Manufacturing performance improved mainly in primary metals, other machinery and equipment, and rubber and plastics. Primary metals benefited from increased exports to overseas automobile companies and the implementation of China’s steel export permit system. The other machinery and equipment sector improved thanks to rising demand from downstream industries such as semiconductors and shipbuilding, as well as expanded machinery exports. Rubber and plastics were influenced by seasonal demand increases in downstream sectors such as cosmetics, wholesale and retail, and food products.

This month, the CBSI for large corporations within manufacturing reached 101.8, surpassing the 100 mark for the first time since June 2022 (104.1). The gap in CBSI between large corporations and small and medium-sized enterprises in manufacturing was 10.0 points, the widest since September 2023 (10.4 points). Although the baseline for the long-term average, which is converted to 100, changes annually and makes direct comparison difficult, it is clear that improvements were led by export-oriented large corporations.

In contrast, the non-manufacturing CBSI fell by 2.1 points to 91.7. In the non-manufacturing sector, financial conditions (down 1.5 points) and profitability (down 0.9 points) were the main factors behind the decline. This month, non-manufacturing performance worsened mainly in professional, scientific and technical services, electricity, gas and steam, and information and communications. Professional, scientific and technical services declined due to a base effect from the disappearance of seasonal factors such as increased orders and cash collection at the end of the year. Electricity, gas and steam were affected by lower electricity rates and reduced solar and thermal energy production due to cold waves. The information and communications sector also saw a decline as software development-related industries experienced a gap in new orders at the beginning of the year.

The business sentiment outlook for next month was surveyed at 91.0, up 1.0 point from the previous month. Manufacturing is expected to rise by 1.0 point to 95.0, while non-manufacturing is forecast to increase by 1.0 point to 88.4. The February outlook for manufacturing improved mainly in primary metals, electronics, visual and communication equipment, and metal processing. The non-manufacturing outlook recovered mainly in wholesale and retail, arts, sports and leisure-related services, and construction. Lee added, “Improvements are expected in wholesale and retail, arts, sports, and leisure-related services in February due to the Lunar New Year holiday effect.”

The ESI, which combines the BSI and the Consumer Sentiment Index (CSI), rose by 0.5 points from the previous month to 94.0. The cyclical component, which removes seasonal factors, stood at 95.8, up 0.6 points from the previous month.

Meanwhile, this survey was conducted from January 12 to 19, covering 3,524 corporate entities nationwide. Of the respondents, 1,815 were in manufacturing and 1,440 in non-manufacturing, totaling 3,255 companies (92.4%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)