Expansion of Investment in KOSDAQ Venture Funds and BDCs Expected

KOSDAQ Earnings Estimates Improving Alongside KOSPI

Focus Intensifies on Large-Cap Stocks in Robotics, Biotech, and Secondary Batteries

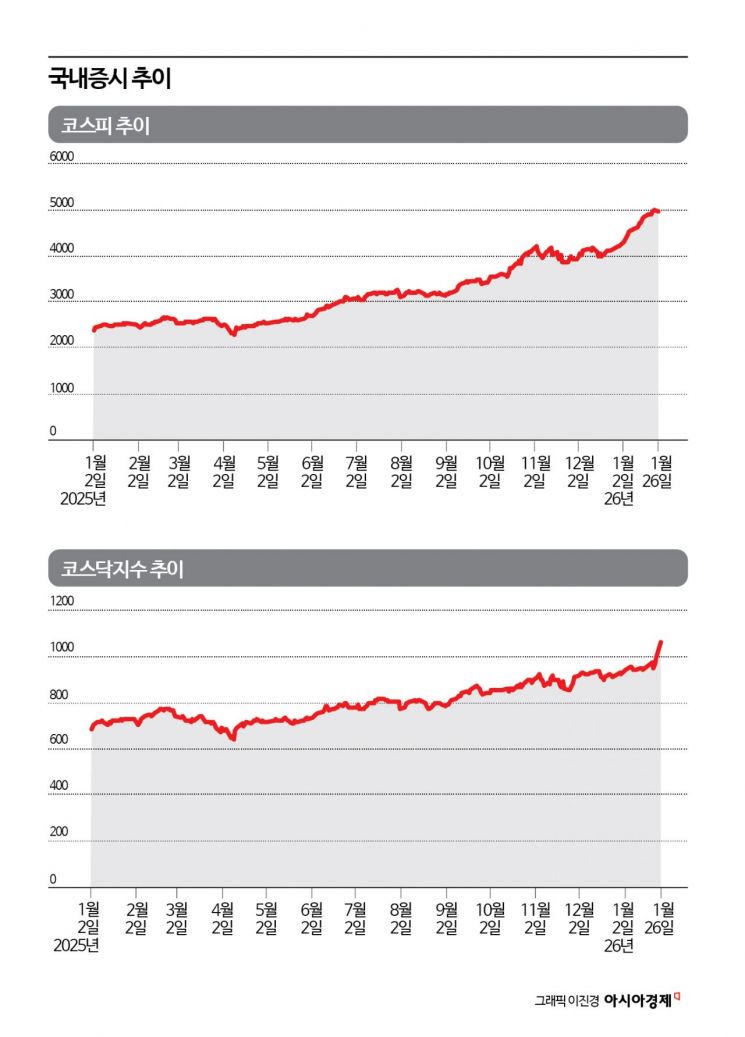

As the KOSPI hovers around the 5,000 mark, attention is shifting to the KOSDAQ, which has seen relatively less of an increase. Last year, while the KOSPI posted a steep rise fueled by expectations for artificial intelligence (AI) and a semiconductor cycle recovery, the KOSDAQ index experienced heightened volatility but limited upward momentum. Market watchers believe the KOSDAQ index will ride an upward trend this year, backed by the government’s commitment to support the market. Although uncertainty surrounding U.S. tariffs may pose a short-term burden, analysts expect the overall upward trend to remain intact.

On the 26th, the KOSDAQ index surpassed the 1,000 mark for the first time in over four years, as displayed on the status board at the Korea Exchange Public Relations Hall in Yeongdeungpo-gu, Seoul. The KOSDAQ closed the day at 1,064.41, up 70.48 points (7.09%) from the previous session. Photo by Yonhap News Agency

On the 26th, the KOSDAQ index surpassed the 1,000 mark for the first time in over four years, as displayed on the status board at the Korea Exchange Public Relations Hall in Yeongdeungpo-gu, Seoul. The KOSDAQ closed the day at 1,064.41, up 70.48 points (7.09%) from the previous session. Photo by Yonhap News Agency

According to the Korea Exchange on January 27, the previous day the KOSDAQ index closed at 1,064.41, up 70.48 points (7.09%). During the session, a sharp rise in the KOSDAQ 150 futures triggered a sidecar (a temporary suspension of program buy orders). This marks the first time in about four years, since January 5, 2022, that the KOSDAQ index has closed above the 1,000 mark. The previous all-time high for the KOSDAQ was 2,925.5, recorded intraday on March 10, 2000, at the height of the dot-com bubble.

The main drivers of demand in the KOSDAQ market were foreign investors and financial investment firms. Notably, financial investment institutions recorded net purchases exceeding 2 trillion won on this day. The market attributes this to investors experiencing FOMO (fear of missing out) as only the KOSPI soared, leading to a surge in purchases of KOSDAQ leveraged exchange-traded funds (ETFs). In fact, the education website run by the Korea Financial Investment Association, which investors must use to complete training before trading leveraged products, was temporarily paralyzed due to high traffic.

Last year, the KOSDAQ was relatively neglected. While the KOSPI rose by 76.5%, the KOSDAQ index managed only a 36.3% gain. The polarization intensified as funds flowed into large-cap KOSPI stocks, such as those in semiconductors, shipbuilding, defense, and nuclear power (supported by companies like Samsung Electronics and SK hynix).

In this context, the catalyst for the KOSDAQ’s sharp rise has been the government’s commitment to supporting the KOSDAQ. On January 22, President Lee Jaemyung, during a luncheon with the Democratic Party’s “KOSPI 5000 Special Committee,” proposed achieving a KOSDAQ 3000 as the next target. In response, Assemblyman Min Byungdeok reportedly suggested the creation of a special-purpose institutional investor, funded by the national pension fund, dedicated exclusively to investing in the KOSDAQ.

The market is pinning its hopes on the government’s proactive KOSDAQ support measures. Previously, the government announced its “2026 Growth Strategy,” which includes: ▲ expanding support for KOSDAQ venture funds ▲ introducing customized technology-based IPO exemptions ▲ establishing business development companies (BDCs) ▲ reflecting the KOSDAQ index in pension fund performance evaluations ▲ tightening delisting requirements, among other plans.

As a result, it is expected that, for the time being, the KOSDAQ market will see gains led by large-cap stocks. This is because institutional funds are anticipated to flow first into the top-tier KOSDAQ companies. The previous day, top stocks in secondary batteries (such as Ecopro), biotech (such as ABL Bio), and robotics (such as Rainbow Robotics) all surged by more than 20% in the KOSDAQ market.

Im Sang-guk, a researcher at KB Securities, said, “Given the seasonal nature of the stock market, the U.S. interest rate cuts, and policies to revitalize the KOSDAQ, there are expectations for a rebound in the previously neglected KOSDAQ market,” adding, “In particular, attention should be paid to large-cap stocks in sectors like robotics and biotech.”

Kang Jin-hyuk, a researcher at Shinhan Investment & Securities, commented, “There was a period in 2018 when the KOSDAQ rebounded as a result of revitalization measures after underperforming the KOSPI. Recently, the gap in performance between the KOSPI and KOSDAQ has reached historic levels, making KOSDAQ’s valuation increasingly attractive.”

Kang further added, “Beyond policy momentum, earnings estimates for the KOSDAQ are improving just as much as for the KOSPI, which should provide additional upward momentum.”

Meanwhile, President Donald Trump’s tariff remarks are not expected to have a significant impact on the KOSDAQ. Around 7 a.m. on this day, President Trump announced via his social media account that, because Korea’s National Assembly had not yet ratified the trade agreement reached in October, he would raise reciprocal tariffs, including those on automobiles, from 15% back up to 25%.

Han Ji-young, a researcher at Kiwoom Securities, explained, “While this news could be a burden for the stock market, particularly for the automotive sector, considering that National Assembly approval is only a matter of time, Trump’s move to reimpose reciprocal tariffs will likely be a temporary noise factor with only a limited impact on the overall market trend.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.