Over 50,000 Seoul Apartments Listed

0.9% Increase After President's Remarks

Land Transaction Permits and Lending Curbs Also in Play

"Inquiries Only About Moving Up Closing Date Before May 9"

"In the Apgujeong area, there are many cash-rich property owners, so rather than suddenly lowering asking prices and putting properties on the market, most are likely to hold out for now. Even if property holding taxes increase, there is a learned tendency to believe that holding on for just three to four years will suffice, so it seems likely that even elderly owners will choose to keep their properties for the time being." (Real estate agency A in Apgujeong-dong, Gangnam-gu, Seoul)

"It seems the policy is encouraging people to focus on owning a single prime property, but won't this only further intensify the concentration of demand in preferred areas of Seoul, like Gangnam or the so-called 'Hangang Belt'?" (Real estate agency B in Heukseok-dong, Dongjak-gu, Seoul)

On January 26, the first weekday after President Lee Jaemyung made it clear over the weekend that he would not further extend the temporary suspension of the capital gains tax surcharge for owners of multiple homes, the atmosphere at major real estate agencies across Seoul remained calm. Aside from inquiries about moving up closing dates to just before the surcharge takes effect, there was no significant increase in calls about listing properties for sale compared to usual.

A real estate agency in Seongdong-gu, Seoul, has posted properties for quick sale and urgent lease. Photo by Yonhap News.

A real estate agency in Seongdong-gu, Seoul, has posted properties for quick sale and urgent lease. Photo by Yonhap News.

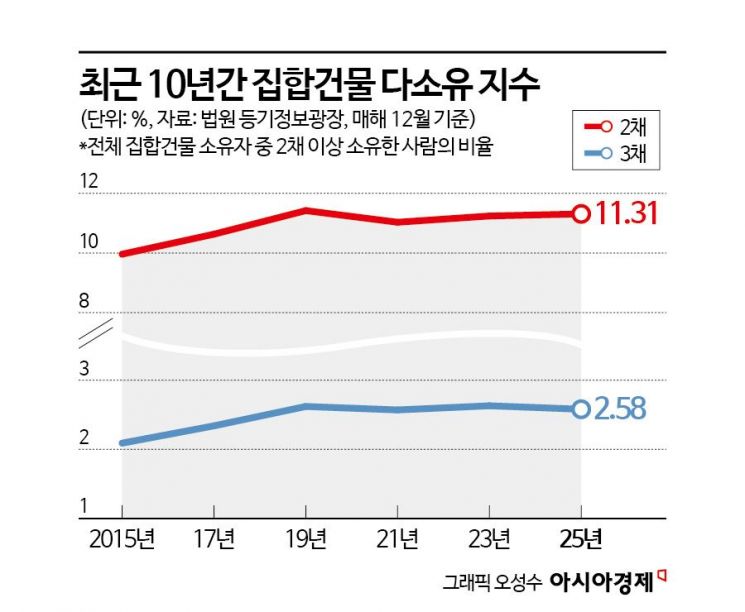

At the field level, many expect that it will not be easy for properties owned by multiple homeowners to immediately flood the market. Most are waiting to see how the situation develops before making decisions. How the property tax system-another pillar of real estate taxation, including property tax and comprehensive real estate tax-will be revised is also a key issue. With about 100 days left until the temporary suspension of the capital gains tax surcharge expires, the adversarial dynamic between multiple homeowners and the government, which was prominent during the previous Moon Jae-in administration, appears to be resurfacing.

According to data from the real estate big data company Asil as of January 26, the number of apartments listed for sale (including officetels) in Seoul stood at 56,777. This represents a 0.9% increase compared to January 22 (56,216), when President Lee stated he would not consider an additional extension of the temporary suspension, which ends in May. However, experts say that this rate of increase is not enough to be seen as a meaningful surge in supply. Even earlier this month, before the president's remarks, the figure was similar at 56,621.

An agent at a real estate agency in Apgujeong-dong said, "There is some movement to sell quickly, and occasionally properties are listed at slightly lower prices than the previous peak, but all the cheaper ones have already been sold. I expect the phenomenon of properties being withheld from the market to intensify going forward." A realtor in Ahyeon-dong, Mapo-gu, commented, "The asking price for a 20-pyeong unit at Mapo Raemian Prugio Apartments is around 2.4 billion won, and some sellers aiming to close before May 9 may lower their prices by about 100 million won. However, since buyers also need time to sell their own homes, asking prices could drop further as time passes."

There are also concerns that transactions are difficult for Seoul apartments, as they are subject to both land transaction permit zones and lending regulations. In these zones, it typically takes three to four months to complete the home-buying process, including application, contract, and final payment. Under the Income Tax Act, the date for capital gains tax assessment is set as the earlier of the final payment date or the registration application date. With about 100 days left until the temporary suspension of the surcharge ends, properties listed now could still be subject to the higher tax. As a result, some interpret President Lee's remarks as an attempt to encourage ultra-low-priced listings to enter the market.

President Lee stated, "We will discuss at the cabinet meeting whether to allow the suspension of the surcharge for contracts signed by May 9," leaving open a possible 'exit route.' Park Wongap, Senior Real Estate Specialist at KB Kookmin Bank, said, "Considering the permit procedures, tax-saving listings in regulated areas will likely appear by mid-April. However, since gap investments involving jeonse leases are difficult, many multiple-homeowners may want to sell but cannot, so while some properties will come on the market, it won't be a flood."

If the capital gains tax surcharge for multiple homeowners is implemented, the tax burden is expected to increase significantly. According to a simulation by Woo Byungtak, Senior Specialist at Shinhan Bank Premier Pass Finder, for a property held for 10 years with a 2 billion won capital gain, the current capital gains tax would be about 718.23 million won. If the surcharge is applied, the tax would rise to 1.35568 billion won for owners of two homes and 1.5754 billion won for owners of three homes. For a property held for five years with a 500 million won gain, the current tax is 177.17 million won, but with the surcharge, it would increase to between 299.82 million and 354.54 million won, nearly doubling.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)