Unusual January Meeting of NPS Fund Management Committee

Need for Portfolio Adjustment as Domestic Stocks Surge

Debate Grows Over NPS Role Amid Soaring Exchange Rate

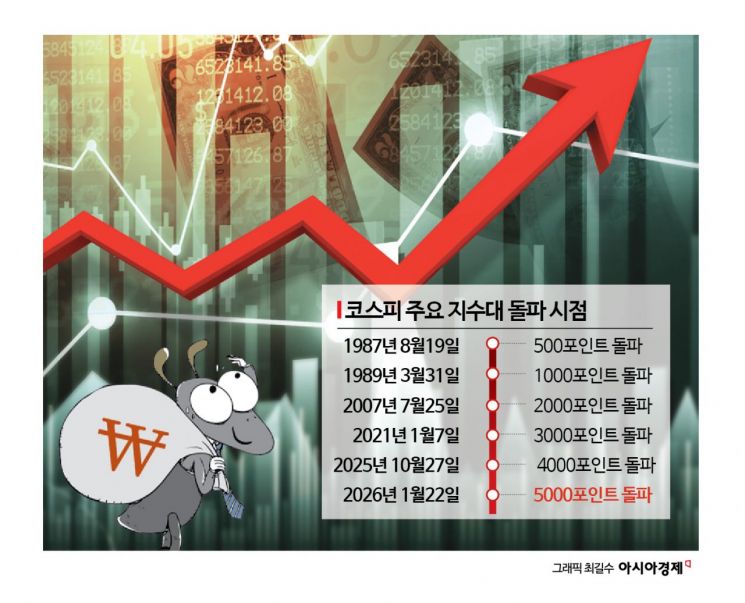

As the won-dollar exchange rate continues to soar and the domestic stock market remains extremely bullish, the National Pension Service is taking the unusual step of convening its Fund Management Committee in January.

As the KOSPI reached an all-time high of 5021.13 during the session, an employee is monitoring the stock market and exchange rates in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul on the 23rd. On this day, the KOSPI opened at 4984.08, up 31.55 points (0.64%) from the previous trading day (4952.53). January 23, 2026 Photo by Jo Yongjun

As the KOSPI reached an all-time high of 5021.13 during the session, an employee is monitoring the stock market and exchange rates in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul on the 23rd. On this day, the KOSPI opened at 4984.08, up 31.55 points (0.64%) from the previous trading day (4952.53). January 23, 2026 Photo by Jo Yongjun

The Fund Management Committee is the highest decision-making body that deliberates and decides on major matters related to the management of the National Pension Fund. Typically, the first meeting of the year is held in February or March to review the previous year’s settlement.

However, this time, the meeting is being called in January before the settlement is complete, marking the first such occurrence in five years since 2021.

Domestic Stock Allocation Hits Maximum 19.4%... Forced Selling Could Be Unavoidable

According to the Ministry of Health and Welfare on the 25th, the National Pension Service will hold the first Fund Management Committee meeting of the year on the 26th to review its fund management strategy. With the domestic stock market surging, it is expected that the National Pension Service’s portfolio will be adjusted.

Previously, the Fund Management Committee set the domestic stock allocation for the National Pension Service in 2026 at 14.4%. Considering the allowable adjustment range of ±5 percentage points by asset class, the maximum limit is 19.4%.

However, as the KOSPI continues to rise, it has become difficult to maintain this allocation. As of the end of October last year, the National Pension Service’s domestic stock allocation stood at 17.9%, already exceeding the target. Given the ongoing upward trend in the KOSPI, the allocation may be approaching or even exceeding the maximum limit.

According to asset allocation principles, the National Pension Service could be forced to sell domestic stocks. This could dampen the stock market and also impact the fund’s returns.

President Lee Jaemyung stated during the National Pension Service work report at the end of last year, "Recently, domestic stock prices have risen, delaying the depletion of the National Pension Fund, and I heard that the domestic stock holding limit has also been exceeded. While it is difficult to comment on the domestic stock market, I believe the National Pension Service also needs to consider this issue." This was interpreted as suggesting the need to adjust the fund’s portfolio, specifically to consider increasing the allocation to domestic stocks.

Kim Sungjoo, Chairman of the National Pension Service, responded at the meeting, "This year (2025), the domestic stock market’s returns have been exceptionally high, causing us to exceed the domestic stock holding limit. Although it is impossible to predict next year’s market conditions, we plan to convene the Fund Management Committee next year to promptly revise our investment guidelines as needed."

High Exchange Rate Situation Mentioned Even by the President... "Around 1,400 Won in Two Months"

On the 20th, the KOSPI index, KOSDAQ index, and exchange rate are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul.

On the 20th, the KOSPI index, KOSDAQ index, and exchange rate are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul.

The situation of the won-dollar exchange rate fluctuating in the upper 1,400 won range may also be discussed at the committee meeting.

President Lee Jaemyung made an unusual comment on the weakness of the won during a press conference on the 21st. Responding to a question about concerns that the exchange rate could rise to 1,500 won, he said, "According to the (foreign exchange) authorities, it is expected to fall to around 1,400 won in a month or two."

It is extremely rare for the president to provide such specific timing and figures in forecasting the exchange rate. While the government and the Bank of Korea have recently announced measures to stabilize the exchange rate focused on addressing the dollar supply-demand imbalance, they have never mentioned specific forecasts or targets. Merely mentioning a certain level of the exchange rate could shock the market. This has been interpreted as a sign that the president views the foreign exchange situation very seriously.

On January 23, Deputy Prime Minister and Minister of Economy and Finance Koo Yooncheol told reporters that "something new and positive is likely to come from the National Pension Service" regarding the high exchange rate situation. He added, "If that happens, the high exchange rate situation may gradually be resolved," expressing optimism.

When asked again whether, as President Lee mentioned, the exchange rate could indeed reach 1,400 won in a month or two, the Deputy Prime Minister replied, "We will do our utmost to achieve that."

Bank of Korea Governor Lee Changyong also commented immediately after the president’s remarks on January 21, stating, "By any model, the current exchange rate is at a high level," and "It is clear to anyone that there is significant room for adjustment in the current exchange rate."

Previously, the Fund Management Committee concluded that the National Pension Service needs to flexibly implement strategic currency hedging in response to market conditions, and formed a consultative body centered on committee members and the Investment Policy Expert Committee. The Ministry of Health and Welfare has established a task force to carry out currency hedging within the scope delegated by the consultative body.

Global investment bank Goldman Sachs recently predicted the possibility of the National Pension Service expanding its currency hedging in a report titled "Is the Weakness of the Won Nearing Its End?"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)