Spreading Beyond Cafes and Dessert Shops Across the Entire Retail Sector

Convenience Stores, Franchises, and Hotels Join the Trend

Purchases Driven More by Experience and Social Proof Than Taste

"Temporary Trend, Demand Expected to Gradually Decl

The "Dubai Chewy Cookie (Dujjonku)" craze, which swept through the retail industry last year, shows no signs of cooling down even as the new year begins. Despite ongoing shortages at major sales channels such as cafes and dessert shops, the trend has spread to hotels, convenience stores, and the food industry, with related products being launched one after another. Demand remains strong even with prices reaching up to 8,000 won per piece. Some observers note that this is an example of a consumer trend shifting toward desserts as people try not to fall behind in trends, while others predict that the Dujjonku craze may prove to be a short-lived fad.

Dubai Jjonduk Cookie (Dubaji Jjonduk Cookie) is displayed at the '2026 Cafe Dessert Fair' held at Kintex in Goyang, Gyeonggi Province. Photo by Yonhap News

Dubai Jjonduk Cookie (Dubaji Jjonduk Cookie) is displayed at the '2026 Cafe Dessert Fair' held at Kintex in Goyang, Gyeonggi Province. Photo by Yonhap News

According to industry sources on January 24, Dujjonku, a dessert that reinterprets Dubai chocolate in a Korean style, is spreading rapidly as similar products flood the distribution market. In the food industry, bakery and cafe franchises such as Paris Baguette, Dunkin', and Twosome Place are either introducing Dujjonku-inspired desserts or preparing to launch new products.

In the convenience store sector, CU, operated by BGF Retail, has released items such as "Dubai Chewy Glutinous Rice Cake," "Dubai Mini Towel Cake," and "Bite-sized Dubai Chewy Rice Cake," with cumulative sales nearing 8.3 million units. GS25, operated by GS Retail, also offers similar products, including two types of desserts-"Dubai Chewy Choco Ball" and "Dubai Choco Brownie"-as well as one type of chocolate and one type of ice cream.

A sold-out notice for pistachios, the main ingredient of Dubaji Jjondeuk Cookie (Dubai Chewy Cookie), is placed at the nut section of a large supermarket in Seoul. Photo by Yonhap News

A sold-out notice for pistachios, the main ingredient of Dubaji Jjondeuk Cookie (Dubai Chewy Cookie), is placed at the nut section of a large supermarket in Seoul. Photo by Yonhap News

Seven-Eleven, operated by Korea Seven, has launched "Kadaif Chewy Ball" and "Dubai-style Kadaif Fat Macaron," while Emart24, a convenience store chain under Shinsegae Group, is selling trend-driven products such as "Choco Castella Kadaif Mochi" and "Choco Kadaif Mochi." In addition, Lotte Hotel Seoul is offering "Pistachio Choco Guimauve" as a course menu dessert at its French restaurant Pierre Gagnaire Seoul until next month, with the hotel industry also hoping to benefit from the popularity of Dujjonku-inspired products. Online communities have even described Dujjonku as a symbol supporting domestic consumption.

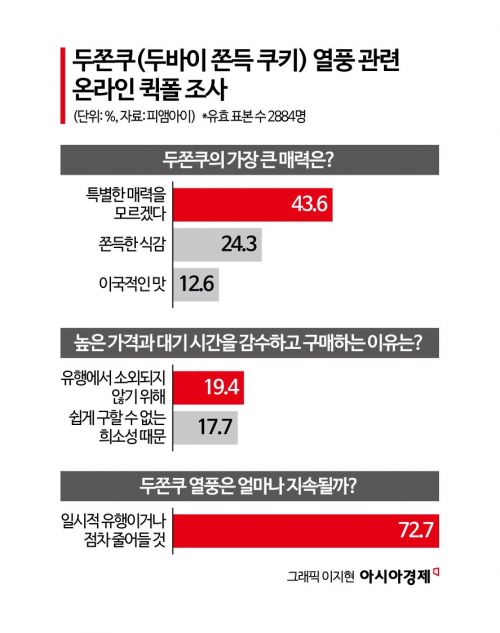

Meanwhile, a survey found that consumers are more interested in the value of the experience than the taste itself when it comes to Dujjonku. According to a quick online poll conducted by data consulting firm PMI on January 20-21 among 2,884 men and women aged 19 to 59 nationwide, 43.6% of respondents said they "do not find anything particularly attractive" about Dujjonku. Responses related to product attributes, such as "chewy texture" (24.3%) or "exotic taste" (12.6%), accounted for less than half of the total.

Instead, the most common reason consumers cited for enduring Dujjonku's high price and long wait times was "not wanting to be left out of the trend" (19.4%). This was followed by "because of its rarity and difficulty to obtain" at 17.7%. In addition, 14.5% of respondents said it was "a small luxury or reward for myself." PMI noted, "Dujjonku consumption is driven less by taste-centered choices and more by experience consumption, proof consumption, and FOMO (fear of missing out) consumption."

Reflecting this, the prevailing view is that the Dujjonku craze will be a fleeting trend. The survey showed that 72.7% of respondents believe it is "a temporary fad or will gradually decline." A PMI representative commented, "The Dujjonku phenomenon is a symbolic case showing that Korean consumers care more about 'why they buy' than 'what they buy.' In the past, Honey Butter Chips stimulated desire through supply shortages, while Dujjonku combines the desire for 'proof of experience,' as represented by Instagram." The representative added, "Only brands that understand this trend will be able to survive beyond a fleeting fad and establish themselves as a dessert category."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)