Rotation Among Leading Stocks Continues to Drive KOSPI's Rally

Secondary Batteries Expected to Take the Baton Next

Surging Demand Projected for Robotics and Data Centers

U.S. Power Demand Growth Brings Attention to Power Equipment

With the KOSPI successfully reaching the historic "Five Thousand Points" milestone, the rotation of leading stocks is being cited as a key driver behind this achievement. Until earlier this month, semiconductor stocks such as Samsung Electronics and SK Hynix saw sharp gains, fueled by expectations for the artificial intelligence (AI) industry and the semiconductor super cycle. Subsequently, a rotation into major leaders in sectors like automobiles (robots) and defense industry lifted the index further. Now, secondary battery and power equipment stocks are drawing attention as the next potential leaders.

As of 9:20 a.m. on January 23, the KOSPI stood at 5,008.14, up 55.61 points (1.12%) from the previous day. Although the index broke through the 5,000-point mark the previous day, it failed to hold above this psychological resistance level in the afternoon as profit-taking occurred. In early trading on this day, the KOSPI attempted to regain and settle above the 5,000-point level.

The reason the KOSPI has been able to sustain its upward momentum is that, instead of semiconductor stocks that have led the market since last year, buying interest has rotated into other leading sectors.

Samsung Electronics and SK Hynix together account for 35.75% of the total market capitalization in the main board, so when these two stocks decline, the KOSPI typically weakens. However, this year has been different. On January 13, Samsung Electronics and SK Hynix fell by 0.86% and 1.47% respectively, but the KOSPI rose by 1.47%. During a period when semiconductor stocks paused due to weakness in U.S. tech stocks, buying shifted to automobile and robotics stocks, which proved effective.

At the "CES 2026," the world’s largest electronics and IT exhibition held in Las Vegas from January 6 to 9 (local time), Hyundai Motor Group unveiled its humanoid robot "Atlas," drawing significant attention. On the previous day, Hyundai Motor's market capitalization reached 108.5 trillion won, ranking third after Samsung Electronics and SK Hynix. Hyundai Motor’s stock price has surged by 78.41% so far this year. During the same period, Kia rose by 35.14% and Hyundai Mobis by 21.58%.

Accordingly, Samsung Securities raised its target price for Hyundai Motor from 650,000 won to 850,000 won. Lim Eunyoung, a researcher at Samsung Securities, commented, "Hyundai Motor’s role goes beyond providing behavioral data for robots; it has been confirmed as a key player in validating AI training and manufacturing robots. The year 2026 will mark the beginning of robotaxi commercialization and the emergence of physical AI services. This is a time when we should not miss out on visible growth potential."

However, Hyundai Motor’s share price fell 3.6% the previous day as foreign investors engaged in massive profit-taking. Foreign investors made net sales of Hyundai Motor shares worth 1.1034 trillion won, making it the most heavily sold stock.

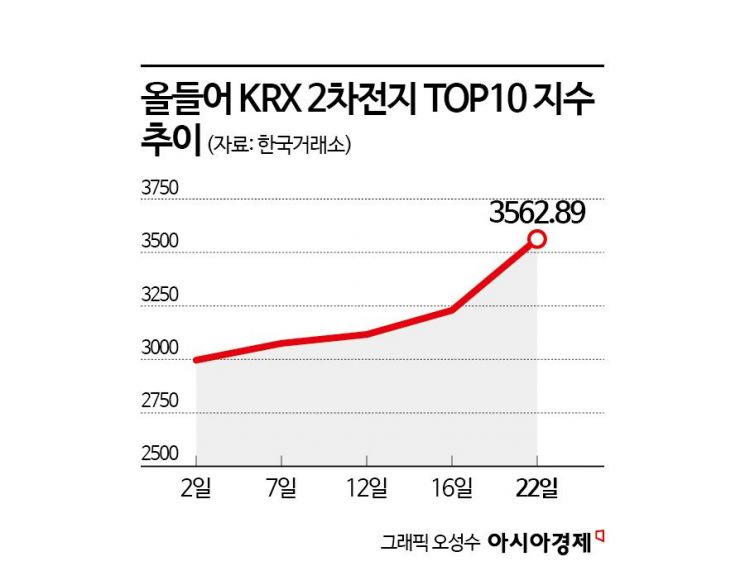

With Hyundai Motor’s stock, which has surged recently, expected to undergo a period of adjustment, investors now appear to be eyeing batteries as the next leading sector after semiconductors and automobiles. On the previous day, Samsung SDI jumped 18.67%, while LG Energy Solution rose 5.70%, Ecopro 10.41%, and L&F 12.81%.

As the robotics industry emerges as a core theme in the stock market, interest is once again shifting to secondary batteries. Additionally, signs of improving policy environments in global markets are supporting investor sentiment. Joo Minwoo, a researcher at NH Investment & Securities, explained, "Expectations for robotics have recently spread to solid-state batteries, leading to notable gains in related stocks. In addition to optimism about robotics, the upcoming InterBattery event (March 11-13), which showcases future technologies, has often triggered preemptive stock price gains from late January, making this a period of heightened interest in solid-state battery-related stocks."

There are also expectations that the growth momentum for secondary battery stocks will be further strengthened by demand from robotics and data centers. Kang Dongjin, a researcher at Hyundai Motor Securities, noted, "Although the battery usage per robot is not large, considering replacement batteries and other factors, this could become a significant market in the long term. While the proportion of batteries in robots is currently very low, the requirements for safety, energy density, and lifespan are high, which will drive demand for high-performance batteries." He added, "Not only energy storage systems (ESS), but also battery backup units (BBUs) based on cylindrical batteries for data centers will see strengthened shipment growth momentum."

Power equipment stocks are also emerging as candidates to lead the next rally in the stock market. HD Hyundai Electric has risen 14.73% so far this year, LS ELECTRIC is up 12.39%, and Hyosung Heavy Industries has gained 31.89%. Factors such as rising electricity demand in the United States and expectations for increased orders are cited as drivers of strength in power equipment stocks. Lee Hangyeol, a researcher at Kiwoom Securities, commented on HD Hyundai Electric, "This year’s new order target has been increased by 10.5% compared to last year. Demand for ultra-high voltage transformers in the North American market remains strong, and discussions are underway for orders of medium- and low-voltage transformers for data centers. Orders from Europe are expected to expand rapidly."

The rotation among leading stocks is expected to sustain the KOSPI’s upward trend. Noh Donggil, a researcher at Shinhan Investment & Securities, stated, "Reaching the 5,000-point level was not achieved by a single theme. It is the structural result of tariff risk mitigation, semiconductor acceleration, the spread of industrials, and a new framework for automobiles. This structure suggests that, in the next phase, the index could level up not through a surge concentrated in a single sector, but through new roles for existing growth engines and the addition of new candidates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)