Deposit Products That Offer Higher Rates as KOSPI Rises

But "Knock-Out" Structure Fixes Basic Rate If Gains Exceed 20-25%

Recent KOSPI Surge Far Outpaces Set Range

More Cases of Rates Being Locked In Before Maturity

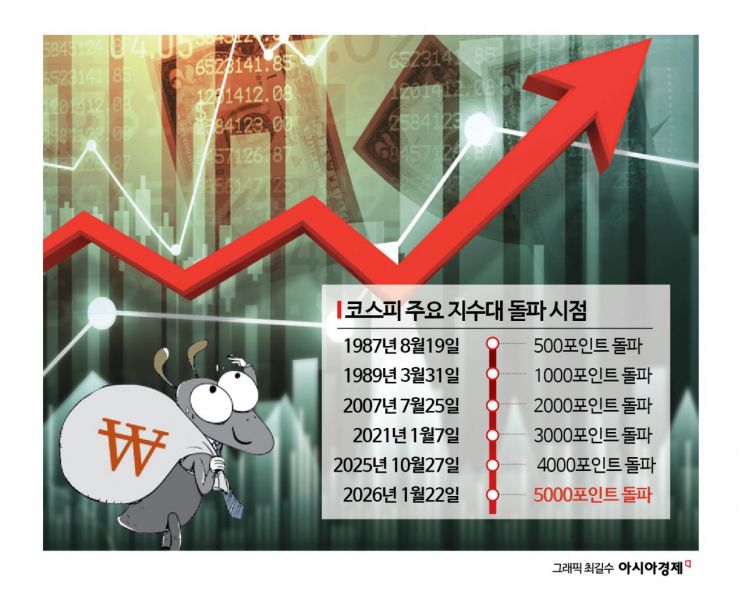

As the KOSPI surpassed 5,000 during intraday trading, fortunes have diverged for Equity-Linked Deposits (ELDs). Although these products are structured to allow for additional returns when stock prices rise, there has been an increase in cases where the minimum interest rate is locked in even before maturity, as the KOSPI has soared sharply in a short period. Paradoxically, the rapid surge in the KOSPI has become a stumbling block for investors.

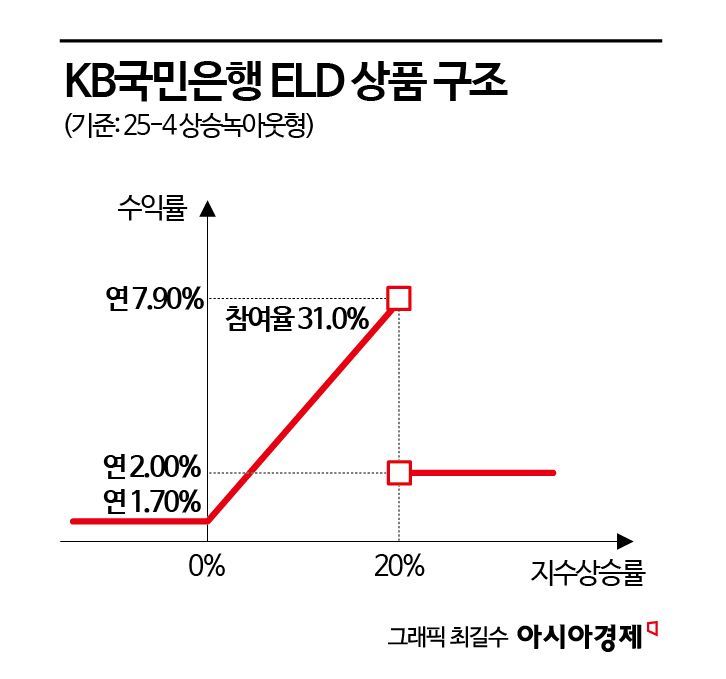

According to the financial sector on January 23, some so-called 'knockout' cases have occurred in ELD products sold last year by four banks: KB Kookmin Bank, Shinhan Bank, Hana Bank, and NH Nonghyup Bank. ELDs determine returns based on fluctuations in an underlying stock index. If the index exceeds the predetermined upper limit (knockout barrier) even once before maturity, the interest rate is fixed at a previously set low rate.

The return range set by banks is typically 15-25%, and in most years, it was rare for the index to exceed this range within a year, so the likelihood of receiving excess returns was high in the past. However, the situation changed as the KOSPI surged rapidly from November last year into the new year. Although the KOSPI was just above 4,000 in early December, it broke through 5,000 during intraday trading the previous day. During this period, the closing price jumped by 22.7%. The KOSPI200, which serves as the underlying asset for ELDs, also rose from 570.79 to 722.3 in the same period, marking a 26.5% increase.

As a result, for the product sold by Shinhan Bank in June last year, which used the KOSPI200 as its underlying asset (Safe Index-Linked Deposit Enhanced Guarantee Upward Type 25-13), customers could have received a maximum annual interest rate of 4.3% if the index increase did not exceed 15%. However, since the index surpassed this threshold, an annual interest rate of 2.5% was fixed before maturity. Similarly, for the product sold by KB Kookmin Bank in November last year (KB Star Index-Linked Deposit 25-4 Upward Knockout Type), a maximum annual interest rate of 7.9% would have been guaranteed if the index did not exceed 20%, but just over two months after launch, the interest rate was already fixed at 2% per annum.

Most customers subscribe to ELDs expecting a relatively higher return than regular deposits, without risking their principal. The bullish domestic stock market led to increased sales of these products last year. The combined ELD sales of the four banks reached 11.761 trillion won last year, up 59.5% from the previous year's total of 7.3733 trillion won. However, as the KOSPI soared in a short time, investors paradoxically ended up receiving the lowest returns.

The banking sector plans to launch more ELDs this year, riding the momentum of rising stock prices. KB Kookmin Bank and Shinhan Bank are scheduled to release new ELDs next week. A banking industry official stated, "The actual terms of ELDs vary greatly depending on the product," and added, "Given the recent increase in KOSPI volatility, it is important to thoroughly review the product structure before subscribing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)