KOSPI 5,000: "Not the End, but a New Beginning"

Semiconductor Profit Momentum and Institutional Changes Align

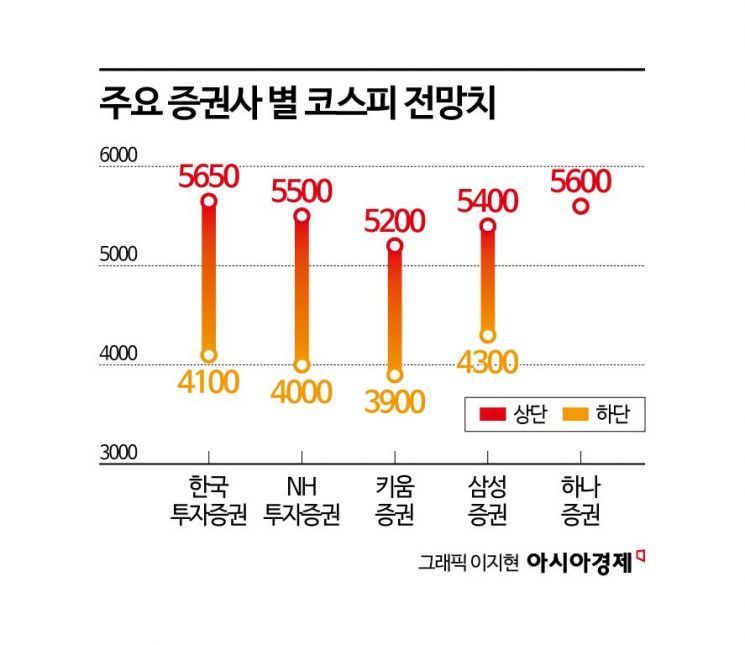

Upper Range Projected at 5,200-5,600 Points

As the Korean stock market surpassed the 5,000-point mark on the KOSPI for the first time in 70 years since its opening, market attention is now divided between the possibility of further gains and the potential for a short-term correction. Major domestic securities firms believe that, given the profit momentum centered on semiconductors and ongoing institutional changes, the upward trend of the KOSPI is likely to continue for the time being.

According to the financial investment industry on January 23, the KOSPI rose to 5,019.54 during the previous session, crossing the 5,000-point threshold for the first time ever. Research center heads at major securities firms interpret the breakthrough of 5,000 not as an endpoint but as the beginning of a new phase. Despite concerns over the sharp rise in the index, the prevailing view is that there is still room for further gains since the rally is accompanied by solid earnings.

Securities firms have set the upper range for the KOSPI between 5,200 and 5,600 points. Korea Investment & Securities suggested an annual upper limit of 5,650 points. In addition, Hana Securities (5,600), NH Investment & Securities (5,500), Samsung Securities (5,400), and Kiwoom Securities (5,200) also forecast that the KOSPI could rise further beyond 5,000 points.

Yoon Changyong, Head of Research at Shinhan Investment & Securities, described KOSPI 5,000 as "a turning point where the market shifts from a narrative-driven phase to one validated by numbers." He explained, "In the past, peaks in the Korean stock market were followed by corrections as profit expectations were revised downward. Currently, however, even during a period of adjustment, the consensus on earnings per share (EPS) is being maintained without downward revisions, indicating a structural difference." He added, "KOSPI 5,000 is not the pinnacle of expectations, but rather a symbolic number testing whether the market can absorb a higher level of profits."

Securities firms most frequently cite the semiconductor industry as the main driver for further gains in the index. Yoon Seokmo, Head of Research at Samsung Securities, said, "There is a high likelihood that the upward trend in semiconductor prices will continue throughout this year. The global big tech companies have solidified their strategies to secure data centers, maintaining a supplier-dominant market, which is simultaneously boosting earnings and stock prices, potentially leading to further gains in the KOSPI."

Yoo Jongwoo, Head of Research at Korea Investment & Securities, also commented, "The KOSPI's upward momentum will persist as long as semiconductor profits do not decline," adding, "On an annual basis, 5,650 points could serve as the upper limit."

Hwang Seungtaek, Head of Research at Hana Securities, likewise stated, "Considering the semiconductor profit cycle similar to that of 2016-2018, the expected return on semiconductor stocks in 2026 could reach 204% compared to 2024. Even taking into account the existing rate of increase, there is still room for further gains, so we see the KOSPI's upper limit at 5,600 points this year."

There is also analysis that, from a valuation perspective, there is significant potential for additional gains. Lee Jonghyeong, Head of Research at Kiwoom Securities, emphasized, "Despite the recent sharp rise in the index, the KOSPI's forward price-to-earnings ratio (PER) valuation is only about 10.2 times, which is merely at the historical average level. Given the strength of profit momentum, it is appropriate to leave the upper range of the index open."

On the other hand, some explain that structural changes in the Korean stock market could drive further gains. Cho Suhong, Head of Research at NH Investment & Securities, said, "With improvements in corporate fundamentals and institutional innovation, the Korean capital market has entered the early stages of becoming an advanced market. The realization of profits by companies related to artificial intelligence (AI) infrastructure and the expansion of shareholder returns prompted by amendments to the Commercial Act will promote the inflow of long-term domestic and foreign capital." He added, "Structural profit improvements and governance modernization among listed companies will serve as momentum for the long-term inflow of domestic and foreign investment funds, going beyond simple regulatory changes."

However, there are also cautious voices stating that this upward phase cannot last forever. Park Heechan, Head of Research at Mirae Asset Securities, said, "The key driver of the current sharp stock price rise is the steep growth in earnings, but I do not believe this earnings growth is a structural change. Given the cyclical nature of Korean companies, it will ultimately be difficult to avoid a correction phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)