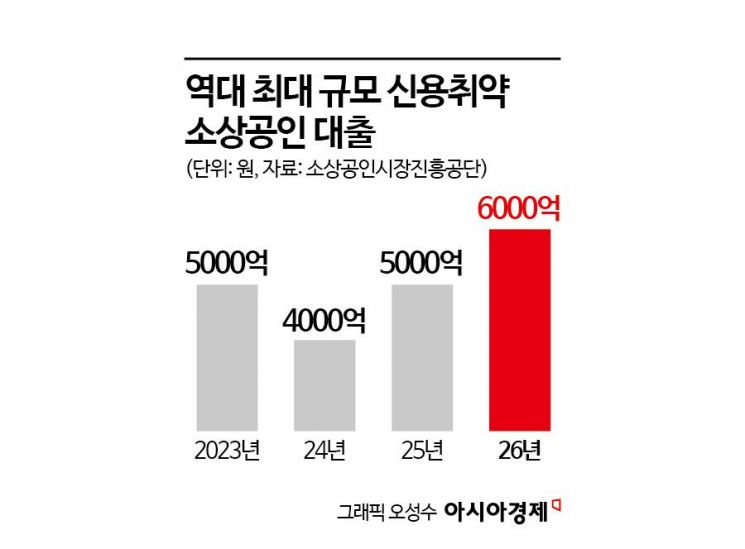

This year’s loans for credit-vulnerable small business owners reach 600 billion won

Prolonged economic downturn worsens business environment

Concerns rise: "Securing funding will become even more difficult"

The government’s “loans for credit-vulnerable small business owners,” which was allocated at a record-high scale this year, saw its January budget depleted almost immediately after applications opened, leading to an early closure. These loans are provided to small business owners with low credit scores who have difficulty accessing loans from financial institutions. This situation indicates that, due to prolonged sluggish domestic demand and a continued economic downturn, a large number of small business owners have been pushed to the brink of survival and are in urgent need of funds.

According to the Small Enterprise and Market Service on January 23, applications for this month’s loans for credit-vulnerable small business owners, which began on January 19, closed just about five minutes after opening. Last year, applications for these loans exceeded expectations and the entire budget was exhausted by the end of June. This year, the program returned at a record scale of 600 billion won after about seven months, but the influx of applicants in the very first month led to the funds being depleted in an instant. An official from the Small Enterprise and Market Service stated, “Even when there are many applicants, the window usually remains open for two to three days. This year, the number of applicants was much higher, which is likely why it closed so quickly.”

Loans for credit-vulnerable small business owners are provided to those with a credit score (NCB) of 839 or below, with a maximum of 30 million won per business. For those with low credit who find it difficult to obtain loans from foundations or banks, this is effectively considered a “last lifeline.” Labor and raw material costs are rising daily, and as consumer sentiment freezes, the business environment has deteriorated. As a result, an increasing number of borrowers are struggling to repay existing loans, signaling a growing crisis. According to a survey conducted last year by the Korea Federation of Micro Enterprise, as of 2023, about 60% of small business owners held debt, with the average debt amounting to 195 million won.

Na Sumi, a research fellow at the Korea Small Business Institute, explained, “Small business debt has continued to accumulate since the emergency special loans provided during the COVID-19 period. Many expected an economic recovery driven by so-called ‘revenge spending’ immediately after, but factors such as rising interest rates and inflation prevented a proper recovery period.”

There are also concerns that, as banks begin to focus more on “risk management” this year, funding channels for low-credit small business owners may narrow even further. According to the financial sector, as of the end of last year, the outstanding balance of corporate loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 844.7254 trillion won, up about 2.9% from the previous year. However, during the same period, the outstanding balance of loans to individual business owners decreased by 0.4% to 324.4325 trillion won. With ongoing global uncertainties such as high tariffs and exchange rates, banks continue to focus their lending on high-quality companies with reliable repayment capabilities.

Kim Yongki, former professor at Ajou University’s School of International Studies, commented, “Given the poor domestic consumption situation, the trend of favoring companies with relatively lower risk weights is likely to continue. As loan requirements become stricter, the financial pressure felt by low-credit small business owners may become much greater.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)