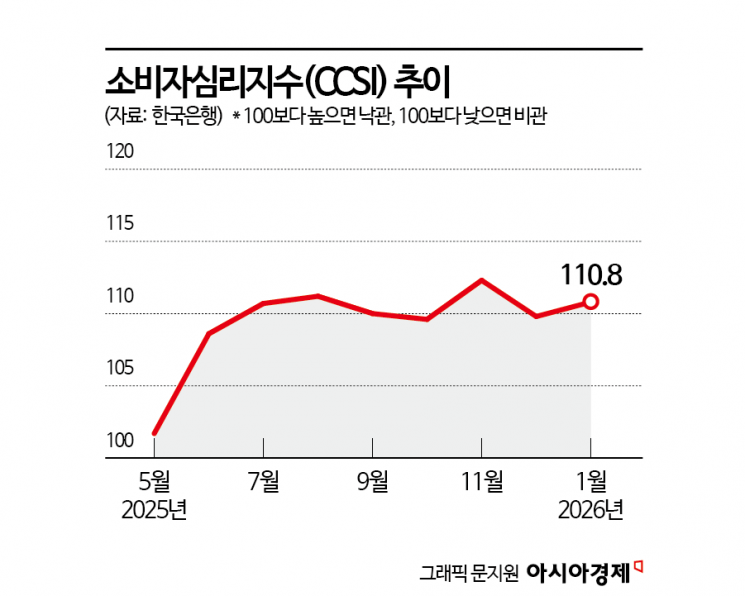

January Consumer Sentiment Index at 110.8, up 1.0 points

Stock Market Rally and Expectations for Government Economic Growth Strategy

Housing Price Outlook CSI '124' as an 8-Month Leading Indicator

Highest Level in 4 Years and 3 Months Since O

The Consumer Composite Sentiment Index (CCSI) for January turned upward after a month. The strong performance of the domestic stock market, including the KOSPI racing toward the symbolic 5000 mark in the Year of the Red Horse, led to an improvement in consumer sentiment. Expectations for the government's new economic growth strategy in the new year also played a role.

January CCSI recovers to 110 level... "Stock market rally and expectations for government economic growth strategy"

According to the "Consumer Survey Results for January 2026" released by the Bank of Korea on the 23rd, this month's CCSI rose by 1.0 points from the previous month to 110.8. The CCSI is a sentiment indicator that comprehensively reflects consumers' perceptions of the economy. It is calculated using six major indices that make up the Consumer Sentiment Index (CSI), including current living conditions, household income outlook, and consumption expenditure outlook. With the long-term average (from January 2003 to December 2025) set as the baseline of 100, a reading above 100 indicates optimism compared to the long-term average, while a reading below 100 indicates pessimism.

The CCSI plunged to 88.2 in December 2024 as consumer sentiment deteriorated due to the 12·3 martial law incident, and remained below the baseline until April last year. In May, the index surpassed the baseline, driven by easing trade risks following the US's mutual tariff suspension and expectations for the launch of the new government. Since then, supported by improving consumption and robust exports, the index hovered around the 110 level from July onward, reaching 112.4 in November-the highest in eight years. In December, concerns over a strong won-dollar exchange rate and rising living costs pushed it down to 109.9.

On the 22nd, when the KOSPI surpassed 5000 during trading hours, employees at the Hana Bank dealing room in Jung-gu, Seoul, are seen clapping joyfully.

On the 22nd, when the KOSPI surpassed 5000 during trading hours, employees at the Hana Bank dealing room in Jung-gu, Seoul, are seen clapping joyfully.

Lee Hyeyoung, Head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, commented, "This month's CCSI saw a slight increase as the domestic economy continued to improve and expectations for the government's economic growth strategy played a role," adding, "A reading above 110 means consumer expectations are higher than the historical average."

In particular, the KOSPI's sharp rise of about 250 points during the survey period (January 8-15) is seen as having had a positive effect on overall consumer sentiment. Lee explained, "The impact of rising stock prices was evident in several indicators, including living conditions, household savings, and consumption expenditure. Improved investment income led to better living conditions, and household savings-which include stocks and funds-also increased. Consumption expenditure was likewise affected by the increase in investment income." The rise in stock prices also contributed to a more positive perception of the economy.

The Current Living Conditions CSI (96) rose by 1 point due to improvements in domestic demand driven by rising stock prices and recovering consumption. The Current Household Savings CSI (99) and Consumption Expenditure Outlook CSI (111) also increased by 2 points and 1 point, respectively. In addition, the Future Economic Outlook CSI (98), which forecasts the economy six months ahead compared to the present, climbed by 2 points, thanks to expectations for the government's economic growth strategy and continued export growth. The Interest Rate Outlook CSI (104) rose by 2 points due to rising market interest rates and weakened expectations for a base rate cut.

Housing Price Outlook CSI, an "8-Month Leading Indicator," Hits Highest Level in 4 Years and 3 Months

The Housing Price OutlookCSI (124) jumped 3 points, reaching its highest level since October 2021-a span of 4 years and 3 months. Lee explained, "This is due to the continued rise in apartment sales prices nationwide and in the Seoul metropolitan area," adding, "Expectations are much higher than the long-term average of 107." Last year, the Bank of Korea's Economic Research Institute reported in "Characteristics and Implications of Housing Price Expectations" that housing price expectations tend to fluctuate significantly over short periods and, once formed, can persist for a long time. An analysis of the lagged correlation with actual price increases showed that the trend leads by about eight months. At the current level of the Housing Price Outlook CSI, it suggests the possibility of a rise in housing prices around September this year.

The expected inflation rate for the next year, which reflects expectations for consumer price increases over the coming year, remained unchanged from the previous month at 2.6%. Although the month-on-month increase in consumer prices slowed, living costs remained high, resulting in this outcome.The expected inflation rate for three years ahead fell by 0.1 percentage points from the previous month to 2.5%, while the five-year ahead expectation remained steady at 2.5%.

Meanwhile, this survey was conducted from January 8 to 15, targeting 2,500 urban households nationwide, with 2,254 households responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)