Domestic Auction Sales Reach 142.7 Billion Won, Overseas Market Up 11.1%

Recovery Driven by High-Value Works Amid Fewer Lots Offered

The art market has moved beyond the overheated phase that followed the pandemic and has now entered a period of adjustment and restructuring. While the overall volume of transactions has decreased, capital is concentrating on verified artists and their signature works, resulting in a clear pattern of selective rebound where recovery and stagnation coexist. These changes are making the gap in strategy and resilience among market participants even more apparent.

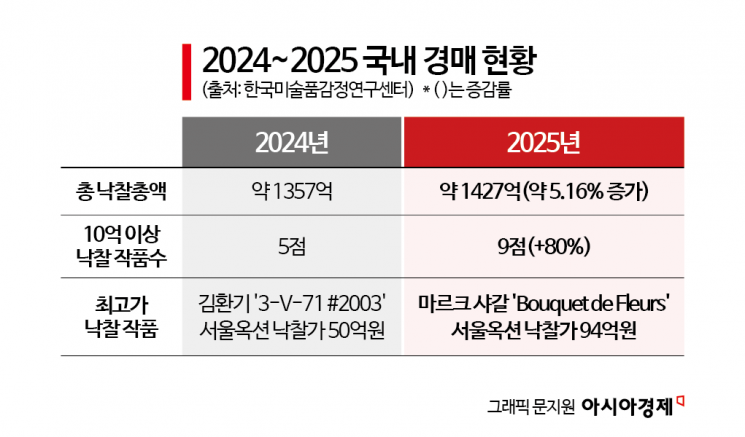

According to the "2025 Art Market Analysis Report" released on January 22 by KAAAI, the corporate research institute of the Korea Art Appraisal Research Center, the domestic art market in 2025 experienced both quantitative contraction and qualitative growth. Despite a decrease in the number of works offered, high-value transactions continued to be led by major auction houses. The total hammer price of nine domestic auction houses reached 142.7 billion won, up 5.16% from the previous year. Both the success rate and the average hammer price also rose, further intensifying the concentration of capital on high-priced blue-chip works. In contrast, the gap with smaller auction houses widened, deepening the polarization of the market.

The global auction market showed a similar trend. According to the report, the total hammer price of artworks at the three major auction houses-Christie’s, Sotheby’s, and Phillips-reached $4.56 billion, an 11.1% increase from the previous year, even though the number of works sold declined by 33.3%. The Impressionist and Modern Art segments surged by 31.4%, showing strong performance, while the Ultra-Contemporary Art segment-which had soared during the pandemic-plummeted by 39.1%, highlighting a stark divergence between categories. Notably, the New York market grew by 25.7% year-on-year, accounting for 68.3% of single-owner collection sales and maintaining its status as the global hub of auctions.

The report identified the key themes for the 2025 art market as "preference for verified names," "quality-focused transactions," and the "rise of single-owner collections." Collectors have shifted their focus from short-term price gains to the art historical value, rarity, and provenance of works. Galleries, too, are restructuring towards project-based operations and cost efficiency rather than aggressive expansion. Although the number of participants in art fairs has decreased, the concentration around major galleries has increased, reinforcing a strategy of selection and focus.

Regionally, the influence of collectors from the Gulf region and Asia has expanded, while Generation Z collectors have emerged as a new consumer group that values lifestyle and brand experience. Meanwhile, in the art-backed loan market, cases of default have increased, particularly among non-bank lenders, exposing the risks of excessive leverage strategies.

KAAAI forecasts 2026 as a "year of quiet recovery" for the art market. While indicators suggest a gradual rebound, the benefits of recovery are likely to be concentrated in specific categories and regions. Artists with established art historical value-such as those in the Impressionist, Modern, and Old Master segments-are expected to remain strong, whereas the highly speculative Ultra-Contemporary Art segment is anticipated to continue its adjustment phase. Large-scale cultural projects in the Middle East and Gulf regions, major biennale seasons, and issues related to AI and copyright have also been cited as major variables for the future market.

The report stressed the urgent need to strengthen the secondary market to address structural imbalances in the domestic art market. It recommends moving beyond the auction house-centric distribution structure and empowering expert-run secondary galleries to analyze artwork condition, provenance, and market trends, thereby offering fair value and enhancing the market’s sustainability and stability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)