Part of the 'Corporate Value Enhancement Plan' announced last October

50% shareholder return ratio target for 2027 likely to be achieved ahead of schedule

Hana Financial Group, a model student in the 'Value Up' initiative, has accelerated its shareholder return efforts this year by completing a 150 billion won share buyback ahead of schedule. As a result, Hana Financial Group's shareholder return ratio for 2025 is expected to rise significantly compared to last year, and the original target of achieving a 50% shareholder return ratio by 2027 is likely to be reached earlier than planned. Amid the recent stock market rally, attention is focused on whether bank stocks-which have been relatively overlooked-will gain upward momentum following this announcement.

According to the financial sector on January 23, Hana Financial Group announced on the 21st that it had completed a share buyback totaling 149.9 billion won. Initially, Hana Financial Group had planned to complete the buyback by January 27 this year, but finished earlier than scheduled. This is part of the 150 billion won share buyback and cancellation promised under the 'Corporate Value Enhancement Plan' announced in October last year. Previously, Hana Financial Group had announced share buybacks worth 400 billion won in March, 200 billion won in July, and 150 billion won in October last year, bringing the total amount of share buybacks to 750 billion won so far.

Hana Financial Group is also steadily carrying out share cancellations following the buybacks. A Hana Financial Group representative stated, "Of the total 750 billion won in shares bought back, 400 billion won has already been canceled," and added, "The remaining 350 billion won will also be canceled within the first half of this year." While share buybacks signal management's commitment to responsible governance, share cancellations are a practical means of enhancing shareholder value by reducing the number of shares in circulation and increasing per-share value.

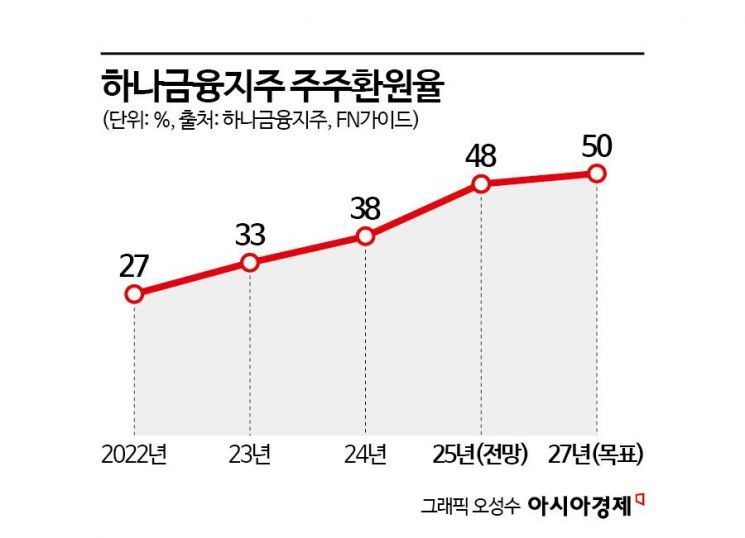

At this pace, Hana Financial Group is likely to achieve its shareholder return ratio target ahead of schedule. Through its 'Corporate Value Enhancement Plan,' Hana Financial Group had announced a goal of reaching a 50% shareholder return ratio by 2027. In fact, the group's shareholder return ratio has steadily increased from 27% in 2022 to 33% in 2023 and 38% in 2024. With this rapid pace of shareholder returns, the ratio for 2025 is projected to jump to around 48%, a significant increase from the previous year. If this trend continues, the originally announced 50% target for 2027 could be achieved as early as this year.

Kim In, a researcher at BNK Securities, analyzed, "Hana Financial Group's 2027 target of a 50% total shareholder return ratio is likely to be achieved ahead of schedule," adding, "With the implementation of tax-free dividends in the future, the shareholder return policy is expected to be further strengthened."

Consequently, there is growing interest in whether bank stocks, which have been left out of the KOSPI rally, will rebound. From January 2, the first trading day of the new year, to January 22, the KOSPI index rose 14.9%, while the share prices of the four major financial holding companies (KB, Shinhan, Hana, Woori) increased by an average of only 6.65%. During the same period, Hana Financial Group's stock rose by 7%, which is only about half the average increase of the KOSPI.

Choi Jungwook, a researcher at Hana Securities, commented, "As the KOSPI rises mainly on IT stocks, bank stocks are not declining, but they are failing to keep up with the market's returns," adding, "However, their dividend appeal is strong, and investment attractiveness could be further highlighted as exchange rates stabilize."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)