After Sub-1% Slumps During the Global Financial Crisis and COVID-19, Growth Rebounded Above 4%

Long-Term Efforts Needed to Diversify Export Structure and Address Polarization

This year, South Korea's economic growth rate is expected to rebound to around 2%. Analysts attribute this rebound to robust exports led by the semiconductor sector, a recovery in consumer spending, and an easing of the slump in construction, all of which are expected to improve domestic demand. However, experts note that, given last year's low growth base effect-when growth barely reached 1%-the recovery remains modest compared to the past. High exchange rates and a still-unstable real estate market have been cited as risk factors for this year. In the long term, efforts to diversify export structures and address polarization are seen as necessary.

Rebound to Around 2% Expected This Year... Semiconductor-Led Export Boom, Consumer Recovery, and Easing of Construction Slump

Earlier this month, the government announced its '2026 Economic Growth Strategy,' setting a target of 2.0% growth for this year. This is 0.2 percentage points higher than the previous forecast of 1.8%. Through active fiscal policy and targeted measures for consumption, investment, and exports, the government aims to raise this year’s growth rate into the 2% range, up from last year’s 1.0%. The government expects the semiconductor industry to continue driving economic growth, as it did last year. Improved terms of trade due to falling international oil prices are also expected to boost exports, with this year’s export growth rate forecast to reach 4.2%.

The Bank of Korea projects South Korea’s economic growth rate at 1.8% for this year. Both private consumption and goods exports are expected to continue their upward trend from last year, and the government’s role is anticipated to expand. Lee Dongwon, Director General of Economic Statistics Department 2 at the Bank of Korea, stated, "The 3.3% increase in this year's government budget will further enhance the government's contribution." The easing of last year’s unusually severe construction downturn is also seen as a positive factor. The current account surplus is expected to reach a record high of 130 billion dollars this year.

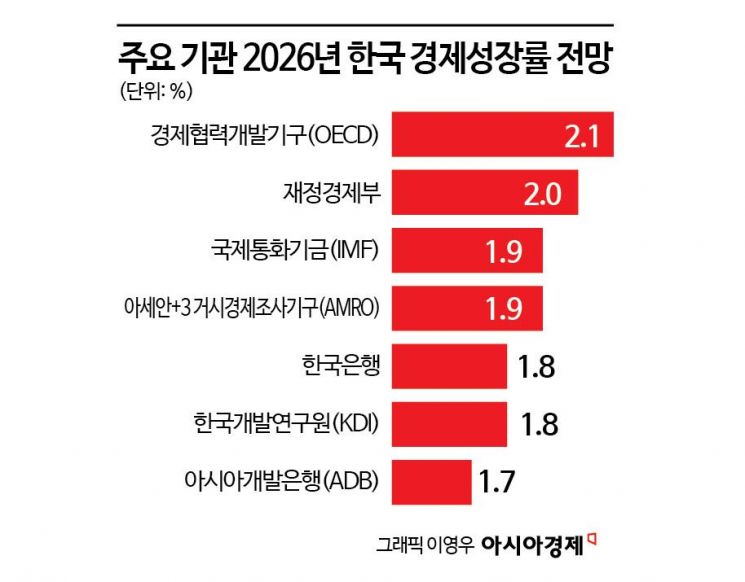

Growth forecasts for South Korea from domestic and international institutions mostly hover around 2% for this year. The Organisation for Economic Co-operation and Development (OECD) projects a higher rate of 2.1%, while the International Monetary Fund (IMF, 1.9%), ASEAN+3 Macroeconomic Research Office (AMRO, 1.9%), Korea Development Institute (KDI, 1.8%), and Asian Development Bank (ADB, 1.7%) have all released forecasts below 2%.

Weaker Than Past ‘Post-Slump Rebounds’... Need to Focus on Structural Reforms Such as Export Diversification

The pace of this year’s recovery is considered sluggish compared to the past. In previous periods of sluggish growth-such as after the global financial crisis and COVID-19-South Korea achieved growth rates above 4% thanks to a rebound in private consumption and facility investment. In contrast, the current rebound is relatively weak. Kim Jeongsik, Professor Emeritus of Economics at Yonsei University, pointed out, "Even with the base effect, if growth reaches only 1.8-2.0% this year, that is still 0.4-0.6 percentage points lower than the United States (2.4%, IMF forecast), meaning the growth rate remains low."

While improvements in consumption and an easing of the construction slump are positive factors this year, concerns regarding the foreign exchange and real estate markets, as well as household debt, have been identified as risk factors. The recovery in domestic demand and robust semiconductor-led exports are expected to drive this year’s economic rebound. However, structural challenges remain, such as the growth rate gap between IT and non-IT sectors, declining potential growth, and polarization. The government warns that if the downward trend in potential growth continues, the rate could fall to around 1% in the 2030s and into the 0% range in the 2040s. Son Jongchil, Professor of Economics at Hankuk University of Foreign Studies, commented, "How much structural reforms and other measures can address obstacles to growth will be a key factor in determining the level of economic growth this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)