Alteogen Plunges for Three Consecutive Days, Down 27.9%

Leading Stock's Sharp Decline Drags Down Bio Stocks and KOSDAQ

Disappointment Over Technology Transfer Deal Size Weighs on Share Price

Alteogen, the top stock on the KOSDAQ, plunged more than 20%, casting a chill over the KOSDAQ market. The sharp decline was triggered by disappointment over the scale of Alteogen's technology transfer agreement. As Alteogen tumbled, other biotech stocks also weakened, pushing the KOSDAQ index down to the 950 level.

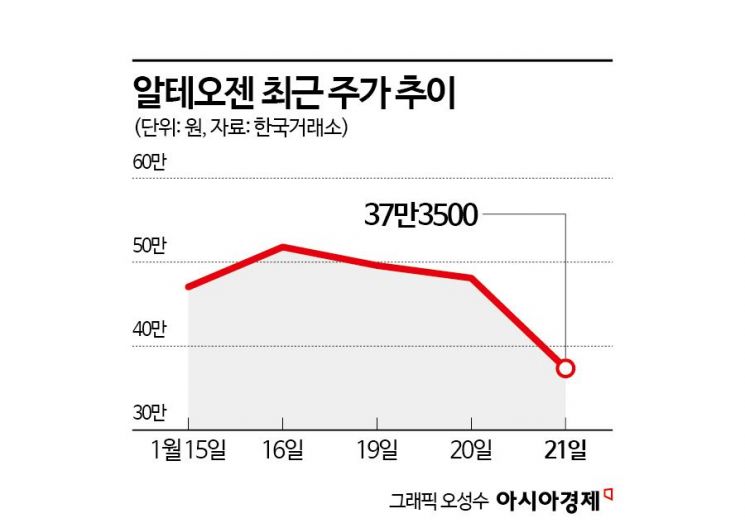

According to the Korea Exchange on January 22, Alteogen closed at 373,500 won on the previous day, down 22.35% from the previous session. The stock continued its decline for three consecutive days, dropping from the 510,000 won range to the 370,000 won range. The three-day drop amounted to 27.9%.

The weakness in Alteogen led to a broad decline among KOSDAQ biotech stocks. ABL Bio fell by 11.89%, Legochem Biosciences by 12.12%, and Peptron by 13.21%, all posting significant losses. Due to the steep declines in biotech stocks, the KOSDAQ index reversed its upward trend after five days and closed down 2.57% at 951.29.

This sharp drop in Alteogen is seen as a reflection of the market's disappointment with the scale of the technology transfer agreement. On January 20, Alteogen announced that it had signed an exclusive license agreement with Tesaro, a US subsidiary of GSK, for its human hyaluronidase product (ALT-B4). The deal was valued at 29.5 billion won in upfront payments and 390.5 billion won in milestone payments, totaling 420 billion won. This figure fell far short of initial market expectations.

Previously, at the JP Morgan Healthcare Conference (JPMHC), Alteogen CEO Jeon Taeyoung stated, "We plan to announce the technology transfer for ALT-B4 as early as next week," and "The scale is expected to be similar to previous technology transfer deals." As a result, the market anticipated a deal worth several trillion won, and Alteogen's stock price surged following these remarks in anticipation of a large contract.

Kim Seona, a researcher at Hana Securities, commented, "Due to the mention of a 'deal at a scale similar to previous ones' at the recent JPMHC, the market was expecting a contract similar to last March's 1.9 trillion won deal with AstraZeneca," adding, "The high expectations were on our side; the GSK deal does not reflect inferior terms related to technology or marketability. Also, in AstraZeneca's case, the contract included two additional pipelines, so the total contract size was different, and there could be significant differences in undisclosed royalties, which should also be considered."

Additionally, the market's disappointment grew when it was confirmed through Merck's third-quarter report that Alteogen's royalty rate from Keytruda SC sales would be 2%. The market had expected a rate of 4-5%. Eom Minyong, a researcher at Shinhan Investment Corp., said, "The detailed contract terms were confirmed through Merck's public disclosures, and due to the non-exclusive and early-stage nature of the contract, the royalty rate is relatively low at 2%." He added, "According to Alteogen, the royalty rates for subsequent contracts will mostly be in the mid-single digits (4-6%)." He went on to say, "If the disclosed Keytruda SC contract terms are reflected, there is a possibility of short-term adjustment due to changes in valuation."

However, some experts noted that the resolution of uncertainty is a positive development. Eom added, "From the perspective of earnings estimates, the resolution of uncertainty is positive, and the GSK deal has also clearly resolved patent risks. We expect growth to continue from a mid- to long-term perspective."

Lee Jisoo, a researcher at Daol Investment & Securities, stated, "GSK is a global top-tier pharmaceutical company that adopts a selective technology acquisition strategy, emphasizing data and commercial necessity in the oncology and immunology fields. This deal signifies that internal verification of the intellectual property (IP), including the patent for ALT-B4, has been completed." He added, "This will serve as a turning point that removes discount factors in future negotiations with other partners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.