Utilization Rate Targeted at 60?70% This Year, Up from 50% Last Year

Focus on Profitability Improvement Ahead of Tesla Supply

Samsung Electronics Foundry, which has signed a large-scale artificial intelligence (AI) chip supply contract with Tesla, is expected to raise its factory utilization rate to 60-70% within this year. The company aims to offset fixed costs and improve profitability by increasing utilization rates, particularly for mature process nodes. This strategy is interpreted as an effort to secure the capacity to compete with Taiwan's TSMC in advanced processes such as 2nm (1nm = one-billionth of a meter).

According to the semiconductor industry on January 21, Samsung Foundry's fab utilization rate, which remained at around 50% last year, is expected to surpass 60% in the first half of this year. After winning orders for Nvidia's 8nm graphics processing units (GPUs) used in Nintendo's gaming consoles last year, Samsung has reportedly also secured Intel's platform controller hub (PCH) orders recently. There are even projections that the fab utilization rate could exceed 70% within the year.

Samsung plans to focus on improving profitability until the Tesla chip supply ramps up in earnest. An industry insider commented, "Although overshadowed by the memory boom, the foundry business is steadily strengthening its fundamentals by securing significant customers." He added, "If the Tesla chip demonstrates strong performance in the market, it could become a turning point where customers who have fallen in TSMC's priority list switch to Samsung."

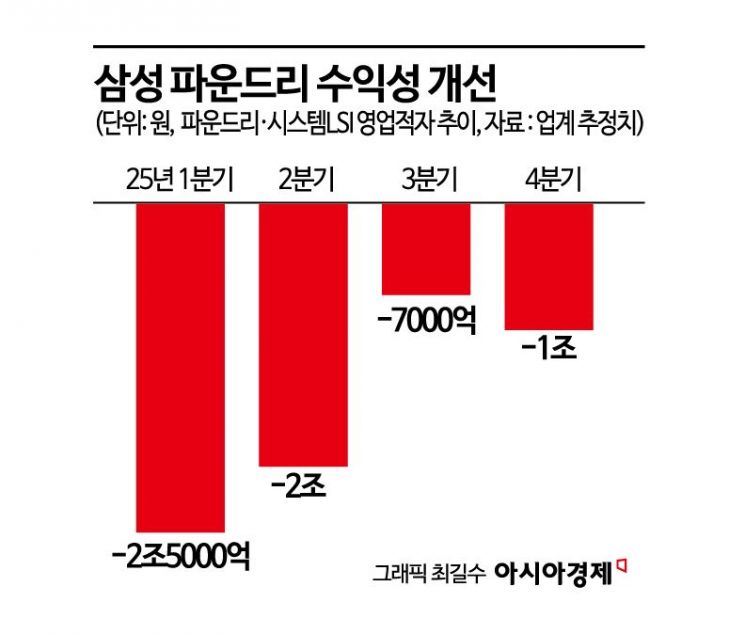

The key to foundry profitability lies in utilization rates. Due to high fixed costs, idle production lines quickly lead to accumulating losses. Last year, Samsung Electronics revised its business roadmap and accelerated profitability improvement by focusing on yield enhancement and expanding orders for mature process nodes. In the third quarter of last year, the Device Solutions (DS) division of Samsung Electronics posted an operating profit of 7 trillion won, with the memory business contributing 7.7 trillion won in profit, while the foundry and system LSI businesses reportedly incurred a loss of about 700 billion won. For the fourth quarter, which has not yet been disclosed, memory operating profit is estimated at 18 trillion won, while non-memory losses are projected at 1-1.5 trillion won. This marks a clear trend of performance improvement compared to the more than 2 trillion won in quarterly losses recorded in the first half of last year.

Furthermore, expectations for Samsung Foundry have risen after Elon Musk, CEO of Tesla, announced that the design of the new chip 'AI5 (3nm)' is nearing completion, and the next-generation 'AI6 (2nm)' design has entered its initial phase. In July last year, Samsung Electronics signed a 23 trillion won supply contract with Tesla for AI6 and also agreed to participate in AI5 production. Considering a design cycle of about nine months, the next-generation AI6 chip is expected to complete its design by the end of this year and enter mass production in 2028. Although the AI5 volume, which will be produced in collaboration with TSMC and others, is relatively small, it is anticipated to serve as a significant reference for advanced process technology in the market.

Some point out that Samsung Electronics is trapped in a "second-choice position." The Financial Times (FT) stated in a column on January 16, "They make products you turn to when you can't get your first choice," evaluating that Samsung is riding the "slipstream" of semiconductor beneficiaries. This is interpreted to mean that Samsung is only benefiting as an alternative for companies unable to secure TSMC's foundry capacity.

However, within the semiconductor industry, there is also an assessment that Samsung's "profitability improvement first" strategy is realistically valid, given that the market share gap has widened to tenfold. An industry source said, "In a situation where the market share gap is extreme, it is a realistic decision to buy time to catch up with the industry leader." The source added, "Since Samsung is already in discussions with major tech companies such as Google and AMD, there is a strong possibility that the market landscape will change after the 2nm process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)