US Links Semiconductor Investment and Production to Tariff Benefits

Korea Faces Challenge of Coordinating Detailed Standards

As the United States begins to actively use semiconductor tariffs to encourage foreign semiconductor companies to manufacture within its borders, the Korean government and industry are closely monitoring how to respond. There are growing concerns that the recent "investment-tariff linkage model" established between the US and Taiwan could become a global standard, inevitably affecting Korean companies. Previously, semiconductor policy was mainly linked to subsidies at the supply chain level, but there is now a clear trend toward the complex interconnection of tariffs, procurement, investment, and security factors.

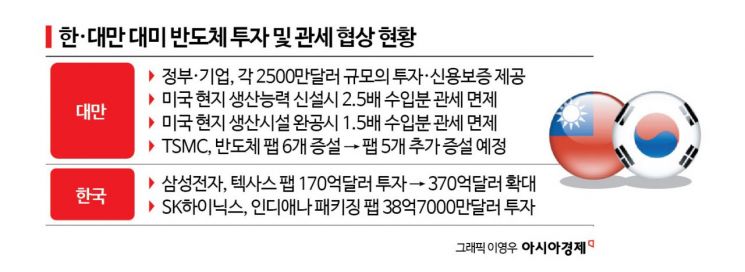

According to the Ministry of Trade, Industry and Energy on January 20, the US government has reportedly introduced a system whereby Taiwanese companies can receive partial tariff exemptions if they expand their semiconductor production capacity in the US to a certain level. This move aligns with the reclassification of semiconductors from simple traded goods to strategic industries and security assets. A ministry official stated, "In the Korea-US negotiations, we secured the most-favored-nation principle to ensure we are not treated less favorably than Taiwan," adding, "However, we will continue to discuss technical issues such as which items tariffs will apply to and the scope of investments recognized with the US side."

The shift in US strategy has also been reflected in local remarks. On January 16 (local time), US Secretary of Commerce Howard Lutnick warned at a semiconductor plant groundbreaking ceremony in New York, "Companies that want to make memory semiconductors have two choices: pay a 100% tariff or produce in the United States." Although he did not specify any countries, his message was interpreted as pressure on memory-producing countries such as Korea and Taiwan to manufacture within the US. Industry insiders have commented that this is a signal to use tariffs as leverage to relocate both production and investment.

Taiwanese companies can receive tariff reductions if they expand their US production capacity by 2.5 times during the construction phase and by 1.5 times after completion. Although the US mentioned bilateral agreements with individual countries, some analysts believe that, as the Taiwanese semiconductor industry accepts US investment demands from a security and supply chain perspective, the US has gained justification to expand similar models to Korea, Japan, and Europe.

It remains uncertain whether the 'most-favored-nation' principle secured by the Korean government will actually translate into tariff benefits. Since the Taiwanese model provides "conditional benefits"-reduced tariffs in exchange for increased US production-the benefits Taiwan receives do not automatically apply to Korea. If investment size or production plans differ by country, the results may also differ, meaning the most-favored-nation principle merely ensures Korea is not treated less favorably than Taiwan, rather than guaranteeing any benefits.

There are considerable burdens for Korean companies in particular. While Samsung Electronics and SK Hynix are building semiconductor plants in the US, a significant portion of AI-related products such as high-bandwidth memory (HBM) are still produced in Korea and China. Shifting production to the US would simultaneously raise challenges in terms of capital expenditures (CAPEX), workforce, electricity, and yield rates. Especially for HBM, which has been increasingly classified as a strategic item due to the explosive demand for AI servers this year, there are concerns that tariffs, procurement, and subsidy regulations could be combined. As a result, the industry largely views these measures as a new set of rules that combine industrial policy, supply chain management, and security, going beyond mere protectionism.

Changes are also emerging at the supply chain level. The US is reclassifying semiconductors as assets of national strategy and security, while expanding cooperation channels with allied countries. Japan is strengthening technological and investment cooperation with the US in semiconductor equipment and materials, and the European Union is working to boost its own semiconductor production capacity and supply chain resilience through the "Chips Act." The global semiconductor supply chain is seen as moving toward realignment around the United States. In contrast, China is taking an adversarial stance against the US, focusing on semiconductor export controls and restrictions on semiconductor equipment, which may narrow the supply chain options available to Korean companies.

The Korean government plans to coordinate with the US side based on feedback from companies. A ministry official said, "Future negotiations will address technical elements such as the definition of AI semiconductors, the scope of recognized processes, and the timing of investments," adding, "We will respond by considering the characteristics of each item, including HBM, foundry, memory, and system semiconductors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.