Nongshim Maintains Domestic Market Dominance... Continues Stable Growth in Scale

Samyang Foods Sees Rapid Shift in Overseas Sales and Profit Structure Led by Buldak

Competition Shifts from Market Share to Global Production Capacity

The stage for competition in the ramen market has shifted. While Nongshim has maintained its throne by leveraging the brand power and distribution dominance of Shin Ramyun, Samyang Foods has rapidly increased its performance, led by Buldak Bokkeummyeon. As the ramen war expands globally, the competition between the two companies is no longer about 'who sells more,' but rather about who can supply global demand more quickly and reliably.

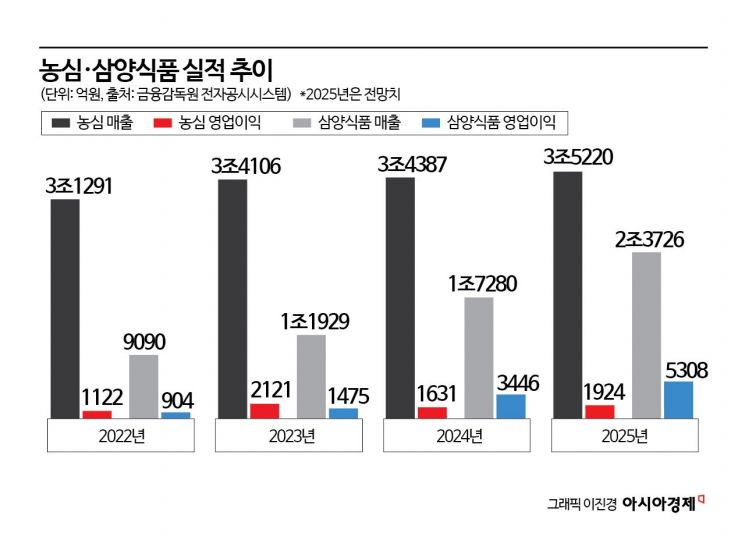

According to market research firm FnGuide on January 20, Nongshim’s sales last year are projected to reach 3.522 trillion won, a 2.4% increase from the previous year. Nongshim’s sales have shown a steady upward trend, rising from 3.1291 trillion won in 2022 to 3.4106 trillion won in 2023, and 3.4387 trillion won in 2024. This trend appears to have continued last year as well. Even as the domestic food market has generally entered a stagnation phase, Nongshim has maintained stable growth in size.

Nongshim Shin Ramyun and K-Pop Demon Hunters collaboration advertisement displayed on a digital outdoor billboard in Times Square, USA. [Photo by Nongshim]

Nongshim Shin Ramyun and K-Pop Demon Hunters collaboration advertisement displayed on a digital outdoor billboard in Times Square, USA. [Photo by Nongshim]

Nongshim Maintains the Throne, but Faces Heavier Structure

Nongshim still holds a unique position in the ramen market, backed by its dominance in domestic distribution networks and brand trust. The lineup of Shin Ramyun, Chapagetti, and Neoguri has occupied consumers’ tables for decades, and this brand equity is difficult to replace in a short period. As of the third quarter last year, ramen accounted for about 84% of Nongshim’s sales, with ramen sales estimated to be around 3 trillion won in 2025.

However, Nongshim’s operating profit growth has slowed. It increased significantly from 112.2 billion won in 2022 to 212.1 billion won in 2023, but then dropped to 163.1 billion won in 2024, and is expected to remain around 192.4 billion won in 2025. While sales increased, expanded spending and higher costs have limited the pace of profitability recovery.

This is attributed to the domestic ramen market having already reached a mature stage. With demographic changes, the increase in single-person households, and the diversification of dining-out and convenience food options, it is no longer easy for ramen consumption to grow quantitatively as it did in the past. Therefore, to sustain growth, price increases, expansion of premium products, brand renewal, and strengthened marketing have become inevitable.

Nongshim has also faced increased cost burdens due to the launch of new products, brand refreshes, and expanded global marketing, which have put short-term pressure on operating profit. However, some analysts view these as proactive investments for mid- to long-term growth, rather than a result of weak demand.

Nongshim is seeking growth solutions overseas. In North America, it is strengthening its localization strategy centered on Shin Ramyun, while in China, it is reorganizing its distribution channels and preparing for mid- to long-term growth. The establishment of a European sales subsidiary is part of the same strategy. Although it is still in the investment phase, the company is laying the groundwork for global brand expansion.

Samyang Foods: Buldak Has Changed the Company's Identity

Samyang Foods stands in stark contrast to Nongshim. Its sales surged from 909 billion won in 2022 to 1.1929 trillion won in 2023, 1.728 trillion won in 2024, and are expected to reach 2.3726 trillion won last year. As of the third quarter last year, ramen accounted for over 90% of Samyang Foods’ sales. The growth in operating profit has been even more dramatic, jumping from 90.4 billion won in 2022 to 147.5 billion won in 2023, 344.6 billion won in 2024, and projected to reach 530.8 billion won in 2025. The rate of profit growth far outpaces that of sales growth.

At the center of this transformation is the 'Buldak' brand, which has fundamentally changed the company’s business structure. Previously focused on the domestic market, Samyang Foods quickly shifted to an export-oriented company after the success of Buldak. As of 2024, overseas sales account for about 77% of Samyang Foods’ total, and last year, this figure is estimated to have approached 80%.

The change in sales structure has led to an increase in average selling price (ASP). As the proportion of overseas sales and high value-added products has grown, Samyang Foods’ ramen ASP has risen by more than 30% cumulatively over the past three years. This explains why operating profit margins have improved despite aggressive marketing expenditures.

The Decisive Factor in the 2026 Ramen War: Supply Capability

As the ramen industry’s battleground moves to the global stage, the decisive factor is now supply capacity. With Buldak products repeatedly selling out in major channels in the United States and China, Samyang Foods has made aggressive moves. The company has significantly expanded production capacity centered on the Miryang Plant No. 2, and has even begun construction of a local plant in China to directly absorb global demand.

After brand demand is established in the global market, if production capacity cannot keep up, the growth curve inevitably flattens. Samyang Foods has chosen a strategy to preemptively resolve bottlenecks after demand and to turn the success of Buldak from a one-time trend into structural growth.

The completion ceremony of Samyang Foods Miryang Plant 2 held in June last year [Photo by Samyang Round Square]

The completion ceremony of Samyang Foods Miryang Plant 2 held in June last year [Photo by Samyang Round Square]

Nongshim’s approach is somewhat different. While maintaining overwhelming competitiveness in domestic production and distribution, Nongshim is pursuing gradual expansion tailored to the characteristics of each global region. Although it is growing the Shin Ramyun brand in North America and China, the structure is different from Samyang Foods, where demand is concentrated on a single brand. This is both Nongshim’s strength and limitation. With a broad and stable product portfolio, its global expansion is proceeding in a more cautious and step-by-step manner.

An industry insider commented, “The brand equity and distribution dominance symbolized by Nongshim’s Shin Ramyun are not easily shaken in the short term. However, the rules of the game are changing in the global market. In the past, the standard was for the top domestic brand to expand overseas, but now, brands that first explode abroad are becoming the growth engines for companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.