Price Index Increased for 56 Out of 73 Key Items

Accounting for 76.7% of All Surveyed Products

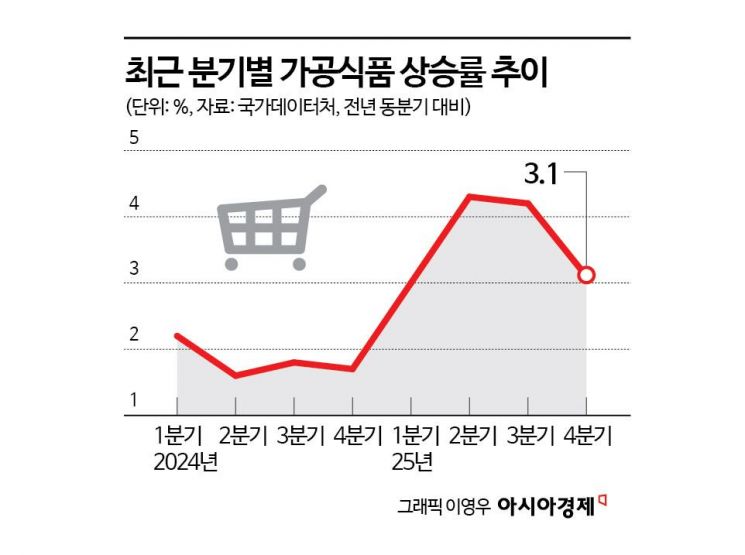

The prolonged period of high exchange rates is driving up the prices of food and petroleum products, with signs that this trend is spreading across overall consumer prices. If the structure in which high exchange rates push up raw material costs and import prices continues, it is expected that the pressure on perceived prices, especially for processed foods, will persist throughout this year.

According to the National Data Office, as of December last year, the inflation rate for processed foods recorded 2.5% year-on-year, marking a decline for three consecutive months. However, among the 73 major items tracked by the government during the same period, the price index for 56 items, or 76.7% of the total, increased compared to the same month last year. The price of dried squid jumped by 24.3% year-on-year, while chocolate (17.2%), cereal (13.6%), dried pollack (11.1%), seasoning sauces (10.5%), and gochujang (10.3%) also saw increases of around 10% or more.

Since the crisis, companies have raised prices on 53 processed food items including coffee, bread, frozen foods, and ramen, causing a surge in "table prices." Many analysts believe that companies had been holding back on price increases in cooperation with the government's price stabilization measures but raised product prices in bulk during the government’s transitional period. The photo shows a coffee sales stand at a large supermarket in Seoul on June 10, 2025. Photo by [Photographer's Name]

Since the crisis, companies have raised prices on 53 processed food items including coffee, bread, frozen foods, and ramen, causing a surge in "table prices." Many analysts believe that companies had been holding back on price increases in cooperation with the government's price stabilization measures but raised product prices in bulk during the government’s transitional period. The photo shows a coffee sales stand at a large supermarket in Seoul on June 10, 2025. Photo by [Photographer's Name]

The main concern is that if high exchange rates persist, there is a significant risk that consumer prices, which had been barely contained, could be pushed up again. When the exchange rate rises, it leads to higher petroleum product prices-even if international oil prices fall-resulting in a broader burden on overall living costs. Last month, petroleum product prices rose by 6.1%, the largest increase in ten months since February (6.3%). Both diesel (10.8%) and gasoline (5.7%) prices saw substantial increases.

Ultimately, rising exchange rates are causing a chain reaction, pushing up prices from petroleum products to industrial goods and then to processed foods. In particular, processed foods are closely linked to international raw material prices such as grains, crude oil, and palm oil. When raw material prices rise, they are typically reflected in consumer prices after a lag of one to two quarters. According to the Food and Agriculture Organization (FAO) of the United Nations, the global food price index in December last year fell by 0.6% from the previous month, but the sugar price index rose by 2.4%. Reduced production in major regions of Brazil and the increased conversion of sugarcane to ethanol were identified as factors driving up sugar prices.

Another issue with processed foods is that even if international prices temporarily decline, retail prices rarely decrease accordingly. This is because food companies face high fixed costs, including marketing, logistics, and labor expenses, leaving little room for price reductions. It is also noteworthy that the rising prices of agricultural, livestock, and marine products, combined with higher processed food prices, are increasing the burden on household grocery expenses. Last year, imported seafood products such as yellow croaker (10.5%) and mackerel (10.3%), which have a high import ratio, directly reflected the impact of high exchange rates in their prices. Protein foods such as pork (6.3%), imported beef (4.7%), and eggs (4.2%) also saw consecutive price increases.

The Bank of Korea expressed concern that high exchange rates are driving up the cost of living. The Bank emphasized, "Despite the decline in international oil prices, the rise in exchange rates has actually accelerated the increase in petroleum product prices." Kang Sungjin, professor of economics at Korea University, explained, "The key point is that even if global oil prices fall immediately, a rise in exchange rates causes the prices of all imported raw materials to increase, inevitably leading to higher processed food prices. Depending on the product, this can typically affect actual prices starting three months after the contract is signed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)