Maintaining Fourth Place as Honda and Nissan Falter

Flexible Production Strategy, Not Passing Tariff Burdens to Consumers, Key to Success

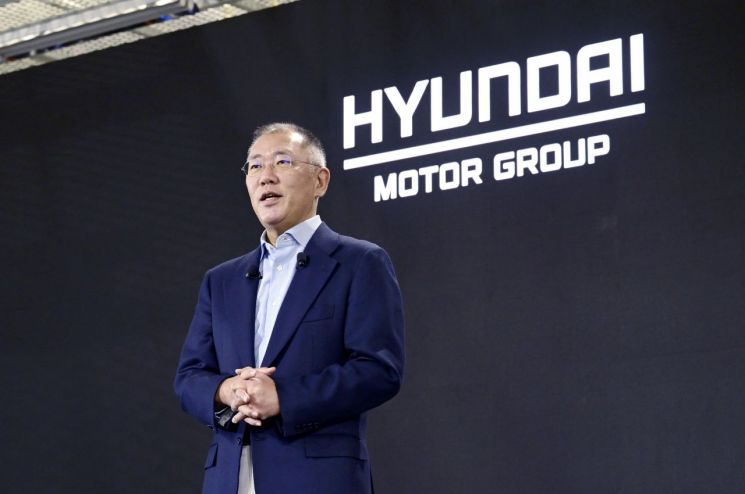

Hyundai Motor Group achieved its highest-ever market share (11.3%) in the United States last year.

According to market research firm Wards Intelligence and industry sources on January 18, Hyundai Motor and Kia sold a combined total of 1,836,172 vehicles in the United States last year, capturing a market share of 11.3%. Hyundai Motor accounted for 6.1% (984,017 units), while Kia held 5.2% (852,155 units).

This marks the first time Hyundai Motor Group has reached an annual market share in the 11% range in the United States. Since entering the U.S. market in 1986, Hyundai Motor Group maintained a 7-8% share throughout the 2010s and recorded a double-digit share for the first time in 2022. The group then posted a 10.7% share in 2023 and 10.8% in 2024.

Compared to competitors last year, Hyundai Motor Group maintained fourth place behind General Motors (17.5%, 2,841,328 units), Toyota (15.5%, 2,518,071 units), and Ford (13.1%, 2,133,892 units).

The significant increase in Hyundai Motor Group's U.S. market share is attributed to the fact that the sales growth rate of Hyundai Motor and Kia far outpaced the overall market average.

Total vehicle sales in the U.S. market last year reached 16,233,363 units, up 2.4% from the previous year. Within this, Hyundai Motor and Kia posted a 7.5% increase, selling 1,836,172 units. American brands saw a 3.3% increase in sales, while Japanese brands only managed a 2.4% rise due to sluggish performance from companies like Honda and Nissan. Among major individual brands, only Toyota (up 8.0%) recorded a higher sales growth rate than Hyundai Motor Group.

Industry analysts attribute Hyundai Motor Group's strong performance to its decision not to pass tariff burdens onto consumers and its flexible production strategies. Hyundai Motor has adopted a "fast follower" strategy, carefully setting prices by monitoring market demand and competitor strategies. The strengthening of local production, such as the completion of Hyundai Motor Group's third U.S. plant, Hyundai Motor Group Metaplant America (HMGMA) in Georgia, is also believed to have had a positive impact.

Hyundai Motor Group plans to expand its local production capacity in the United States from 700,000 units as of two years ago to over 1.2 million units in the future.

According to Hyundai Motor Group's HMG Research Institute, the U.S. market is projected to contract to around 15 million units for the first time in three years, with an anticipated sales decline of -2.3%. The HMG Research Institute explained, "Gradual interest rate cuts and tax reduction policies will serve as positive factors by easing the burden on buyers, but price increases for vehicles and parts due to tariffs, as well as the resulting rise in insurance premiums, are expected to have a greater impact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.