KOSPI Sets New Highs, Surpasses 4,800 Last Week

Earnings Forecasts for Q1 and Q2 Rise Sharply

Bubble Concerns Emerge... "Market May Fluctuate on Key Issues"

"Correction Possible During Q4 Earnings Announcements"

The KOSPI, which has been surging since the beginning of the new year, has now surpassed the 4,800 mark, putting the achievement of the "5,000 KOSPI" within reach. Analysts attribute this upward momentum to abundant market liquidity and the easing of geopolitical crises. Stock market experts acknowledge the possibility of a short-term correction due to the rapid rally, but they also assess that it is not yet time to worry about a bubble.

According to the Korea Exchange on January 19, the KOSPI closed at a record high of 4,840.74 on January 16, up 0.90%. Since the first trading day of the year, the index has set new records every single day. This 11-day consecutive rise is the first in about four months, since September 2-16 of last year. The total market capitalization of the Korea Exchange also surpassed 4,000 trillion won for the first time in history.

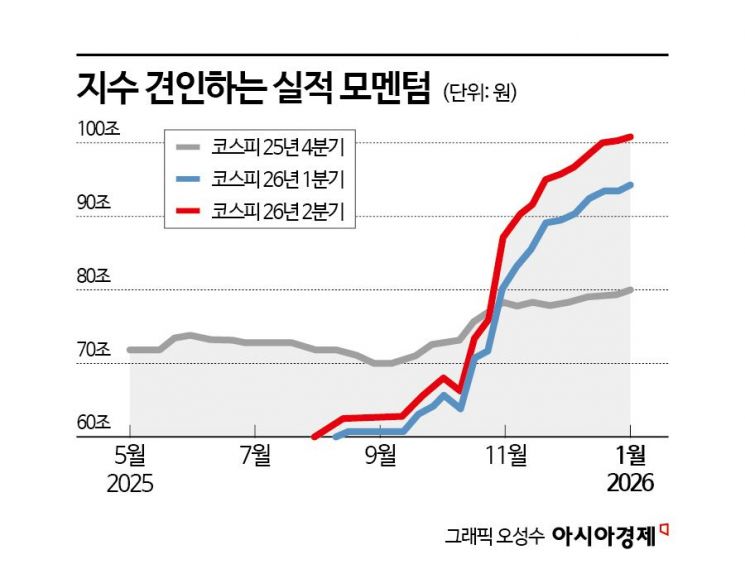

One of the factors behind this strong KOSPI performance is the steadily rising earnings forecasts. While the yet-to-be-announced fourth-quarter earnings estimates for last year have increased moderately, forecasts for the first and second quarters of this year have climbed sharply. This indicates that securities firms are rapidly raising their outlooks.

The rotational market trend is also a key factor. Even as semiconductors, which drove the index at the start of the year, have slowed, new leaders have emerged, such as physical artificial intelligence (AI) and defense industry stocks. Na Jeonghwan, a researcher at NH Investment & Securities, explained, "Although profit-taking occurred in the semiconductor sector, which led the KOSPI rally on early-year earnings expectations, other sectors such as automobiles, defense, and shipbuilding have seen significant gains in a rotational market, allowing the KOSPI to maintain its upward momentum."

Experts agree that the KOSPI's upward trend is likely to continue for the time being. This is because market liquidity remains abundant, and the geopolitical uncertainties that had dampened investor sentiment are now being resolved. According to the Korea Financial Investment Association, investor deposits-funds waiting to be invested in the stock market-surpassed 92.85 trillion won on January 8, setting a new record. The outstanding balance of margin loans also reached a new high of 28.65 trillion won as of January 13.

Of course, there are also considerable concerns about a stock market bubble. This is due to the burden of overheating from the rapid short-term rally, as well as the accumulation of stocks that need to be digested. Kang Daeseung, a researcher at SK Securities, stated, "The current index partly reflects expectations for earnings growth. During the fourth-quarter earnings announcement period, profit-taking could lead to a market correction."

Lee Kyungmin, Head of FICC Research at Daishin Securities, noted, "With KOSPI earnings forecasts rising rapidly, valuation pressure is not significant at the moment." However, he also pointed out, "As price levels increase, the market may become more sensitive to specific issues." This week, several major market events are scheduled, including the release of key countries' GDP data, the U.S. Personal Consumption Expenditures (PCE) Price Index for November last year, and the Bank of Japan's policy meeting.

However, the securities industry is drawing a clear line against the notion of a KOSPI bubble for now. This is because the upward momentum in earnings forecasts for leading stocks remains intact, and political discussions on the third amendment to the Commercial Act-which would mandate the cancellation of treasury shares-are rapidly gaining traction. This is expected to serve as a catalyst for share price gains in holding companies and securities firms with a high proportion of treasury shares.

Lee Youngkon, Head of Research at Toss Securities, said, "Although stock prices have risen significantly in a short period, the upward revision of earnings forecasts is progressing even faster, so valuations are not at a burdensome level." He projected the KOSPI's expected range for January to be between 4,600 and 5,000. Seo Hanbaek, a researcher at iM Securities, also commented, "While the index level may appear burdensome, there is still upside potential," predicting that the KOSPI will fluctuate between 4,600 and 5,200 this month.

Some analysts have drawn parallels between the current KOSPI trend and the "three lows boom" of the late 1980s. Lee Euntaek, a researcher at KB Securities, said, "If a similar trend continues, the KOSPI could reach 5,000 by the end of January. However, if the market follows the same pattern as back then, a sharp drop could occur in the second quarter." At that time, the KOSPI experienced a correction of -17.6% by October of the same year after the U.S. Federal Reserve announced the end of its interest rate cut cycle in August 1986.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)