Korea Housing Finance Corporation Report

Data Centers Reshape the Real Estate Market

Big Tech as Tenants, PE as Asset Owners

Power Grids and Cooling Water Now Key Location Factors

"Infrastructure Reuse Offers a Chance for Regional City Revitalization"

There is a growing opinion that artificial intelligence (AI) data centers could become key facilities capable of revitalizing regional cities. This is because, by repurposing existing infrastructure, these cities can ensure a more stable power supply compared to the greater Seoul area. As the AI era unfolds, some argue that real estate value may increasingly be determined by access to power grids and the efficiency of heat management.

According to the financial sector on January 19, Choyonghan, a research fellow at Korea Housing Finance Corporation, expressed this view in a recent report titled "AI Infrastructure Investment and the Restructuring of the Real Estate Market: New Location Value Created by Data Centers." Choyonghan analyzed, "As AI evolves into a physical device industry requiring vast amounts of power and land, the real estate market is undergoing accelerated structural change, with big tech companies becoming 'core tenants' and private equity (PE) funds emerging as 'asset owners.'"

Typically, constructing a single hyperscale data center requires a minimum investment of between 500 billion and 1 trillion won, including land, construction, and equipment costs. He explained, "If big tech companies such as Microsoft, Google, and Meta finance these costs entirely with their own cash and own the assets, it creates a negative impact by lowering their return on invested capital (ROIC) on the balance sheet."

He added that big tech companies prefer to focus their available cash on developing AI models or purchasing expensive graphics processing units (GPUs) rather than acquiring assets. Choyonghan emphasized the division of capital, stating, "This is where large PE firms like Blackstone have found their niche." Instead of building facilities themselves, big tech companies engage in "sale and leaseback" arrangements, selling land or buildings to financial institutions and leasing them back for long-term use-often for more than 10 years-at centers developed by PE funds.

In this process, PE funds play the role of "infrastructure developers," securing power and land and resolving regulatory issues as specialized operators in infrastructure development and management. From the perspective of PE funds, securing high-quality tenants like big tech companies allows them to expect stable annual returns of over 10%.

Choyonghan explained that AI data centers are also changing the priorities for real estate locations. Rather than focusing on proximity between workplaces and residences as in the past, the emphasis is shifting to creating environments that are optimal for machines. For example, locations near 154kV or 345kV ultra-high-voltage substations, areas with cool climates or abundant water resources for maximizing cooling efficiency, and regions that are safe from earthquakes and floods and face little local opposition are becoming increasingly valuable.

Choyonghan argued, "Paradoxically, this can offer new opportunities to declining regional cities and aging industrial complexes." One of the biggest challenges in building data centers is the construction of new transmission towers, but industrial complexes that previously housed factories already have substations and transmission networks for high-voltage power in place. This means regional cities can leverage these existing resources to attract data centers.

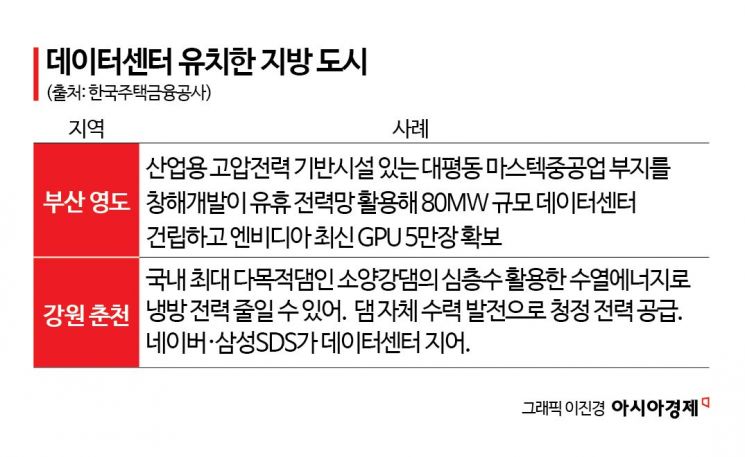

A representative example is Yeongdo-gu in Busan. The Masstek Heavy Industries site in Daepyeong-dong, formerly a shipyard, retained infrastructure for industrial high-voltage power. Changhae Development utilized this idle power grid to build an 80MW-class data center. Choyonghan evaluated this as "a model case of infrastructure regeneration, where the heart of a defunct shipyard was instantly replaced with an AI core, without wasting years on transmission tower construction."

He also emphasized that regional cities can attract data centers by utilizing local natural resources to reduce operating costs. For instance, Chuncheon in Gangwon Province has dramatically lowered cooling power consumption for its data center by using deep water from Soyanggang Dam, the largest multi-purpose dam in Korea, for water-based cooling energy. At the same time, the ability to receive direct electricity supply from the dam's hydropower has led Naver and Samsung SDS to establish data centers in the area, according to Choyonghan.

Haenam County in South Jeolla Province has also established the largest solar power complex in Korea, creating a model where data centers can immediately consume generated power. In fact, on January 8, South Jeolla Province and Haenam County signed a business agreement to build an energy-specialized AI data center.

Choyonghan suggested, "We need to shift our perspective and view data centers not simply as undesirable facilities or 'energy hogs,' but as core anchor facilities for urban regeneration that can revitalize regional cities on the brink of extinction, as seen in the case of Yeongdo, Busan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)