"Claims of '488 Trillion Won in RP Purchases by the Bank of Korea Last Year' Are Flawed"

Reserve Supply Greatly Overstated Due to Misguided Approach

Actual RP Purchases at 15.9 Trillion Won; Absorption Through Monetary Stabilization Bonds and Others

Unnecessary Market Anxiety Stoked?Caution Advised

The Bank of Korea has strongly refuted claims that it supplied excessive liquidity to the market last year by purchasing repurchase agreements (RPs) worth 488 trillion won, stating that such assertions are "seriously flawed." The central bank argued that the scale of RP purchases should not be assessed by simple cumulative addition, but rather by looking at the average balance. The Bank of Korea emphasized that last year’s RP purchases amounted to 15.9 trillion won, not 488 trillion won, and that it absorbed more reserve funds through the issuance of Monetary Stabilization Bonds.

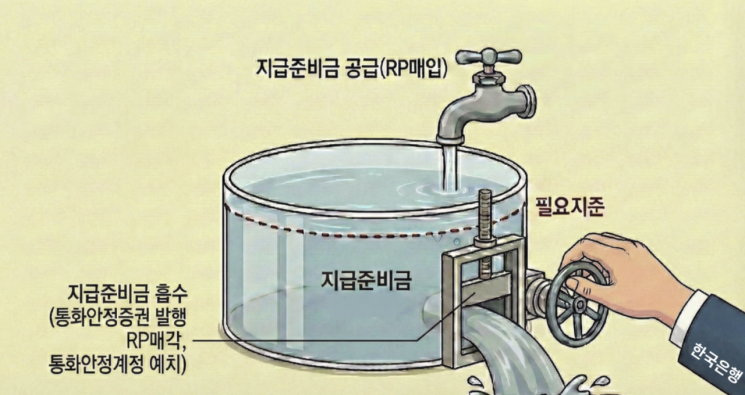

On January 16, the Bank of Korea posted an article on its blog titled "The Serious Flaw in the Argument That the Bank of Korea Is Supplying Excessive Liquidity Through RP Purchases," clarifying its position. Yoon Okja, Head of the Market Operations Team at the Bank of Korea’s Financial Markets Department, along with Deputy Director Ryu Changhun and Manager Ham Gun, explained, "To accurately determine whether the water in a tank is increasing or decreasing, you need to consider both the faucet and the sluice gate." They continued, "Open market operations should also take into account both RP purchases, which are like the faucet supplying water to the tank, and instruments such as Monetary Stabilization Bonds and RP sales, which act as the large sluice gate draining water from the tank." They stressed that claiming the Bank of Korea is supplying excessive liquidity by simply adding up RP purchases is akin to only watching the faucet while ignoring the sluice gate.

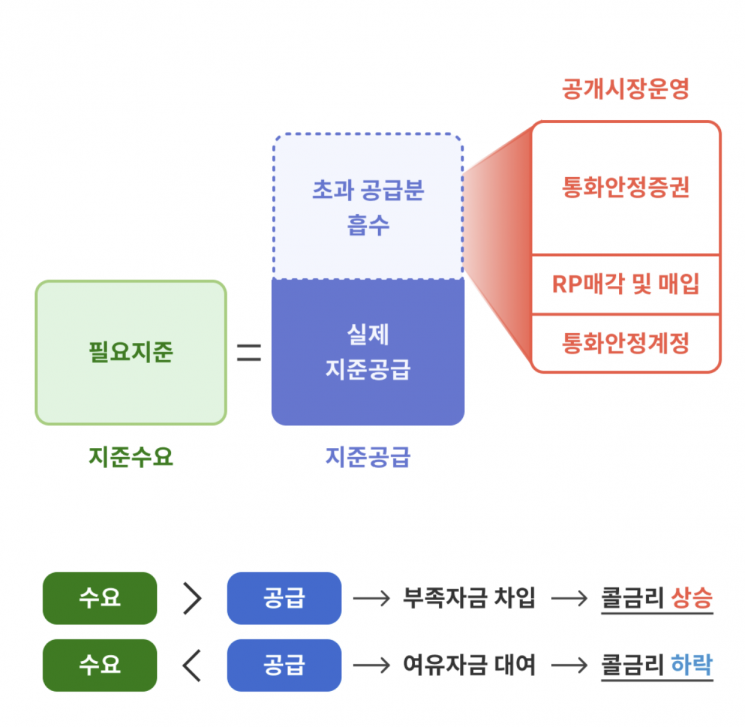

Banks are required to deposit a certain amount of reserve funds (reserves) with the Bank of Korea to prepare for withdrawals and other contingencies. This is called required reserves. If the reserve balance falls short of the required reserves, banks compete to borrow funds, putting upward pressure on the call rate. If the reserve balance exceeds the required reserves, banks try to lend out the excess funds, putting downward pressure on the call rate. The Bank of Korea uses open market operations to adjust the total reserves held by financial institutions to the required level, guiding the call rate to remain stable at the policy rate set by the Monetary Policy Board. The call rate established in this way spreads to other interest rates through transactions in the financial market.

The Bank of Korea uses a variety of tools to adjust the total reserves, including the issuance of Monetary Stabilization Bonds, RP transactions, and deposits in the Monetary Stabilization Account. Issuing Monetary Stabilization Bonds, selling RPs, and deposits in the Monetary Stabilization Account are means of absorbing reserves, while RP purchases are a means of supplying reserves. The Bank of Korea absorbs structurally excess reserves through the issuance of relatively long-term Monetary Stabilization Bonds, while temporary imbalances in reserve levels are absorbed (through RP sales) or supplied (through RP purchases) using short-term RP transactions.

Achieving balance between demand and supply of reserve funds through open market operations. Bank of Korea

Achieving balance between demand and supply of reserve funds through open market operations. Bank of Korea

Recently, some have claimed that the Bank of Korea supplied massive liquidity of 488 trillion won last year through RP purchases, but the Bank of Korea explained that this greatly exaggerates the effect of reserve supply by simply adding up the RP purchase amounts. Team leader Yoon stated, "This misunderstanding arises from a lack of understanding of the RP transaction mechanism. The maturity of RP purchases is only two weeks, and when they mature, the reverse transaction automatically occurs, and the funds are withdrawn. If you simply add up the individual amounts of these short-term RP purchase transactions, the impact on the total reserves is recorded as much larger than it actually is."

For example, if you borrow and repay 100,000 won with a one-week maturity repeatedly for a year, your wallet would not have held 5.2 million won (100,000 won x 52 weeks), but just 100,000 won at any given time. Team leader Yoon said, "It is appropriate to evaluate the scale of the Bank of Korea’s RP purchases based on the average balance, not the simple cumulative transaction amount. Last year, the average balance of RP purchases was only 15.9 trillion won." He emphasized, "If the reserve supply is overstated due to a flawed approach, it may create the misconception that liquidity supply is excessive, unnecessarily unsettling the market."

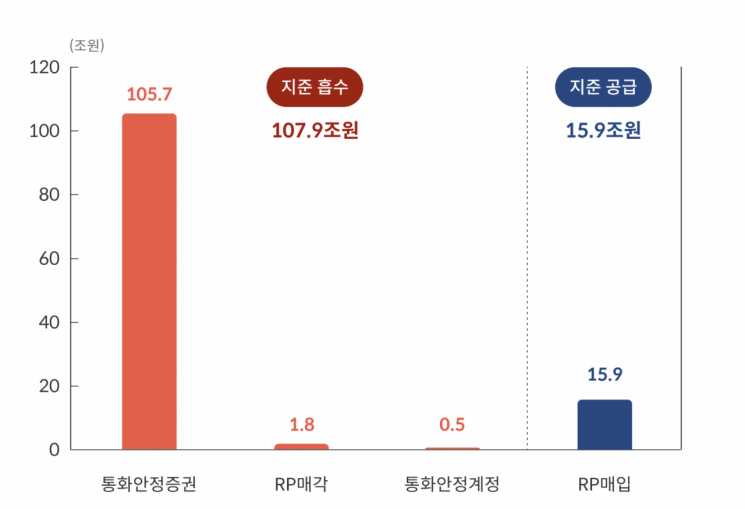

Reserve absorption and supply scale through open market operations (based on the average balance in 2025). Bank of Korea

Reserve absorption and supply scale through open market operations (based on the average balance in 2025). Bank of Korea

Looking at the operational scale (average balance) of other instruments, last year the Bank of Korea absorbed a total of 107.9 trillion won in reserves through the issuance of 105.7 trillion won in Monetary Stabilization Bonds, 1.8 trillion won in RP sales, and 500 billion won in Monetary Stabilization Account deposits. Team leader Yoon stated, "The amount of water drained from the tank through the sluice gate was much greater than the amount supplied through the faucet. In Korea, the total reserves have consistently exceeded the required reserves due to the holding and management of foreign exchange reserves. Therefore, open market operations are conducted to absorb this excess and prevent the call rate from falling below the policy rate."

Meanwhile, the increase in RP purchases last year was a result of introducing two-way RP transactions to respond to greater short-term volatility in reserves. While the Bank of Korea continued to absorb reserves as a basic policy, it regularized RP purchases to flexibly respond to temporary changes in reserve levels. Team leader Yoon emphasized, "The increase in RP purchases was a result of fine-tuning reserve levels based on this system reform. The underlying trend of absorption has not changed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)