Korea Automobile Journalists Association New Year’s Seminar Held on January 16

India Maintains Growth Momentum... ASEAN Expected to Rebound After Four Years

"Chinese Market Unlikely to See a Policy-Driven Rebound"

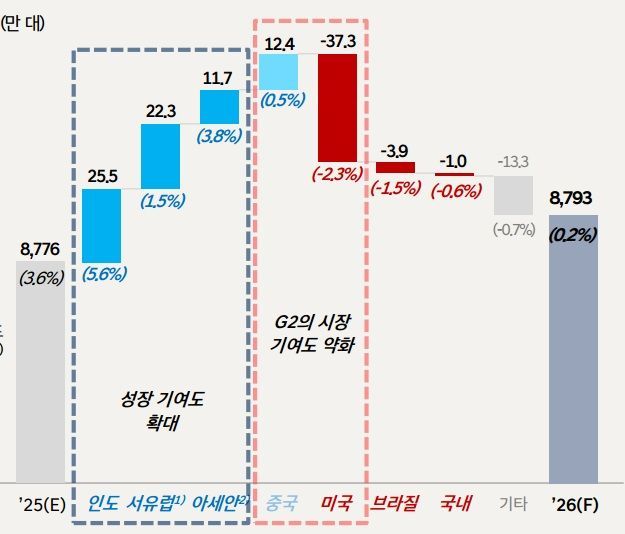

HMG Institute of Management Research, the think tank of Hyundai Motor Group, predicted that as the growth momentum of the Chinese automotive market weakens this year, the axis of growth will shift to emerging markets such as India and ASEAN. With the Chinese market, which had driven global demand until last year, expected to see its growth rate plummet from around 7% to just 0.5%, automakers are expected to become increasingly reliant on emerging markets.

Yang Jinsoo, Director of HMG Institute of Management Research, presented these insights at the Korea Automobile Journalists Association’s New Year’s seminar held at the Automobile Hall in Seocho-gu, Seoul, on January 16. He forecast that this year, the automotive market growth rates in major regions such as the United States (-2.3%) and China (0.5%) will slow down, while growth will continue to be led by India (5.6%) and ASEAN (3.8%). He also projected moderate growth for Western Europe (1.5%).

The region where the most significant change is expected is China. Last year, the Chinese automotive market recorded 24.34 million units sold, a 7.8% year-on-year increase, thanks to the strengthening of the "old-for-new" policy and base effect. However, this year, due to economic uncertainty and a shortage of subsidy funds in some local governments, the market is projected to grow by only 0.5% year-on-year, reaching 24.47 million units. Yang stated, "Starting this year, as the Chinese government maintains its stance to curb overproduction and ease price competition, automakers are likely to adjust their production volumes."

In contrast, the Indian and ASEAN markets are expected to show relatively robust trends. The Indian market is projected to grow by 5.6% this year, reaching 4.82 million units, driven by improved consumer sentiment following the reformation of the Goods and Services Tax (GST) system. Yang explained, "The reduction in tax rates will strengthen the sales momentum for small cars, and the increased launch of new SUV models will drive market growth."

The ASEAN market is also expected to grow by 3.8% this year, reaching 3.19 million units, marking a return to growth for the first time in four years after a 0.1% decline last year. Yang analyzed, "The market will be revitalized as Chinese companies expand their local investments and major automakers roll out new models."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)