National Assembly Passes Amendments to Capital Markets Act and Electronic Securities Act on January 15

Domestic STO Market Expected to Reach 370 Trillion Won in Market Cap by 2030

Limitations of Atypical Underlying Assets Like Buildings and Artworks

The token securities (STO) bill, which had been stalled for over three years, has passed the National Assembly plenary session, clearing the first hurdle toward institutionalization. With the establishment of a legal framework for the issuance and distribution of blockchain-based securities, the domestic STO market is now poised to officially launch within the regulatory system. However, issues such as delays in over-the-counter (OTC) exchange approvals and information asymmetry stemming from underlying assets remain challenges that need to be addressed.

According to the financial investment industry on January 16, nearly three years after the Financial Services Commission announced its “Plan for Improving the Regulatory Framework for Token Securities Issuance and Distribution” in early 2023, the National Assembly held a plenary session the previous day and passed amendments to the Capital Markets Act and the Electronic Securities Act, with the institutionalization of STOs as the core focus.

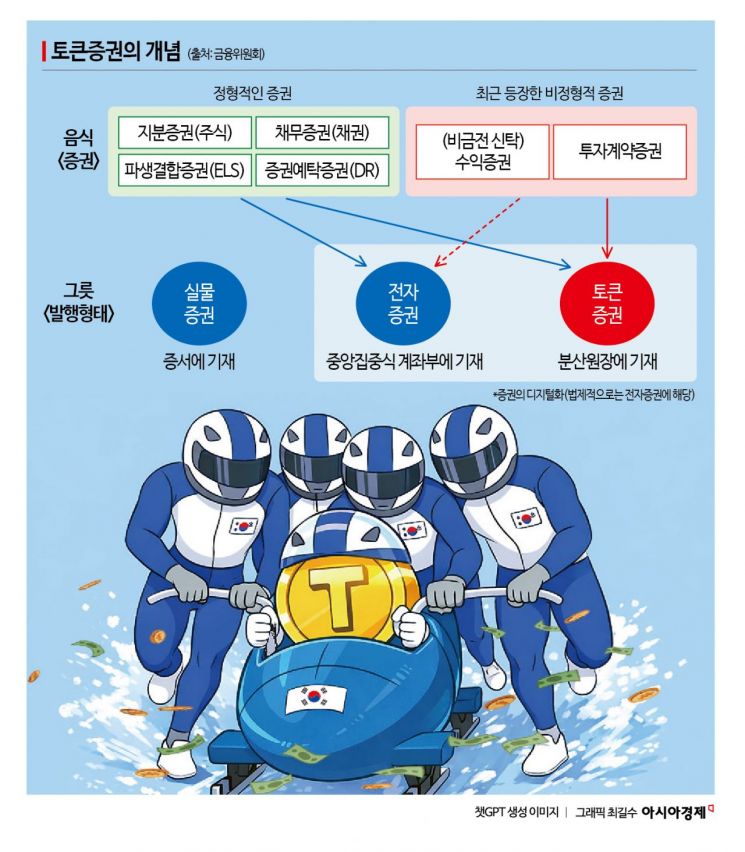

STO is a method in which rights to physical or financial assets are structured as “securities” under the Capital Markets Act, then issued and distributed in the form of blockchain-based digital tokens. Not only stocks and bonds, but also claims on illiquid assets such as real estate and artworks, can be divided and issued in token form. This enables individuals to participate in assets that are difficult to invest in alone, even with small amounts. For example, a building can be divided into fractional units, allowing multiple investors to share rental income.

The core of this bill is that blockchain-based tokens are clearly defined as a type of security under the Capital Markets Act, and that even investment contract securities, which had previously been restricted from trading, can now be traded within the institutional securities market. In other words, the issuance of STOs will be governed by the Electronic Securities Act, while their distribution will be regulated by the Capital Markets Act.

With the passage of the bill, the domestic STO market is expected to begin in earnest. According to a 2023 report by Hana Institute of Finance, based on Boston Consulting Group’s global STO market outlook, the market capitalization of the domestic STO market is projected to grow from about 34 trillion won in 2024 to 119 trillion won in 2025, and to 367 trillion won by 2030.

However, there are still hurdles to overcome. One notable example is the delay in the announcement of preliminary approvals for fractional investment OTC exchanges. Initially, on January 14, the Financial Services Commission was scheduled to review preliminary approval for “Korea Exchange-Koscom (KDX Consortium)” and “NextTrade-Musicow (NXT Consortium)” at its regular meeting. However, the process was delayed after a request to re-examine the LucentBlock Consortium, one of the applicants. As a result, concerns have been raised that the market launch may be postponed.

In addition, information asymmetry arising from the non-standardized nature of underlying assets is a concern. While the global real-world asset (RWA) tokenization market is growing around standardized “typical assets” such as US Treasury bonds, money market funds (MMFs), and gold, Korea is focused on “non-standardized assets” whose value is subjectively assessed, such as real estate, copyrights, and Korean beef. RWA refers to assets in which ownership of traditional physical assets is converted into digital tokens. Stablecoins are a representative example.

Yang Hyunkyung, a researcher at iM Investment & Securities, said, “Even if distribution infrastructure is established, there is a lack of profitable underlying assets that can actually be tokenized and offered. In Korea, tokenizing non-standardized securities such as real estate and artworks as underlying assets creates information asymmetry between issuers and investors, raising the risk of a lemon market similar to that of the used car market.”

Securing liquidity in the early stages of the market has also been identified as an important challenge. She added, “Currently, domestic STOs are expected to be issued and distributed via private blockchains for security reasons. If trading volumes are insufficient, the price discovery function will be weakened, and there is a risk that investors may exit the market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)