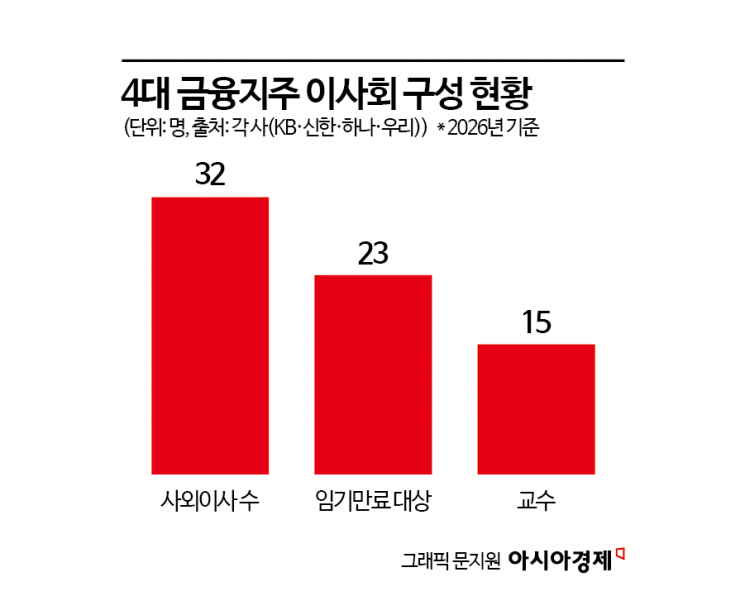

23 out of 32 outside directors' terms expiring (72%)

Reappointment tradition disrupted by FSS chief's "trench-building" criticism

Financial sector voices concerns over limited talent pool and management continuity

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group.

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group.

As financial authorities continue to issue sharp criticisms regarding the governance structure of financial holding companies, attention is focused on whether there will be a large-scale replacement of outside directors at the four major financial groups (KB, Shinhan, Hana, and Woori) ahead of the March shareholders’ meetings. Traditionally, outside directors have served terms of three to four years, or up to five or six years at most, but there are now predictions that the practice of consecutive reappointments may be disrupted due to pressure from regulators.

Seven out of ten outside directors’ terms expiring... Most at Shinhan and Hana

According to the financial sector on January 16, 23 out of 32 outside directors (71.9%) at the four major financial holding companies will see their terms expire in March. By group, Hana Financial Group has the highest number, with eight out of nine outside directors’ terms expiring, followed by Shinhan Financial Group (seven out of nine), KB Financial Group (five out of seven), and Woori Financial Group (three out of seven). When first appointed, outside directors are guaranteed a two-year term, with one-year extensions for each reappointment. The maximum term is five years at KB Financial Group and six years at the other three groups. Among those whose terms are expiring this time, Yoon Jaewon, Chairman of the Board at Shinhan Financial Group, is certain to be replaced, having completed the maximum term.

Typically, only one or two outside directors are replaced each year, but this year the atmosphere is different. The Financial Supervisory Service has announced a special governance inspection of the eight major financial holding companies (KB, Shinhan, Hana, Woori, NH Nonghyup, iM, BNK, and JB), starting on January 19. Lee Chanjin, Governor of the Financial Supervisory Service, has repeatedly criticized the composition of financial holding company boards as “trench building,” and President Lee Jaemyung has also directly attacked them as a “corrupt inner circle.”

Financial authorities have cited the following as major issues with the boards of directors at financial holding companies: self-renewal of CEOs who have entrenched themselves within the board, boards and various committees reduced to rubber-stamp roles, and the weakening of the actual oversight and monitoring functions of outside directors. In addition, Governor Lee has pointed out that boards are composed almost entirely of professors. The authorities plan to use this special inspection to assess how well exemplary governance practices are actually functioning. Based on the results of this inspection, a governance advancement task force will discuss possible improvements.

"No candidates available"... Financial sector struggles with a limited talent pool

Financial holding companies are deeply concerned as the shareholders’ meetings approach. With financial authorities raising issues such as the dispersion of outside director terms, the concentration of professors, disclosure of nomination channels, and increasing the number of outside directors, the companies are considering reflecting these points in this year’s shareholders’ meetings. BNK Financial Group has already introduced a public nomination process for outside directors, and iM Financial Group has implemented a preliminary candidate recommendation system for outside directors in response.

However, there are growing complaints on the ground that the pool of candidates for outside directors is excessively limited. Since the 2010s, financial authorities have implemented best practice standards for financial company governance, disclosure of CEO succession procedures, and term limits for outside directors. This is the so-called “paradox of regulation.” Under the Financial Company Governance Act, full-time employees with significant business relationships or competitive or cooperative business ties with financial companies cannot serve as outside directors. Because the qualifications are so strictly limited, boards are inevitably composed of professors with no conflicts of interest. In fact, 15 out of 32 outside directors (47%) at the four major financial holding companies are former professors, accounting for nearly half.

An official at one of the financial holding companies said, “Since the financial authorities have specifically stated that they will scrutinize the composition of outside directors, financial companies will have no choice but to comply to some extent. However, from the perspective of continuity, it is not possible to simply replace everyone, and given the particularly narrow talent pool for outside directors in the financial sector, it is a reality that finding new candidates immediately is very difficult.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)