Chinese Semiconductor Firm Launches IPO in Hong Kong Amid AI Race

Rising Investment Demand and Market Recovery Drive Hong Kong Listing

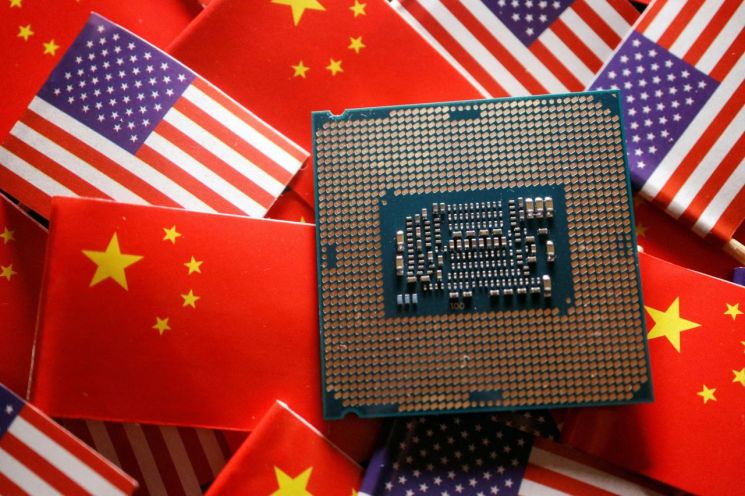

Between the flags of China and the United States, a central processing unit (CPU) semiconductor chip is placed. Photo by Reuters Yonhap News

Between the flags of China and the United States, a central processing unit (CPU) semiconductor chip is placed. Photo by Reuters Yonhap News

Chinese semiconductor design company Montage Technology (Montage) is set to bring in JP Morgan and Alibaba Group Holding as cornerstone investors ahead of its Hong Kong initial public offering (IPO). This move is seen as evidence of strong investment demand for artificial intelligence (AI) companies in the Hong Kong market as well.

According to Bloomberg on the 14th (local time), JP Morgan and Alibaba will participate as cornerstone investors in Montage's IPO. Cornerstone investment is a system in which institutional investors are secured by the issuer and the lead underwriter before the IPO prospectus is filed, allowing a large allocation of shares to these investors. Institutional investors participating as cornerstone investors typically hold the shares for at least six months.

Montage, which is already listed on the Shanghai Stock Exchange, will begin accepting investment applications as early as the 16th and is scheduled to be listed on the Hong Kong Stock Exchange later this month. Through this listing, Montage is expected to raise approximately 900 million dollars (about 1.3 trillion won). If the underwriters exercise the overallotment option, the amount raised could increase further.

Montage specializes in designing interconnect chips and memory interface chips. The products manufactured by Montage optimize data flow and increase speed within data centers and AI accelerators. Although the company was founded in the United States in 2004, it became a Chinese company in 2014 after being acquired by Tsinghua Unigroup Technology (Tsinghua Uni) of China.

Montage recorded operating profits of 1.4 billion yuan (about 300 billion won) in 2024 and 2.3 billion yuan (about 500 billion won) in 2025. The outlook for this year stands at 3.3 billion yuan (about 700 billion won).

Montage, already listed in Shanghai, is pursuing a Hong Kong listing due to the high investment demand amid the AI competition between the United States and China. According to Bloomberg data, funds raised through Hong Kong IPOs in the first two weeks of January 2026 reached 4.3 billion dollars (about 6 trillion won). Additionally, the recovery of the Hong Kong stock market since last year has also played a role.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)