A Series of Setbacks for EV Batteries

Breakthrough via LFP Line Conversion and Expansion

Market Expected to Double by 2030

US-China Tensions and Big Tech Infrastructure Drive Growth

North American Market Share Projected to Reach 86% Next Year

The surge in electricity demand driven by artificial intelligence (AI) data centers is ushering in a new "super cycle" for the domestic battery industry. The three major battery manufacturers, which had faced a crisis due to stagnating demand in the electric vehicle market (chasm), are now expanding into the North American energy storage system (ESS) market and are expected to more than triple their market share.

According to industry sources and Standard & Poor’s (S&P) on January 15, the global ESS battery market is projected to grow from 166 gigawatt-hours (GWh) in 2024 to 350 GWh by 2030, more than doubling in size. In particular, as big tech companies ramp up infrastructure to operate AI servers, the compound annual growth rate is approaching 40%.

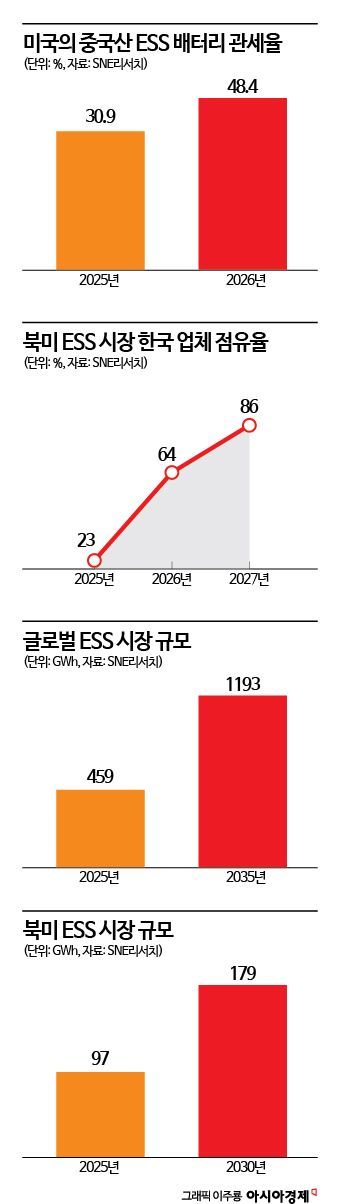

The United States government's tariff barriers against China present a significant opportunity for Korean companies. The U.S. has sharply increased tariffs on Chinese-made ESS batteries from 30.9% to 48.4% starting this year. Following the Inflation Reduction Act (IRA), the imposition of additional tariffs is seen as a clear intention to completely block Chinese ESS products from entering the U.S. market. Energy market research firm SNE Research forecasts that, thanks to these trade policy changes, the market share of Korean companies in the North American ESS market will soar from 23% last year to 64% this year, and to 86% by 2027. This means that in just three years, their market dominance will expand nearly fourfold, fully offsetting the temporary stagnation in demand for electric vehicle batteries and establishing a new cash cow. Until now, the North American ESS market had been dominated by Chinese companies leveraging low prices, but the tariff hike has sharply eroded their price competitiveness. In contrast, the three major domestic battery manufacturers (LG Energy Solution, Samsung SDI, and SK On), equipped with advanced technology and stable supply chains, are expected to enjoy significant windfall gains and solidify their lead in the market.

Korean battery companies are directly overcoming setbacks such as the cancellation of electric vehicle battery supply contracts and reduced order volumes by pivoting to ESS. LG Energy Solution saw its 9.6 trillion won contract to supply electric vehicle batteries for Ford's European operations canceled. SK On dissolved its joint production partnership with Ford in the United States, while POSCO Future M failed to fulfill more than 80% of its contract to supply high-nickel cathode materials for electric vehicles to General Motors (GM), a deal worth over 13 trillion won.

In response, Korean battery manufacturers are rapidly converting their North American production lines from electric vehicle batteries to ESS batteries. LG Energy Solution has begun mass production of lithium iron phosphate (LFP) batteries for ESS at its Holland, Michigan plant, accelerating its efforts to secure early market leadership. The company quickly converted part of its Michigan plant, previously dedicated to electric vehicle batteries, to ESS battery production, moving up the mass production timeline by one year ahead of schedule. In November last year, it also began mass production of ESS LFP batteries at its joint venture plant with Stellantis in Ontario, Canada, and is building an ESS LFP battery production line at its Ochang plant in North Chungcheong Province, targeting mass production in 2027.

Samsung SDI began producing nickel-cobalt-aluminum (NCA) batteries for ESS at its joint venture plant with Stellantis in Indiana in October last year. The company is also preparing to convert a production line to LFP batteries for ESS, aiming to begin operations in the fourth quarter of this year. With these moves, Samsung SDI plans to expand its annual ESS battery production capacity in the U.S. to about 30 GWh by the end of next year. SK On will also begin mass production of LFP batteries for ESS in the second half of this year.

The materials industry is also moving quickly. L&F has finalized plans to establish a lithium iron phosphate (LFP) cathode material plant in Muskegon, Michigan, with an annual capacity of 15,000 tons. The amount of cathode material used per ESS unit varies by design, but the industry standard is generally between 300 and 600 kilograms. Based on this, an annual production capacity of 15,000 tons of cathode material would be enough for approximately 25,000 to 50,000 ESS units. This will be the first cathode material production base established in the United States and is expected to play a key role in building a "non-Chinese value chain" in the North American market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)