Average One-Year Fixed Deposit Rate at Savings Banks Rises to 2.93%

Up 0.26 Percentage Points from Two Months Ago

"Focus on Loan-to-Deposit Ratio Management" ... Prioritizing Soundness Over Deposit Growth

The 3% range for fixed deposit interest rates, which had disappeared from the savings bank sector for some time, is making a comeback. However, this is interpreted not as an aggressive special promotion, but rather as a management move to maintain an appropriate level of deposits.

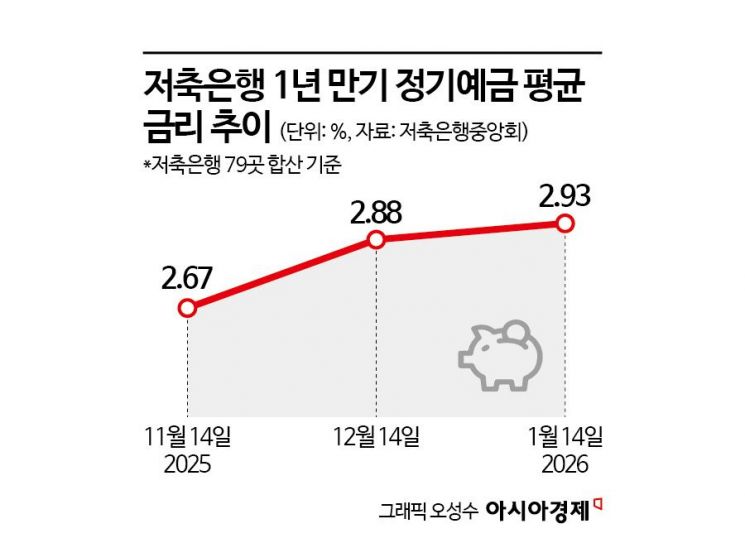

According to the Korea Federation of Savings Banks on January 15, the average annual interest rate for one-year fixed deposits at 79 savings banks nationwide was 2.93% as of the previous day. Just two months ago, the rate had fallen to as low as 2.67%, but it has been rebounding at the turn of the year.

As recently as mid-November last year, there were no one-year fixed deposit products at savings banks offering interest rates in the 3% range. However, as of the previous day, 125 out of 370 products guaranteed rates in the 3% range. The highest rate was offered by Must Samil Savings Bank's 'e-Fixed Deposit' at 3.2% per annum. CK Savings Bank, HB Savings Bank, Dongyang Savings Bank, and Smart Savings Bank offered 3.18%, while JT Savings Bank, JT Chinae Savings Bank, and Cham Savings Bank, among others, introduced products at 3.17%.

Although savings banks are rapidly launching fixed deposit products with interest rates in the 3% range, industry insiders say this is a "no other choice" situation. The impact of defaults in real estate project financing (PF) has yet to subside, and lending is difficult due to tighter regulations, making it burdensome for savings banks to aggressively increase deposits. However, with first-tier banks now offering higher fixed deposit rates than savings banks, and a stock market boom drawing funds into commercial banks and securities firms, savings banks cannot simply stand by. An industry official said, "Unlike in the past, we are not aggressively promoting special high-interest products at the beginning of the year," adding, "The reintroduction of 3% range products is for managing the loan-to-deposit ratio and as a form of marketing."

The total deposit balance at savings banks has recently fallen below 100 trillion won for the first time in six months. According to data submitted by the Korea Deposit Insurance Corporation to Assemblyman Lee Heonseung of the National Assembly's Political Affairs Committee, the deposit balance at savings banks stood at approximately 99 trillion won at the end of last month. This is the first time since June of last year (99.5159 trillion won) that the balance has fallen below 100 trillion won. Although the deposit insurance limit was raised to 100 million won in September last year, which was expected to attract more funds to savings banks, the opposite has occurred.

The savings bank industry does not expect the trend of launching high-interest products to last long. For the time being, the focus will be on risk management rather than aggressive marketing. Financial authorities are also prioritizing the strengthening of risk management capabilities at savings banks by urging the swift disposal of distressed real estate PF assets and raising the loan loss reserve ratio for multiple debtors.

To enhance financial soundness, the savings bank sector will conduct the seventh demand survey for a joint fund to dispose of distressed real estate PF assets by January 20. Last year, 2.41 trillion won worth of distressed assets were disposed of through the first to sixth funds. The specialized management company SB NPL, which handles non-performing loan disposal, recently increased its capital to 10.5 billion won through a paid-in capital increase and plans to begin full-scale operations this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)