Korea Institute of Finance Report

"Significant Expansion of Corporate Loans Led to Deterioration of Asset Soundness"

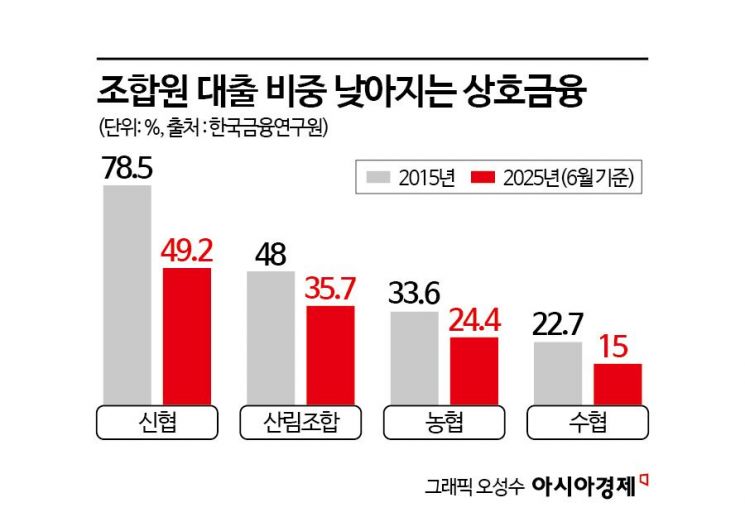

Decline in Proportion of Member Loans Signals Weakening of Core Role

Proposal to Deposit Surplus Cooperative Funds with the Feder

Amid worsening asset soundness due to excessive profit-seeking by mutual finance institutions such as agricultural cooperatives, fisheries cooperatives, credit unions, and community credit cooperatives, there are growing calls that, paradoxically, a "reasonable level of profitability" is necessary to support their fundamental role, such as expanding financial services for low-income groups. Experts have particularly suggested the need for a system in which surplus funds from individual cooperatives are centrally managed by the federation headquarters.

According to the financial industry on January 15, Koo Jeonghan, Senior Research Fellow at the Korea Institute of Finance, stated in a recent report titled "Development Directions in Line with the Identity of Mutual Finance" that "mutual finance institutions have recently experienced a significant deterioration in asset soundness by concentrating funds in high-risk assets, contrary to their founding purpose." He added, "Securing an appropriate level of profitability is essential to continue fulfilling their original role."

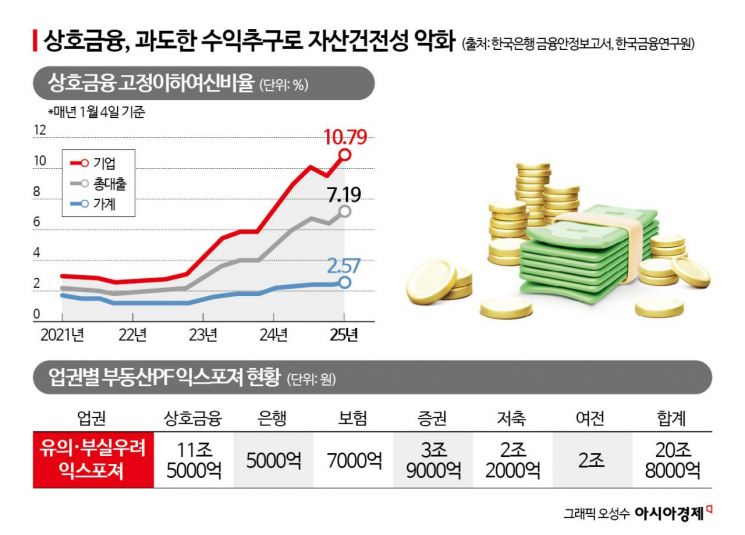

According to the report, the soundness indicators of the mutual finance sector have shown a clear downward trend. The ratio of non-performing loans to total loans in mutual finance remained in the 2% range in the first quarter of 2021, but soared to 7.19% in the first quarter of last year, an increase of more than 5 percentage points. In particular, for corporate loans, the ratio rose from the 3% range to 10.79% during the same period, an increase of over 7 percentage points.

Koo analyzed that this was because, as the government tightened household debt management in response to an overheated real estate market in the past, mutual finance institutions significantly expanded corporate loans related to real estate as a result of the so-called "balloon effect." He explained, "Due to strengthened regulations such as the loan-to-value (LTV) ratio and the debt-to-income (DTI) ratio on mortgage loans, the growth of household loans by mutual finance institutions has been curbed since 2017. However, real estate-related corporate loans, including joint loans, have expanded significantly." He further diagnosed, "Since 2022, as the real estate market has stagnated, the asset soundness of mutual finance institutions that had expanded real estate-related corporate loans, such as project financing (PF) loans, has rapidly deteriorated."

As a result, mutual finance institutions have the highest real estate PF exposure (risk exposure) among all financial sectors. Of the 2.08 trillion won in exposure classified as "caution" or "concern for insolvency" based on business feasibility assessments, mutual finance institutions accounted for 1.15 trillion won, the largest share in the sector. Koo pointed out that mutual finance institutions have failed to fulfill their original role, as evidenced by the declining proportion of loans to cooperative members. For example, in the case of credit unions, the proportion of loans to members dropped sharply from 78.8% in 2015 to 49.2% in June of last year, a decrease of 29.6 percentage points.

He cited "easy access to funding and a lack of suitable investment opportunities" as one of the causes of excessive profit-seeking. Koo stated, "Contrary to the original intent, tax-exempt benefits have been used as a financial tool by high-income individuals, allowing mutual finance institutions to easily raise low-cost funds compared to other financial sectors." He added, "In the case of cooperatives (or credit unions) with insufficient investment opportunities, funds raised through tax-exempt benefits during the real estate boom were invested in high-risk, high-return real estate-related assets." He assessed that the recent legislative move to gradually reduce the tax exemption on deposit interest income is a positive development.

He emphasized that securing an appropriate level of profitability must come first to break the vicious cycle of "deteriorating asset soundness → increased provision for bad debts → worsening profitability." Referring to the structure in which agricultural and fisheries cooperatives offset net losses from economic activities such as the sale of agricultural and marine products with net profits from credit business, he added, "A certain level of net profit is necessary to provide services for the benefit of cooperative members based on this foundation."

As an alternative, he proposed depositing surplus funds from individual cooperatives with the federation headquarters for integrated management. This approach aims not only to improve asset soundness but also to secure profitability through economies of scale. In addition, he suggested that the government should provide incentives for handling policy-based financial products for low-income groups, such as the Sunshine Loan, and relax lending ratio regulations within business areas when supplying proprietary credit loans to diligent borrowers, thereby creating incentives for mutual finance institutions to faithfully fulfill their original role.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.