Food Industry Turns to Powdered Products

Paldo's Powdered Soup Sales Surge 156%

Popularity Rises Among Single-Person Households and Travelers

The Quiet Growth of the Powdered Product Market

Powdered products that deliver both flavor and functionality in a single sachet are gaining a stronger presence in the food and beverage market. Their advantages-easy storage, portability, and the ability to use only the needed amount-are driving consumption, especially among single-person households, travelers, and those engaged in outdoor activities. Rather than replacing finished products, these powdered items are increasingly being consumed alongside them depending on the situation, quietly but surely emerging as a solid growth driver.

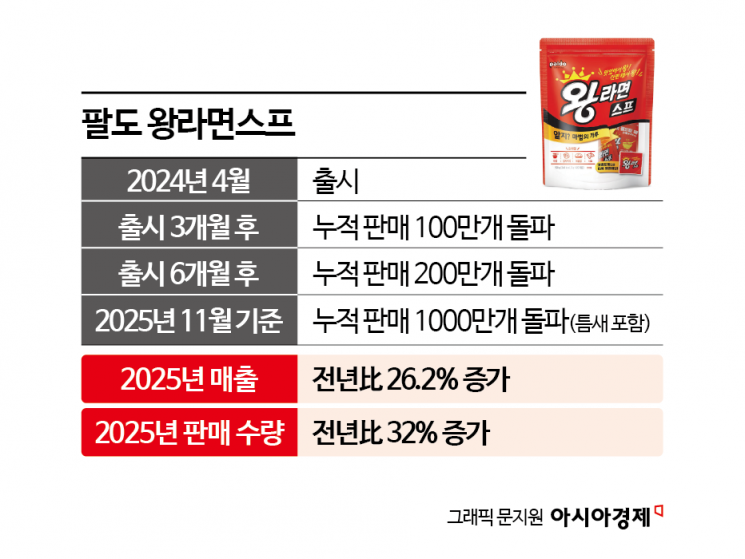

According to Paldo on January 16, sales of the company's powdered ramen soup products increased by 156% year-on-year in 2025. The number of units sold also rose by 151.3% over the same period. Currently, Paldo offers two types of powdered soup-Wang Ramen Soup and Teumsae Ramen Soup. As of November 2025, the combined cumulative sales of these two products surpassed 10 million units.

In particular, Wang Ramen Soup, launched in April 2024, recorded a 32% year-on-year increase in units sold and a 26.2% increase in sales in 2025. The fact that the product maintained double-digit growth even after the initial new product effect had faded indicates that repeat purchases are becoming established, rather than just one-time trials.

The sales channels have also expanded step by step. Wang Ramen Soup surpassed 1 million cumulative sales within three months of its launch, and after entering Daiso stores in July 2024, it firmly established itself in everyday consumer channels. Word-of-mouth as a "Daiso hot item" helped it exceed 2 million units in just six months, and in the second half of 2024, it was selected as one of Coupang's "Best New Seasoning Products," which further boosted online sales.

This trend is not limited to Paldo. In late September last year, Ottogi expanded its established ramen brand into a small powdered format by launching "TokTokTok Jin Ramen Stick." Over 100,000 units were sold within two months of its release, and the product was introduced at select Daiso stores and the Incheon Airport duty-free shop, receiving positive responses particularly from travelers and foreign tourists. The strategy of emphasizing portability and immediate usability has broadened consumption scenarios.

In the beverage sector, Donga Otsuka's Pocari Sweat powdered product continues to see stable demand. From January to November last year, sales of this product grew by 21% compared to the same period the previous year. By mixing one sachet with one liter of water, consumers can achieve a taste similar to the finished product, making it a staple at military PX stores. Its convenience for replenishing fluids and electrolytes outdoors has led to steady consumption, especially among workers in extreme heat or cold environments. Riding on Pocari Sweat's popularity, Donga Otsuka also launched its milk tea brand, Dejaoua, in powdered stick form in November last year.

The industry is paying attention to powdered products because they offer clear structural advantages in terms of investment and distribution. Compared to liquid or finished products, powdered items have smaller packaging volume and weight, resulting in greater logistics efficiency and relatively lower risks of damage or expiration. They can deliver the same taste and functionality while reducing transportation and storage costs, making profitability management easier when expanding distribution channels.

The margin structure is also stable. Powdered products are perceived as concentrated forms of a brand's flavor and functionality, so consumers have less clarity when comparing prices. Unlike finished products, where unit price per volume is a key consideration, the perceived value of powdered products varies depending on usage situations and frequency, resulting in lower price resistance.

An industry insider explained, "Powdered products carry a low risk of failure because they can leverage the brand power of existing hit products. Rather than making new investments, companies find it attractive that they can increase profitability by expanding their accumulated brand assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)