Toss Bank to Launch Mortgage Loans This Year

Competition Among Three Internet-Only Banks to Intensify

Challenges Ahead in Strengthening Competitiveness Amid Household Lending Regulations

With Toss Bank set to launch its mortgage loan product this year, competition among the three internet-only banks in the mortgage sector is expected to intensify. However, some predict that aggressive business expansion, as seen in the past, will not be easy due to the continued regulatory stance of financial authorities on household lending.

According to the financial sector on January 14, Toss Bank is currently focused on preparing its mortgage loan product, aiming for a launch within the first half of the year. As internet-only banks are releasing mortgage loans about five years after their launch, it has become essential for Toss Bank, which began operations in 2021, to add mortgage loans to its portfolio. Given that Toss Bank has previously introduced financial products featuring innovative ideas, market expectations are high. For example, when launching its jeonse and monthly rent loan products, Toss Bank received positive feedback for incorporating real-time notifications of changes in the certified copy of the real estate register.

Due to the nature of mortgage loans, internet-only banks have so far expanded their business through competitive interest rates. In particular, KakaoBank has become so popular among financial consumers that terms like "interest rate hotspot" and "mortgage loan open run" have been coined. According to the Korea Federation of Banks' disclosure, the average interest rate for KakaoBank's mortgage loans (based on amortized, newly originated loans) is 4.02%, which is about 0.38 to 0.5 percentage points lower than the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup). K Bank's apartment mortgage loans are also following closely behind KakaoBank in terms of interest rate competitiveness. K Bank's average interest rate is 4.12%, about 0.28 to 0.4 percentage points lower than the five major banks.

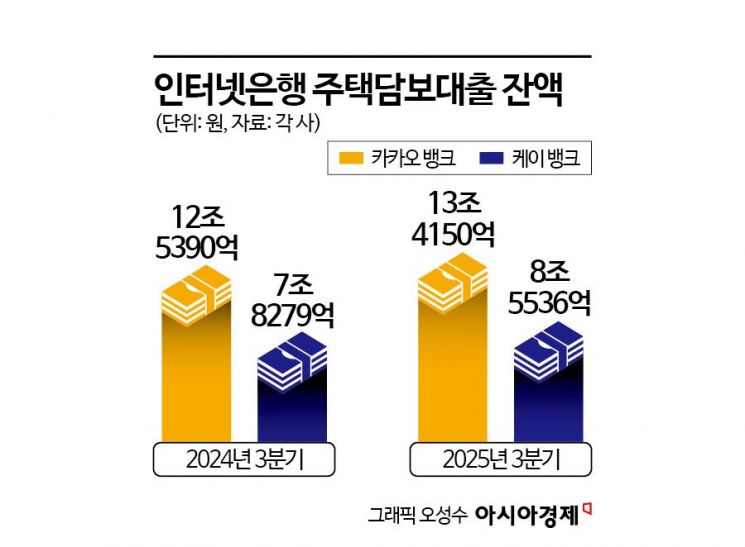

Thanks to this interest rate competitiveness, internet-only banks' mortgage loans have continued to grow even under household loan regulations. As of the third quarter of last year, the balance of KakaoBank's mortgage loans (excluding jeonse and monthly rent loans) increased by 876 billion won year-on-year to 13.415 trillion won. K Bank's mortgage loan balance also rose by 725.7 billion won year-on-year to 8.5536 trillion won as of the third quarter.

For this reason, some in the financial sector predict that it will not be easy for the latecomer Toss Bank to enhance its competitiveness. Since KakaoBank introduced mortgage loans in 2022, non-face-to-face mortgage loans have become established in the banking sector, and convenience has greatly improved. In addition, it is difficult to expand business by offering the "low interest rates" most desired by mortgage loan customers, due to the government's continued regulatory stance on household lending. A banking industry official said, "Even in the new year, banks are taking a conservative approach to mortgage loan business," adding, "It will be difficult to aggressively attract customers with low interest rates under the watchful eye of the authorities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)