Lucent Block Raises Major Objections Ahead of STO Licensing

'Protection of Innovative Companies' vs. 'Licensing Competition' Logic in Direct Conflict

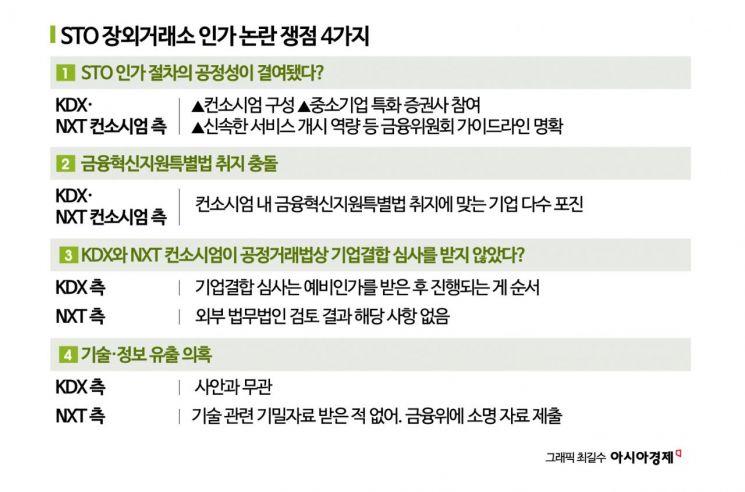

The core issues at the center of the controversy surrounding the licensing of over-the-counter (OTC) exchanges for fractional investment security tokens (STO) can be summarized into four main points: ▲the fairness of the STO licensing process, ▲potential conflict with the purpose of the Special Act on Financial Innovation Support, ▲possible violations of the Fair Trade Act, and ▲suspicions of technology and information leakage. Lucent Block, which is effectively facing elimination from the licensing process, claims this is "an expropriation by vested interests," while the Korea Exchange-Koscom (KDX Consortium) and NextTrade-Musicow (NXT Consortium) maintain that the outcome is the result of fair competition according to established procedures. This has led to a direct clash between the system’s intent to protect innovative companies and the logic of licensing competition.

According to the financial investment industry on January 13, the controversy spread after Lucent Block requested a re-examination ahead of the Financial Services Commission’s (FSC) review of preliminary licensing for the OTC exchanges proposed by the KDX Consortium and the NXT Consortium.

Lucent Block, which has operated a domestic STO platform, is primarily arguing that the licensing process lacked fairness. At a press conference the previous day, Lucent Block CEO Heo Seyoung stated, "Please make your judgment based on the intent and principles of the law," and added, "Administrative actions and market restructuring centered on vested interests during the process of institutionalization are completely at odds with the purpose of the legislation."

After being designated as an innovative financial service by the FSC in 2018, Lucent Block launched its STO service ‘SOYU’. To date, the company has recorded approximately 500,000 users and cumulative asset issuance and distribution of around 30 billion KRW.

Lucent Block explained that the FSC framed this licensing process as the institutionalization of pilot services operated under the financial regulatory sandbox, but claimed that in reality, the licensing was conducted in a way that favored established financial institutions. CEO Heo stated, "It is difficult to accept that a company proven over four years as an innovative financial service provider is excluded during the institutionalization process."

However, there are differing interpretations within the industry. Some point out that Lucent Block, despite its role in STO proof-of-concept, is being eliminated from the institutionalization process because it failed to meet the licensing criteria set by the FSC. According to the FSC’s ‘Guidelines for New Licensing of Fractional Investment OTC Exchanges (Distribution Platforms)’ released in September last year, the review items for collective evaluation are based on the licensing requirements under the Capital Markets Act. In addition, extra points are awarded for three factors: ▲consortium composition, ▲participation of securities firms specializing in small and medium-sized enterprises, and ▲the ability to launch services quickly. An industry insider said, "The criteria for the external evaluation committee were clearly presented," and added, "The Lucent Block consortium was likely at a disadvantage in terms of diversity of composition."

There are also mixed opinions regarding Lucent Block’s second claim about conflict with the Special Act on Financial Innovation Support. This is because Lucent Block is not the only company with innovative financial business status.

CEO Heo pointed out, "In a system designed to protect and nurture innovative startups, it goes against the fundamental intent of the law for a company that has long served as a model case to find itself unable to continue its business." The law includes safeguards to ensure that the achievements of pioneering companies operating under the regulatory sandbox are not imitated or encroached upon during institutionalization.

On the other hand, Musicow, a fractional investment platform included in the NXT Consortium, stated, "Lucent Block is a single-company consortium of an innovative business operator," and added, "The NXT Consortium includes not only Musicow, but also Sejong DX, Stock Keeper, Together Art, and 18 securities and financial companies in total."

Additionally, Lucent Block claimed that Korea Exchange (KRX) and NextTrade (NXT) violated the obligation to report business combinations during the consortium formation process. Under the Fair Trade Act, a report is required if one of the companies involved in the combination has total assets (or sales) of at least 300 billion KRW and the other has at least 30 billion KRW. A Korea Exchange official explained, "It is true that the largest financial institution in the consortium must undergo a business combination review, but Lucent Block’s argument is out of sequence," adding, "The proper procedure is to obtain preliminary approval and then undergo the Fair Trade Commission’s business combination review."

On the final issue of technology and information leakage, Lucent Block and NXT present conflicting claims. Lucent Block alleges that NXT, under the pretense of investment review, signed a non-disclosure agreement (NDA), received confidential materials, and used them in the competitive licensing process. If proven true, this could become a major issue, as the government is highly sensitive to startup technology theft.

However, NXT emphasizes that while it did receive materials from Lucent Block, none of them were considered confidential. NXT maintains that it never misappropriated any technology or ideas during the licensing process. The NXT side explained, "We never stole any technology, and the materials we received were only basic financial and business plan overviews," adding, "We never promised to participate in the Lucent Block consortium."

The FSC will conduct a review of the preliminary licensing agenda at its regular meeting on January 14. An FSC official stated, "No conclusion has been reached yet. The final decision will be made based on the review and evaluation results of the three consortia, independent of the Securities and Futures Commission’s opinion," expressing a cautious stance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)