Trapped in a "Stagnant Box Range"... Entering Survival Mode

Staff Reductions and Downsizing Emerge as Key Strategies

Overall Dining-Out Volume Shrinks... In-Store Dining Falters

The established growth formula for the domestic dining-out industry is collapsing. Until now, the industry has expanded by aggressively opening new locations, but with the sharp increase in labor costs, raw material prices, and rent, the sector has entered a phase where expanding sales alone can no longer offset rising expenses. As a result, the dining-out market is at a major turning point. This year, dining-out businesses have shifted from pursuing growth to focusing on restructuring and survival.

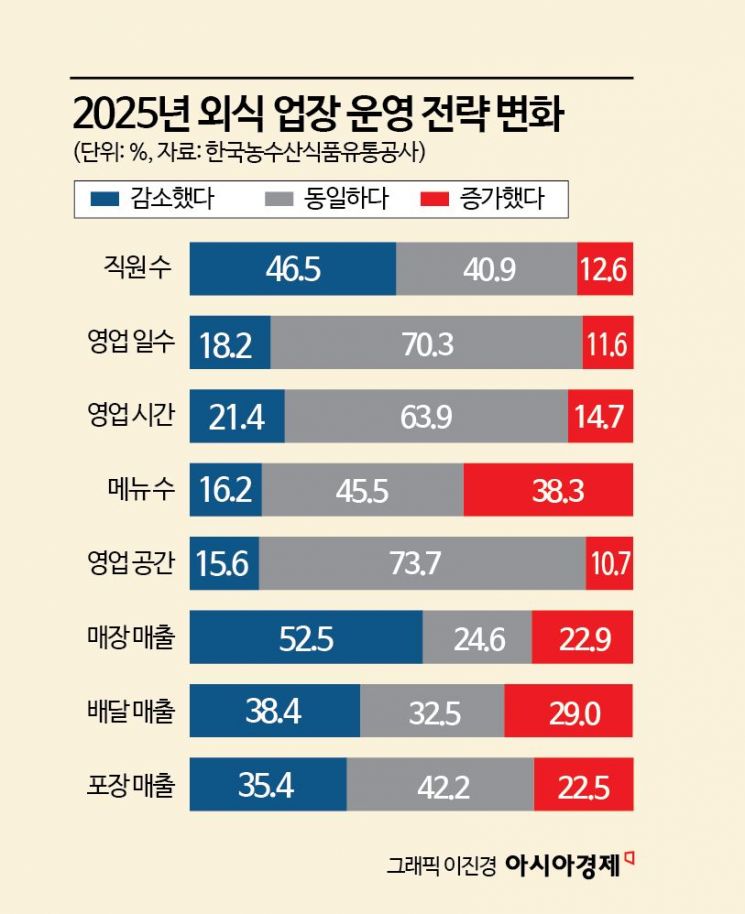

According to the '2025 Domestic and Global Dining-Out Trends' report by the Korea Agro-Fisheries & Food Trade Corporation (aT) released on January 17, the most notable operational change among dining-out businesses has been in staffing. Last year, 46.5% of respondents said they reduced their number of employees compared to the previous year, while only 12.6% reported an increase. This means that one out of every two dining-out businesses is reducing staff and restructuring its cost base.

Half of Dining-Out Businesses in Survival Mode, Reducing Staff

These survey results indicate that the dining-out industry has shifted from a period of hiring freezes to a structure where hiring more staff actually increases losses. In the past, staffing was directly linked to service quality, and service quality translated into sales. However, now, increasing staff leads to a surge in fixed costs, while sales can no longer keep up with these expenses.

The cutbacks have not been limited to staffing. 18.2% of respondents said they reduced the number of business days, and 21.4% reported shorter business hours. In contrast, only 11.6% and 14.7%, respectively, said they increased these. As more consumers opt for quick lunches and dine at home for dinner, the core business hours for dining-out-dinnertime-have seen a sharp decline in demand. As a result, maintaining longer hours only increases labor costs without a corresponding increase in sales.

Interestingly, there is little evidence that dining-out consumption has shifted to delivery or takeout. The share of in-store, delivery, and takeout sales last year showed little change compared to 2024. However, a significant number of respondents reported that sales for all three channels declined year-on-year. This suggests that the act of dining out itself is decreasing, rather than consumption shifting to a particular channel.

Dining-out businesses have responded by reducing staff and hours but increasing the number of menu items. 38.3% said they expanded their menu offerings, more than double the 16.2% who reduced them. Sales of ready-to-eat meals (HMR) also increased (29.8%) more than they decreased (23.6%). As traditional dine-in sales falter, businesses are restructuring dining-out as a product. Whereas a meal out used to be a single, complete consumption experience, now it is being divided into multiple products per meal. Main dishes, sides, takeout, ready-to-eat, and semi-prepared products are all becoming separate revenue streams within a single store.

Consumer attitudes toward dining out have also changed. Dining out has become a means of managing household expenses. Consumers are reducing the frequency of dining out, avoiding time slots and menu items with higher costs, and only choosing to dine out when necessary.

Structure Where Even Sales Leave No Profit... Costs Overwhelm Revenue

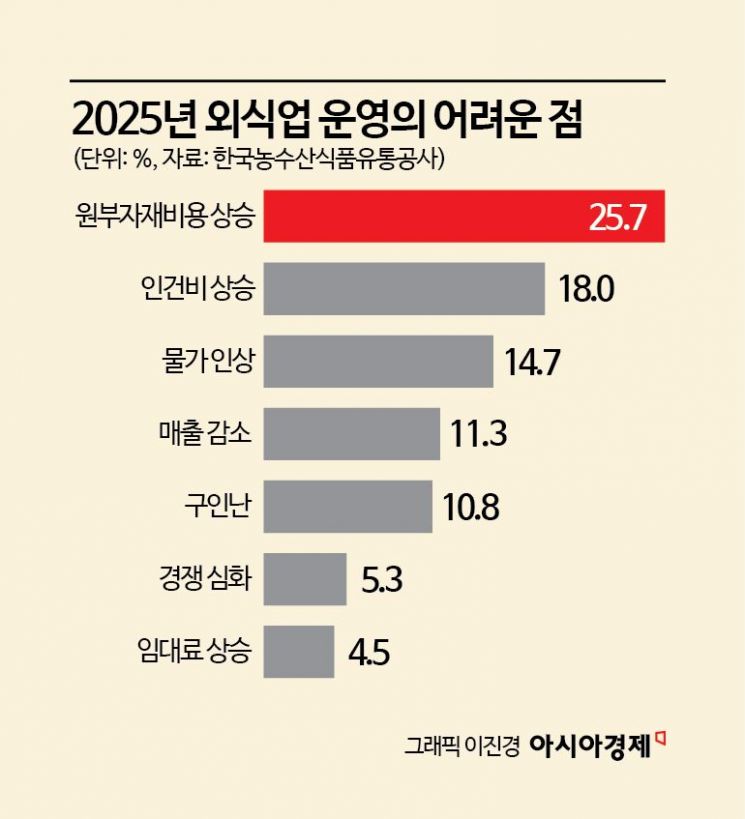

Recently, the domestic dining-out industry has fallen into a structural crisis. When asked about operational difficulties, the top three responses were rising raw material costs (25.7%), rising labor costs (18.0%), and overall inflation (14.7%). Declining sales (11.3%) ranked lower. This shows that the core crisis perceived by dining-out businesses is not a lack of demand, but cost pressure. Even if sales recover slightly, the burden of fixed costs such as labor, rent, and raw materials is so high that there is nothing left over as profit.

This year, the dining-out market is expected to remain stagnant rather than recover. The fact that more respondents reported a decrease in sales last year (45.2%) than an increase (43.4%) clearly shows that the market remains in a stagnant box range rather than a recovery phase. As a result, dining-out businesses are likely to enter a second phase of restructuring this year, further reducing staff and operational scale.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)