Welcomes the '2026 Economic Growth Strategy'

CR REITs Tax Support Extended by One Year

The Korea REITs Association has welcomed the government’s plan to expand tax support for REITs (Real Estate Investment Trusts).

On January 11, the association stated, “We actively welcome the inclusion of expanded separate taxation benefits for listed REIT dividend income and the extension of tax support for Corporate Restructuring REITs (CR REITs) in the government’s ‘2026 Economic Growth Strategy’ announced on January 9.” The association added, “This is a meaningful policy signal that will encourage private capital participation in the market and help mitigate structural risks in the real estate market.”

“Expansion of Separate Taxation for Listed REITs Will Help Build Public Wealth”

The association commented on the push to “expand low-rate separate taxation benefits for dividend income from listed REITs” included in the latest economic growth strategy, saying, “This policy will significantly contribute to stable asset formation and increased national income.” The specific details are expected to be finalized through future amendments to the tax law, enforcement decrees, and notifications.

Previously, in December 2025, the National Assembly passed a revision to the Restriction of Special Taxation Act, allowing dividend income for high-dividend listed company shareholders to be taxed separately at a rate of 14-30%, instead of being subject to comprehensive taxation. However, REITs were excluded from this benefit on the grounds that they were already eligible for separate taxation. Under the current system, dividend income from REITs held for more than three years is subject to a tax rate of 9.9% (including local taxes) for amounts up to 50 million won.

However, the requirements are considered overly strict, as investors must apply separately immediately upon purchase, and those with financial income exceeding 20 million won are excluded from eligibility, rendering the benefit virtually ineffective. According to the Korea REITs Association, the total amount of separate taxation benefits received by all REIT investors in 2023 was only 400 million won, amounting to less than 1,000 won per investor.

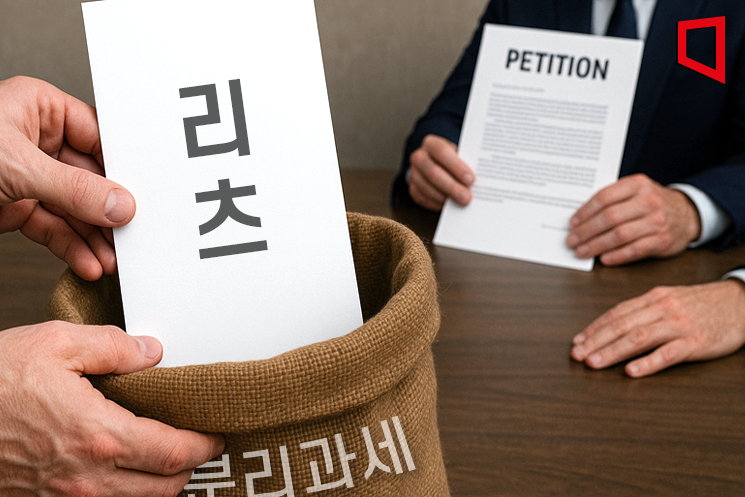

For this reason, expanding separate taxation for REIT dividend income has been a long-standing goal in the REIT industry. In July 2025, the association submitted a petition to the Ministry of Economy and Finance and the National Assembly’s Strategy and Finance Committee to include REITs as eligible for separate taxation. In August, a similar proposal and petition were delivered to Han Jeongae, Policy Committee Chair of the Democratic Party, and in November, to Lim Ija, Chair of the Strategy and Finance Committee, as part of active policy advocacy efforts.

One-Year Extension of CR REIT Tax Support... Hopes for Resolving Regional Unsold Housing

Regarding the extension of tax support for CR REITs, the association stated, “We expect this will make a substantial contribution to resolving the issue of unsold housing in regional areas.” CR REITs are REITs that acquire and manage real estate arising from corporate restructuring processes.

The government has been offering tax benefits for CR REITs, such as acquisition tax reductions and exemptions from additional corporate tax when acquiring unsold housing. The support period, which was set to expire at the end of last year, has now been extended until the end of this year as part of the new economic growth strategy. The government plans to utilize CR REITs to help resolve the backlog of nearly 30,000 unsold housing units, mainly in regional areas. The association also officially requested a one-year extension of the CR REIT tax support period from the Ministry of Economy and Finance in September 2025.

The Korea REITs Association stated, “We view it very positively that an environment has been created in which both listed REITs and CR REITs can be activated according to their respective functions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)