Online Purchase Households Still at 70%

Weekly Purchase Frequency Declines

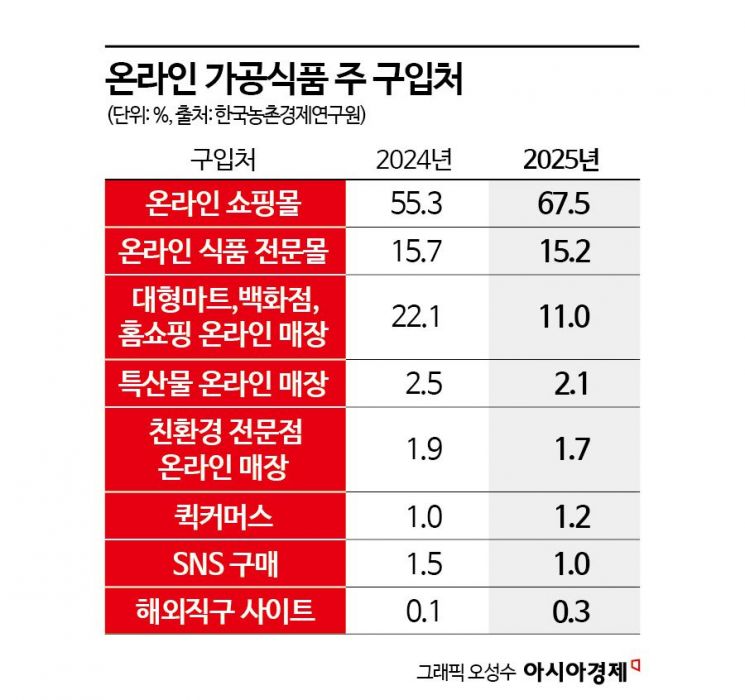

Concentration on Online Specialty Malls Intensifies

Accelerated Shift Away from Hypermarket and Home Shopping Online Channels

The digital transformation of the processed food market has entered a new phase. Although the proportion of households using online channels is already nearing saturation, consumers are restructuring their consumption patterns not by purchasing more frequently, but by changing where and what they buy.

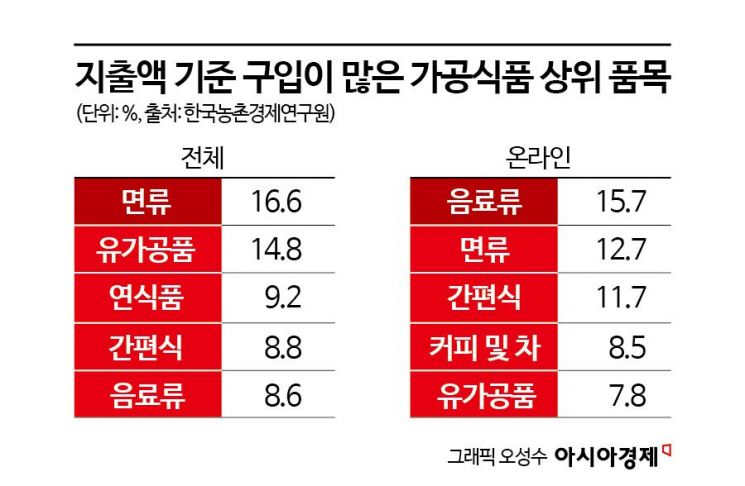

Platform Restructuring Within Online Channels... Beverages and Dairy Products Go Online

According to the "2025 Processed Food Consumer Attitude Survey" by the Korea Rural Economic Institute released on January 10, the proportion of households that purchased processed foods online in the past year remains high at 70.7%. However, the share of households buying online more than once a week dropped by 3.0 percentage points to 34.8%, down from 37.8% the previous year. While online usage is holding steady, the "normalization of frequency" has begun following the exceptional surge during the COVID-19 pandemic.

The shifts within online channels are even more pronounced. In the 2025 survey on main online purchase channels for processed foods, the share of "online retail specialty malls" soared by 12.2 percentage points year-on-year to 67.5%. In contrast, the online stores of hypermarkets, department stores, and home shopping channels plummeted by 11.1 percentage points, losing their position as the second most popular channel. Online food specialty malls rose to second place at 15.2%. This structural change indicates that consumption is shifting toward "online-native platforms" that specialize in price, delivery, and repeat purchases, rather than the online channels of traditional offline retailers.

Qualitative changes are also evident in the product mix. Across all distribution channels, the top spending categories are noodles, dairy products, ready-to-eat meals, and beverages. However, for online spending alone, beverages ranked highest at 15.7%. Notably, the online spending share for dairy products increased by 2.0 percentage points year-on-year, showing a marked upward trend. This suggests that the shift of everyday food items to online channels is accelerating. It is not just ready-to-eat meals and snacks being purchased online, but also staples such as milk, noodles, and beverages-items consumed repeatedly at home-are moving to these platforms.

Ready-to-eat meals (HMR) continue to show growth. The average purchase experience rate across 16 product categories reached 77.6%. Dumplings, pizza, and instant soup were classified as leading growth categories, with both high purchase experience rates and increased purchase scores. However, satisfaction with the price of ready-to-eat meals was the lowest at 3.22 points, compared to convenience (4.13 points) and variety (3.91 points). The top reason for not purchasing ready-to-eat meals was "because they are expensive," reaffirming that price competitiveness is the biggest obstacle to market expansion going forward.

From "Most Purchased Channel" to "Distribution Infrastructure"... The Role of Online Channels Is Changing

The stagnation in the proportion of households buying online, the decline in purchase frequency, and the growing concentration on specialty malls are not just signs of economic fluctuations but indicate that the distribution structure itself is changing.

First, while the proportion of households using online channels has exceeded 70% and reached a virtual saturation point, the share of households purchasing more than once a week has actually decreased. This means consumers are shifting their consumption patterns from impulsive or frequent purchases to buying necessary items in bulk on a regular schedule. Online channels are no longer merely replacing offline channels but are beginning to serve as regular infrastructure for managing household food purchases.

At the same time, the rapid intensification of concentration on online specialty malls suggests that the online transformation strategies of offline retailers have reached their limits. Consumers no longer perceive "hypermarket online malls" as extensions of offline stores. In terms of delivery reliability, price comparison, and convenience for repeat purchases, specialty platforms are now functioning as the actual hubs for the distribution of daily necessities.

Changes are also clear in terms of product categories. High-consumption foods such as beverages and dairy products, which are repeatedly purchased for household use, are moving to the top of online spending. This signals that online channels are evolving from being focused on special deals and promotional products to becoming structural distribution channels that manage the basic ingredients of daily diets.

Ultimately, the online processed food market has moved beyond the expansion phase and entered a stage of restructuring. The metric for growth is no longer how frequently people buy, but how many everyday food items are entrusted to the platform.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)