Domestic Equity Holdings Changes in Q4 Last Year

Stake in ISU Petasys, Daeduck Electronics Down... Profit-Taking in Growth Stocks

Aggressive Buying of Overlooked Stocks in Retail and Holding Companies... OCI Holdings Up 1.78%p

Selective Construct

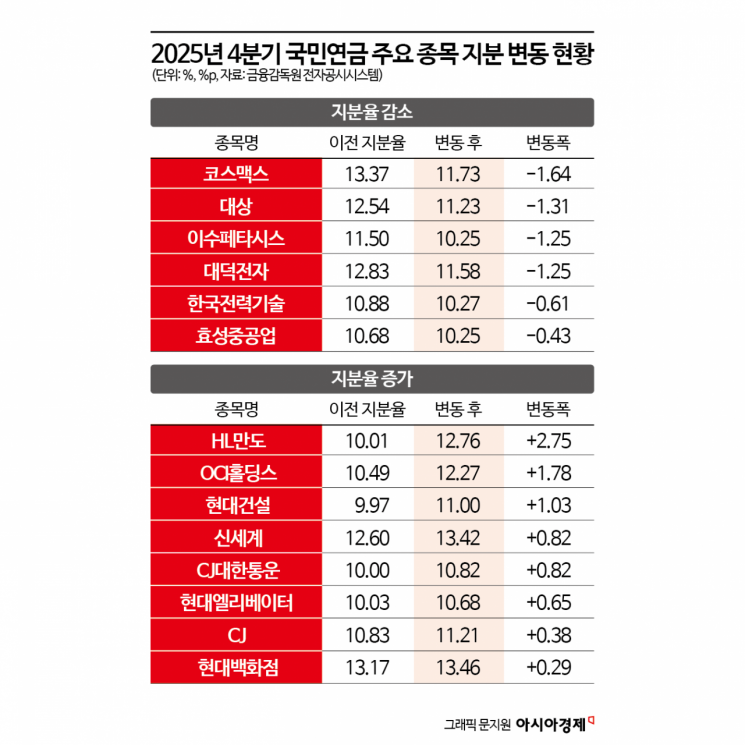

In the fourth quarter of last year, the National Pension Service, a major player in the domestic stock market, restructured its domestic stock portfolio by reducing its holdings in growth stocks that had surged in a short period due to the artificial intelligence (AI) boom, and instead purchased undervalued stocks in the retail, holding company, and construction sectors. Analysts say that, rather than continuing to realize profits from AI and semiconductor beneficiaries, the National Pension Service shifted to bargain buying, focusing on low price-to-book ratio (PBR) stocks with high expectations for corporate value enhancement programs and expanded shareholder returns.

Profit Taking in AI-Fueled Materials, Components, and Equipment Stocks

According to the Financial Supervisory Service's electronic disclosure system on January 9, the National Pension Service reduced its stakes at the end of last year in stocks that had soared after being grouped as AI semiconductor substrate-related stocks. Notably, its stake in Isu Petasys, a high-performance printed circuit board (PCB) manufacturer, dropped from 11.50% to 10.25%, while its stake in Daeduck Electronics, a semiconductor substrate supplier, fell from 12.83% to 11.58%-both declines of more than 1 percentage point. These companies had posted record-high stock price increases last year due to surging demand for AI servers. Industry experts analyze that the National Pension Service has been taking profits from overheated growth stocks.

Additionally, the fund realized gains by partially reducing its stake in Cosmax, an original design manufacturer (ODM) for cosmetics that benefited from the K-beauty boom, from 13.37% to 11.73%. It also trimmed its holdings in some consumer goods stocks, such as Daesang (from 12.54% to 11.23%), as part of its risk management strategy.

Massive Buying of Undervalued Retail, Holding Company, and Other Neglected Stocks on 'Value-Up' Expectations

In contrast, the National Pension Service significantly increased its holdings in large-cap stocks that had long been classified as neglected and undervalued. In particular, retail stocks with department stores and large discount chains saw notable gains. Its stake in Shinsegae rose from 12.60% to 13.42%, and in Hyundai Department Store from 13.17% to 13.46%. The stake in OCI Holdings, which has remained undervalued since its conversion to a holding company, also jumped sharply from 10.49% to 12.27%, a 1.78 percentage point increase. These are representative low-PBR stocks whose share prices are low relative to asset value and profitability, and are considered direct beneficiaries of the government's corporate value enhancement policies. Industry insiders interpret the National Pension Service's selection of these stocks as a focus on value stocks that can resolve undervaluation, rather than seeking short-term growth momentum.

Furthermore, amid a sluggish domestic construction market, the fund increased its holdings in construction stocks with nuclear power plant and overseas order momentum, such as Hyundai Engineering & Construction (from 9.97% to 11.00%). Bae Seho, a researcher at iM Securities, noted that Hyundai Engineering & Construction "expanded its presence last year as a large-scale nuclear power plant and small modular reactor (SMR) engineering, procurement, and construction (EPC) company within the nuclear value chain, and is scheduled to begin nuclear power contracts and groundbreaking in earnest this year," recommending it as the top pick in the construction sector. In the case of HDC Hyundai Development Company (from 10.16% to 10.45%), the National Pension Service appears to be betting on the potential for a mid- to long-term recovery, judging that the stock price has reached a bottom.

In addition, the fund showed strong buying intent by raising its stake in HL Mando by 2.75 percentage points in just one quarter, from 10.01% to 12.76%. This is seen as a reflection of the assessment that HL Mando has successfully transformed itself into a core company for future mobility, focusing on autonomous driving and electrification components.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)