No direct intervention such as "pressure for chairman resignation" unlike predecessors...

Attention on the launch of the task force early in the term

Concerns over "signals of management intervention" as National Pension Service's right to recommend

After Lee Chanjin, Governor of the Financial Supervisory Service, criticized the practice of reappointing financial holding group chairmen by saying, "Even next-generation leaders will become antiques," the debate over "government intervention" in the financial sector is intensifying. Observers note that it is unusual for the Financial Supervisory Service to establish a task force on improving financial company governance together with the Financial Services Commission just about 150 days after Lee took office. Some in the financial industry predict that concerns about excessive government involvement in the management of private companies may persist for the time being.

Lee Chanjin, Governor of the Financial Supervisory Service, is delivering a New Year's address at the '2026 Pan-Financial New Year Meeting' held at Lotte Hotel in Jung-gu, Seoul on the afternoon of the 5th. 2026.1.5 Photo by Kang Jinhyung

Lee Chanjin, Governor of the Financial Supervisory Service, is delivering a New Year's address at the '2026 Pan-Financial New Year Meeting' held at Lotte Hotel in Jung-gu, Seoul on the afternoon of the 5th. 2026.1.5 Photo by Kang Jinhyung

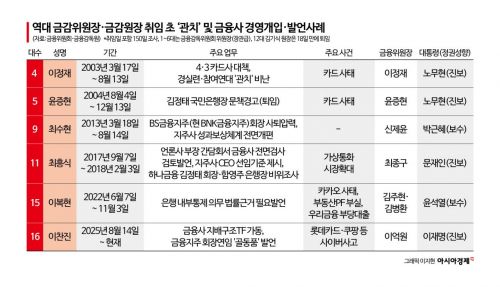

According to financial authorities and industry sources as of January 9, there have been numerous cases since the establishment of the Financial Supervisory Service where its governors made strong statements on financial company governance or management issues early in their tenure, often triggering controversy over government intervention. In particular, during the tenure of the Financial Supervisory Commission Chairman, who also held a ministerial-level position as the head of the Financial Services Commission, there were frequent debates about government intervention, especially during the post-IMF financial crisis restructuring and the response to the credit card crisis, when strong regulatory measures were justified.

In fact, from the launch of the Financial Supervisory Service in 1999 until the organizational restructuring in 2008, there were ongoing controversies over the appointment of executives and outside directors at banks and insurance companies, disputes over intervention in hiring processes, conflicts and strikes during the merger of Kookmin Bank and Housing Bank, criticism from civic groups regarding government intervention, and disciplinary actions or sanctions against some financial company CEOs.

The core of the debate is that, even after the "private sector governor" system was established in 2008, controversies over government intervention have continued. Industry insiders note that Governor Lee’s statements are stronger compared to previous private sector governors, and the fact that he launched a governance task force with the Financial Services Commission early in his term could be seen as "management intervention." It is reportedly the first time that a governance improvement body for financial companies has been officially established with the Financial Services Commission within 150 days of a governor’s appointment. Although former Governor Lee Bokhyun also formed a similar organization, it was not at the early stage of his tenure, indicating a difference in pace.

Some in the financial sector worry that, even considering recent presidential remarks about a "corrupt inner circle" in the financial industry and the trend toward expanding shareholder rights following amendments to the Commercial Act, repeated messages from authorities that could be interpreted as intervention may increase market uncertainty. Compared to former governors Choi Soohyun (9th), Choi Heungsik (11th), and Lee Bokhyun (15th), who were relatively directly involved in governance issues after 2008, Lee Chanjin’s comments on holding company governance and board composition are perceived as even stronger.

Immediate attention is focused on whether the governance task force will lead to legal or institutional reforms, and if so, how far those reforms will go. Since the Financial Services Commission is also involved, some in the industry speculate that de facto "guidelines" for CEO succession could be established.

Experts in the financial sector and academia note that while it may be unrealistic to impose outright restrictions such as "prohibiting the reappointment of holding company chairmen," other measures-such as limiting the term or reappointment of outside directors (e.g., a single three-year term) or strengthening the requirements for special resolutions at shareholder meetings when reappointing chairmen-could be discussed. Some interpret that amending the articles of incorporation of financial companies could also be an option.

A financial company official said, "Since the Korea Federation of Banks and major financial holding groups are participating in the task force, we hope it will serve as a forum that reflects a wide range of private sector opinions," adding, "Given that the governor mentioned the independence of outside directors, it is highly likely that this topic will be a major agenda item in the task force."

In academia, concerns have been raised about Governor Lee’s comments regarding the National Pension Service’s right to recommend outside directors. Some point out that his statement-clarifying that "this is not pension socialism" in response to controversy over the National Pension Service’s involvement in the appointment and dismissal of outside directors-could be interpreted as justifying the management involvement of quasi-governmental institutions under the government. However, others argue that, unlike some of his predecessors who pressured specific holding company chairmen to resign or directly presented CEO appointment criteria, Governor Lee has not taken such direct "actions," so it is important to distinguish between statements and actions during the ongoing discussion.

Cho Myunghyun, Professor of Business Administration at Korea University, said, "The fact that a governance task force with the participation of the Financial Services Commission was launched immediately after the president’s remarks shows a faster pace than under the previous governor (Lee Bokhyun). While the content of the task force’s discussions is important, if large institutional investors like the National Pension Service become more involved in the appointment of outside directors, it could be perceived by the market as a signal of 'management intervention.'" He added, "Since it is rare for institutional investors other than activist hedge funds to exert influence over the appointment of outside directors, it is crucial to closely examine potential side effects during the design of any new system."

However, Governor Lee is also aware that excessive management intervention by supervisory authorities could become controversial. At his first press conference after taking office on December 1, when asked about his comments regarding BNK Financial Group during the National Assembly audit, he explained, "It seemed that the candidates for holding company chairman were very eager to be reappointed, and I raised concerns about the soundness of governance," clarifying, "I have absolutely no intention of intervening in the management of any specific company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)