Hanmi Semiconductor's Adjusted Share Price Nears 9.3 Million Won with 100-Won Par Value

Warming Investment Sentiment Spreads to Materials, Parts, and Equipment Sector

Net Short-Selling Balance Exceeding 6% Emerges as a Key Variable

The first "Emperor Stock" of the new year (stocks trading above 1 million won per share) is expected to emerge from an unexpected sector. While Hanmi Semiconductor's current share price is in the 100,000 won range, its adjusted share price is already nearing 10 million won. This is a result of the semiconductor investment fever, which has been driving record highs in the KOSPI, now spreading to the materials, parts, and equipment (MPE) sector. However, with a significant volume of short selling, the future trajectory of the stock price is not expected to be entirely smooth.

According to the Korea Exchange on January 8, Hanmi Semiconductor closed at 186,500 won the previous day, up 1.52%. This marks four consecutive trading days of gains since the start of the year. In the Nextrade Pre-Market, the stock immediately hit the upper price limit (238,500 won) after the market opened, setting a new all-time high, but quickly gave up its gains and ended with a long bearish candle. Since the pre-market operates on a call auction system, the opening price can easily hit the upper or lower limit with just a small volume of orders right after opening.

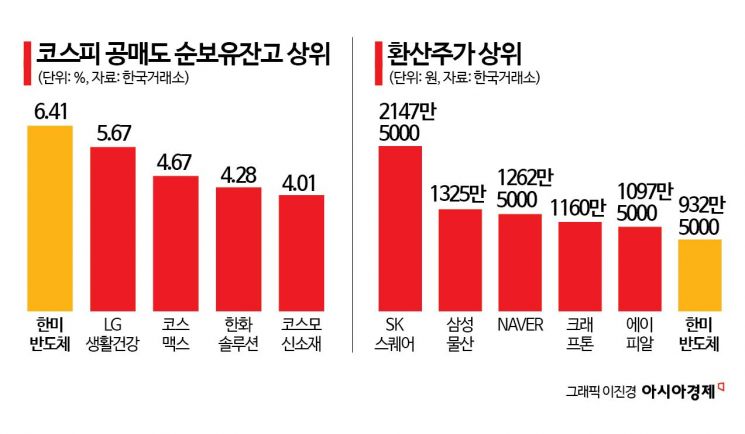

Based solely on the market price on the exchange, Hanmi Semiconductor's ascension to "Emperor Stock" status still seems distant. However, by adjusted share price, it is already on the verge of surpassing "Super Emperor Stock" status. The adjusted share price standardizes the par value of each stock to 5,000 won, allowing for direct comparison. With a par value of 100 won, Hanmi Semiconductor's adjusted share price stands at 9,325,000 won, just shy of the 10 million won mark. Currently, there are only five stocks with an adjusted share price above 10 million won: SK Square (21,475,000 won), Samsung C&T (13,250,000 won), Naver (12,625,000 won), Krafton (11,600,000 won), and APR (10,975,000 won).

As leading semiconductor stocks Samsung Electronics and SK hynix have both been setting new record highs since the beginning of the year, the heat is spreading to the MPE sector as well. In particular, Hanmi Semiconductor, which boasts the world's top market share in TC bonder equipment, recently unveiled next-generation electromagnetic wave shielding process equipment targeting the low earth orbit (LEO) satellite communications market, further stimulating investor sentiment. So far this month, foreign investors have net purchased Hanmi Semiconductor shares worth 384.4 billion won, making it the third most net-bought stock by foreigners.

Noh Donggil, a researcher at Shinhan Investment Corp., stated, "The proportion of MPE stocks with improving earnings per share (EPS) has recently risen to 71%," adding, "This is a signal that the profit growth in the MPE sector is no longer limited to a few stocks, but is entering a phase of broader expansion." While it may be time for investors to gradually broaden their focus from major semiconductor stocks to the MPE sector, Noh emphasized that selective stock picking is still necessary rather than a sector-wide approach.

In the case of Hanmi Semiconductor, the stock has surged more than 38% so far this year, drawing a steep upward curve. However, the burden of short selling remains a key variable. As of January 2, Hanmi Semiconductor's net short position stood at approximately 882.6 billion won, ranking second among all listed companies, just behind LG Household & Health Care (893 billion won). The proportion of Hanmi Semiconductor's net short position relative to its market capitalization (13.7726 trillion won) is 6.41%, the highest among KOSPI-listed firms. Excluding Hanmi Semiconductor, only two other companies-Enchem (6.60%) and Woori Technology (6.18%)-have a net short position ratio exceeding 6%. The net short position represents the remaining quantity of borrowed shares that have been sold, and a higher figure indicates that more investors expect the stock or index to decline further.

Securities lending balance statistics are another indicator that Hanmi Semiconductor investors should pay attention to. According to the Korea Financial Investment Association, as of January 6, Hanmi Semiconductor's securities lending balance stood at 2.9127 trillion won, ranking third among all listed companies after Samsung Electronics and SK hynix. The securities lending balance represents the outstanding amount of shares lent by institutional investors to borrowers. While this balance does not necessarily indicate the exact amount of future short selling, a rising balance often leads to increased short selling pressure, which is why it is referred to as a "leading indicator" for short selling.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)