Bitcoin Recovers to $93,000 Level

Sharp Rebound on Expectations of Lower Energy Prices

Venezuela’s Hidden Coins Emerge as a Future Variable

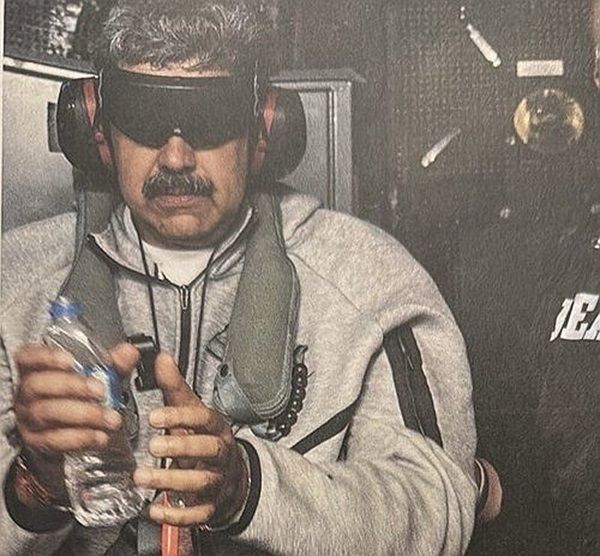

Cryptocurrency assets, with Bitcoin at the forefront, began to rebound before and after the operation to arrest Venezuelan President Nicolas Maduro in the United States. Expectations that Venezuelan oil could flow into the U.S. and lower energy prices, thereby reducing cryptocurrency mining costs, are acting as a positive catalyst. However, some warn that cryptocurrencies held as hidden assets by high-ranking Venezuelan officials could be released into the market, which could trigger a decline.

Bitcoin Recovers to $93,000 Level... Growing Optimism for Reduced Mining Costs

According to Binance, the world’s largest cryptocurrency exchange, the price of Bitcoin started at $87,412.91 on January 1, 2026, the first trading day of the year (local time), but recovered to the $93,000 level after President Maduro was arrested on January 3. After surpassing the $120,000 mark on October 2025, Bitcoin’s price had been on a continuous decline, falling below $90,000 in December 2025. Ethereum also rebounded from around $4,200 at the beginning of the year to around $4,700.

Expectations that Venezuelan oil will be supplied to the U.S. at low prices following President Maduro’s arrest, thereby lowering cryptocurrency mining costs, have acted as a positive factor. Bitfinex, a cryptocurrency exchange, stated in a report on January 3, “If U.S. companies begin to develop the vast oil reserves in Venezuela, there will be an immediate impact on the energy market and a positive effect on the Bitcoin and crypto asset markets. The lower the price of crude oil, the more significantly mining companies’ profitability can improve.”

There is also growing optimism that falling oil prices will help ease U.S. inflation and lead to increased liquidity. Arthur Hayes, founder of the crypto investment firm Maelstrom, recently stated on social media, “If Venezuelan oil is supplied to the U.S., oil prices will stabilize and the U.S. government’s inflationary pressures will be greatly reduced. For the Trump administration, which is considering interest rate cuts, this will provide momentum to push forward with liquidity expansion policies, and as market liquidity increases, the cryptocurrency market will be revitalized.”

The U.S. government is reportedly preparing to bring Venezuelan oil into the U.S. market. On January 6, U.S. President Donald Trump announced on his social media platform Truth Social, “I am pleased to announce that Venezuelan authorities will deliver high-quality oil to the United States. This oil will be transported directly to U.S. unloading docks by storage vessels.”

Could Venezuela’s Hidden Bitcoin Become a Negative Factor?

Some are focusing on the possibility that Bitcoin held by the Maduro regime’s leadership could be sold in large quantities. Given that Venezuela has been under U.S. economic sanctions for a long period since 2018, it is speculated that the country has accumulated significant cryptocurrency assets.

CoinPost, a cryptocurrency-focused media outlet, reported, “The Maduro regime secretly accumulated Bitcoin while under prolonged U.S. economic sanctions, and rumors in the crypto market suggest the amount could reach $60 billion. If senior officials of the Maduro regime were to liquidate this Bitcoin in large quantities, there could be a temporary sharp decline.”

The exact amount of Bitcoin stockpiled by Venezuela is currently unknown. According to Bitcoin Treasuries, a crypto market research firm, the amount of Bitcoin recently confirmed in Venezuelan crypto wallets was only $22 million. However, since Bitcoin can be held through wallets in other countries, it is difficult to determine the precise amount based on this alone.

CNBC reported, “There is a possibility that the Venezuelan regime’s leadership holds much more Bitcoin than is publicly known through unofficial means. However, in such cases, it is more likely that the U.S. government will track and seize these Bitcoins, making it difficult for them to be released into the market immediately.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)