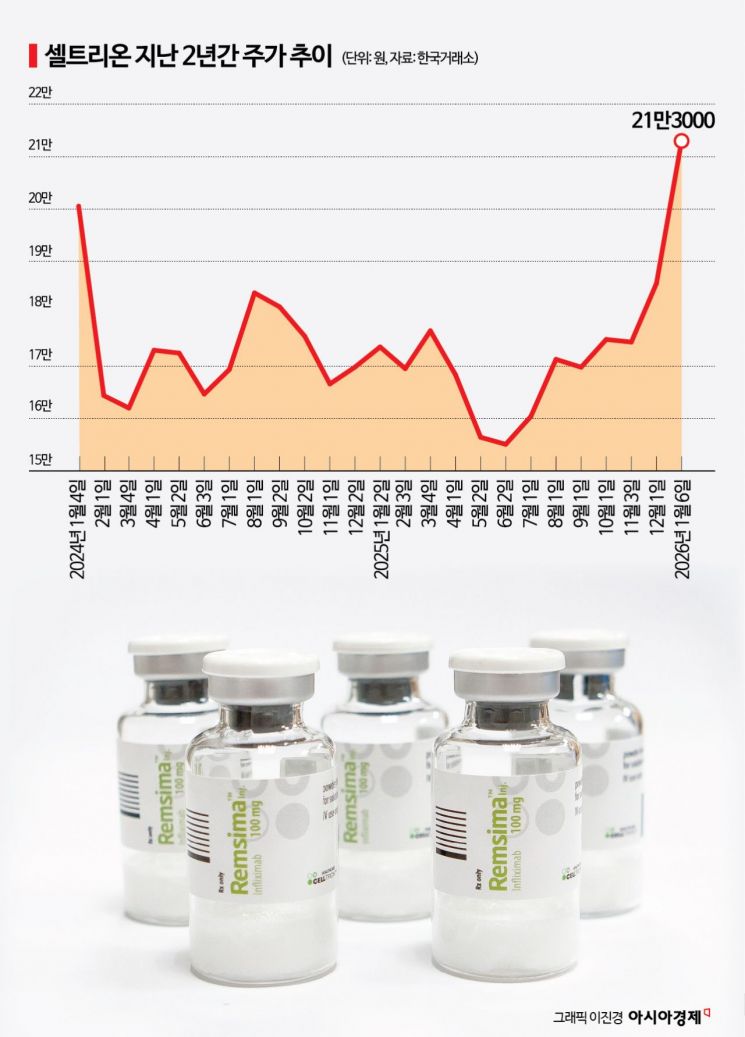

First Time Above 200,000 Won in Two Years Since January 2024

Strong Earnings and Clear Growth Visibility Secured

Celltrion's stock price has settled above the 200,000 won mark for the first time in two years. As strong fourth-quarter results have been confirmed and growth visibility for the new year has become clearer, the market's evaluation is shifting from a 'discount' to a 'rerating' (value reassessment).

According to the industry on January 7, Celltrion's closing price on the previous day was 213,000 won, breaking out of the '200,000 won box range' that had persisted for nearly two years since surpassing 200,000 won on January 2 of this month. Since recording a closing price of 200,551 won on January 4, 2024, Celltrion's stock had remained between 150,000 and 200,000 won. Even in January 2024, the stock price exceeded 200,000 won on only three trading days, making this breakout from the 200,000 won range effectively the first in four years and three months since October 2021.

For shareholders, Celltrion had been a 'frustrating' blue-chip stock, as the stock price failed to keep up with its steadily improving results. The market assessed that high-cost inventory became a drag after the merger with Celltrion Healthcare in 2023. However, much of this concern was alleviated after the company announced an 'earnings surprise' outlook at the end of last year. Celltrion projected consolidated sales of 1.2839 trillion won and operating profit of 472.2 billion won for the fourth quarter of last year. While sales were in line with the market consensus (1.2579 trillion won), operating profit exceeded consensus (396.8 billion won) by more than 19%.

The key question is 'why did things improve?' Profitability was enhanced as sales of high-margin new products expanded. In the fourth quarter, new products such as Remsima SC (marketed as Zymfentra in the US), Yuflyma, Vegzelma, and Stekima are all expected to have recorded double-digit growth rates, with their share of total sales projected to surpass 60%. With the negative impact of the merger eliminated, profitability is expected to accelerate further. In particular, the completion of high-cost inventory clearance and R&D amortization from before the merger-which had been an unavoidable drag on operating profit-along with improved production yields, is expected to boost future operating margins. Based on the expansion of high-margin new product sales, Kiwoom Securities estimated Celltrion's 2024 results at 5.3404 trillion won in sales and 1.5456 trillion won in operating profit.

Securing a US production base is another pillar of growth. By acquiring the Branchburg plant in New Jersey, Celltrion has established a local production and supply system, providing a foundation for contract manufacturing (CMO) volumes related to Teva and Eli Lilly to be reflected in its results. With expectations of annual CMO sales of around 200 billion won and production capacity expanded to 132,000 liters, this is expected to contribute to performance. In addition, as the competitiveness of its new drug pipeline grows, Celltrion's 'growth narrative' is entering a new phase. The US FDA has approved the IND (Investigational New Drug) application for the multi-antibody-based anticancer new drug 'CT-P72/ABP-102', and the antibody-drug conjugate (ADC) based anticancer candidate 'CT-P70' has received fast-track designation. The company is now presenting itself to the market not only as a biosimilar company, but also as a new drug developer.

Shareholders' evaluations are also changing. Doubts about Chairman Seo Jungjin's management strategy have largely subsided amid the previous stock price stagnation. The sentiment among shareholders, who once called for the chairman to step down during sluggish periods, is gradually shifting to viewing Celltrion as a 'high-yield savings account.' Last year alone, Celltrion invested over 2 trillion won in shareholder-friendly policies such as dividends, share buybacks, and cancellations.

Securities firms are raising their target prices for Celltrion one after another. Kiwoom Securities raised its target price from 230,000 won to 250,000 won, citing strong results driven by the expansion of high-margin new product sales. Yuanta Securities focused on the fact that new biosimilars will begin contributing significantly to sales this year and raised its target price from 220,000 won to 250,000 won. Daol Investment & Securities also raised its target price from 230,000 won to 240,000 won, while IBK Investment & Securities, Eugene Investment & Securities, and NH Investment & Securities all raised their target prices to 250,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)