Clear Shift from Bank Deposits to Stocks: 'Money Move' Accelerates

Bank Time Deposits Up Only 1.3% Last Year

Investor Deposits at Securities Firms Surge by 62%

Low Deposit Rates and Stock Market Boom Drive Trend

"Expecting Higher Returns Than

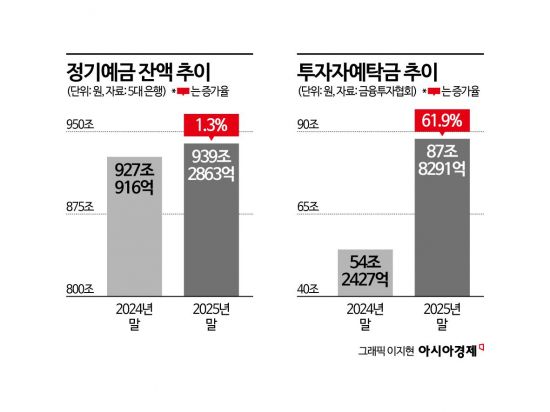

Last year, there was a clear trend of money moving from bank deposits to the stock market. While investor deposits-funds set aside for stock investments-increased by 62%, the balance of time deposits at major commercial banks rose by only 1.3%. This was the result of a stock market boom that began with the launch of the new government, coupled with a downward trend in interest rates. This year, as the KOSPI surpassed the 4,500 mark at the beginning of the year and the domestic stock market continues to hit record highs, many expect the shift of funds to the capital market to accelerate even further.

According to the financial sector on January 7, the balance of time deposits at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 939.2863 trillion won at the end of last year, up 1.3% (12.1947 trillion won) from 927.0916 trillion won at the end of the previous year. This represents a significant slowdown compared to 2024, when the balance increased by 77.7959 trillion won, or 9.2%, over the year.

In contrast to the noticeable slowdown in the growth of time deposits, investor deposits at securities firms surged sharply. According to the Korea Financial Investment Association, investor deposits at the end of last year reached 87.8291 trillion won, a 61.9% (33.5864 trillion won) increase from 54.2427 trillion won the previous year. This far exceeds the increase of 1.489 trillion won (2.8%) recorded in 2024.

Demand deposits, another form of idle funds at commercial banks, also rose from 631.2335 trillion won at the end of 2024 to 674.0084 trillion won, but the growth rate was only 6.8%, lagging behind the pace of investor deposits. This indicates a clear trend of funds moving from traditional bank products such as deposits to capital market instruments such as securities.

This phenomenon was largely driven by the sharp rally in the domestic stock market following the launch of the new government in the second half of last year. According to the Korea Exchange, the KOSPI index closed at 4,214.17 at the end of last year, up from 2,399 at the end of 2024. The annual growth rate was 75.6%, the highest among the G20 countries. The new government's clear commitment to revitalizing the capital market, combined with improved investor sentiment due to a recovery in the semiconductor industry, contributed to this trend.

Meanwhile, the downward trend in time deposit interest rates at commercial banks further encouraged the movement of funds. According to the Bank of Korea, the average interest rate on time deposits, which stood at 3.22% at the end of 2024, had fallen to 2.78% as of November last year.

Although banks raised deposit rates back to the 3% range to attract funds, resulting in an upward trend since September last year, this was not enough to offset the impact of eight consecutive months of decline from January to August. The balance of time deposits also increased in October and November, but about 32 trillion won flowed out in December alone, limiting the annual net inflow. While it is common for deposits to decrease at the end of the year as companies prepare for year-end settlements, this time the decline was exacerbated by a year-end credit crunch and deteriorating funding conditions for both businesses and households.

The movement of funds into the capital market is likely to accelerate even further this year. Deputy Prime Minister and Minister of Economy and Finance Koo Yooncheol made clear in his New Year's address that the government intends to fundamentally shift the flow of funds toward venture capital and the capital market. The government has also previously introduced tax incentives for investors returning from overseas stocks to the domestic stock market.

An Seonghak, a research fellow at Hana Institute of Finance, stated, "With the government's capital market activation policies and the expansion of domestic and global liquidity, the inflow of funds into the capital market is expected to continue this year. While some funds may flow back into time deposits due to rising interest rates, the inflow into stock market-related products such as equities and exchange-traded funds (ETFs), which are expected to offer higher returns, will likely expand even further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)