Prevent Losses by Using Card Installments Instead of Cash

Lack of Institutional Safeguards Such as Surety Insurance and Mutual Aid Membership

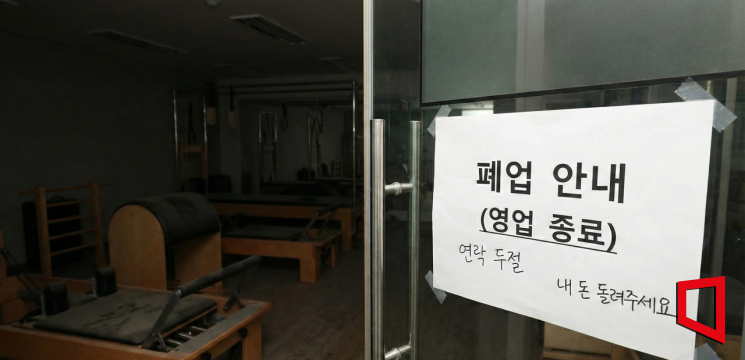

"I was tempted by the offer of 1 million won for 100 sessions, so I paid for it, but after only nine visits, the center closed down. I can't even get in touch with them, let alone get a refund."

Lee, a 27-year-old office worker, faced a setback after purchasing a long-term membership at a Pilates center near her home. At an irresistible price of 10,000 won per session, she hastily paid for 100 sessions. However, the company went bankrupt due to business difficulties, causing her to lose the remaining 91 sessions-worth about 900,000 won-entirely.

Recently, not only local gyms and Pilates centers but also large nationwide franchises have been going bankrupt one after another, resulting in a surge of so-called 'Muk-Twi' damages.

Recently, not only local gyms and Pilates centers but also large nationwide franchises have been going bankrupt one after another, resulting in a surge of so-called 'Muk-Twi' damages.

Recently, not only local gyms and Pilates centers but also large nationwide franchise fitness facilities have been going bankrupt one after another, resulting in a surge of damages.

According to a compilation of reports by The Asia Business Daily on January 7, a Pilates company with over 20 franchise locations nationwide recently began bankruptcy proceedings at its headquarters. There was a bankruptcy-related hearing in November last year, and members were informed that refunds would be difficult due to the owner's excessive debt. As the headquarters' worsening finances led to closure notices at each branch, the branch managers initially said refunds were possible, but in the end, both members and instructors have suffered losses.

Hundreds of members who prepaid tuition fees have not received refunds, and the known damages so far exceed 100 million won. Victims are spread across the country, but the Suwon Yeongtong Police Station under the Gyeonggi Nambu Provincial Police Agency has consolidated the cases and is currently investigating.

The problem is that these so-called 'Muk-Twi' closures are not a new phenomenon. According to the Korea Consumer Agency, there were a total of 987 applications for relief related to prepaid transactions at sports facilities that closed down between January 2020 and August last year. The total amount of damages reached 212.94 million won. By business type, gyms accounted for 351 cases and Pilates centers for 334, making up the majority. Considering that formal reports to the Consumer Agency represent less than 10% of all cases, the actual financial losses suffered by consumers are estimated to be much higher.

In addition, there are insufficient institutional channels for consumers to receive refunds if services are suspended due to the closure of fitness facilities such as Pilates centers or gyms. This is because, under the current Sports Facilities Act, it is not mandatory to purchase guarantee insurance, join a mutual aid association, or deposit a business security deposit.

Lee Youngae, a professor of consumer studies at Incheon National University, said, "Opening a gym or Pilates center has a low barrier to entry and intense competition, so it is common for businesses to go bankrupt after overextending themselves with too many branches. From the consumer's perspective, you should not be lured by the sweet temptation of large discounts for cash payments. The only way to prevent losses is to pay in installments by credit card and, in the event of closure, exercise your 'right to withhold payment' for the remaining installments through your card company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)