Total Investment Maintains 2024 Level, but Number of Deals Plummets in 2025

AI Mega-Trend Continues, Accounting for 23.6% of Total Investment

Semiconductors and Bio Remain Strong

Investment in Shopping and Finance Targeting Overseas Markets Increases

It has been identified that the concentration of capital among a small number of companies in the domestic startup investment market has intensified.

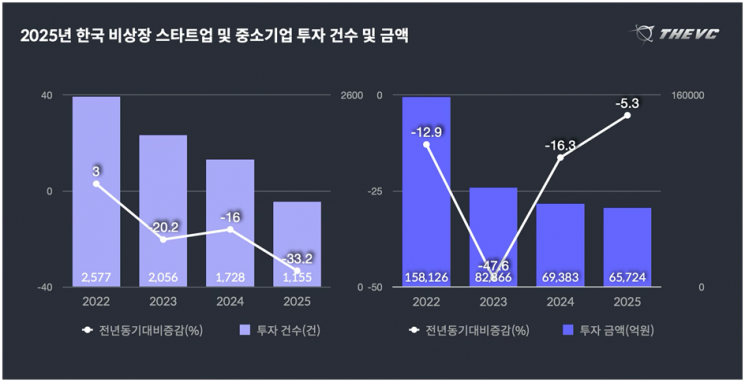

According to the "2025 Korean Startup Investment Statistics" released by The VC, a startup capital market database company, on the 2nd, the number of investments in unlisted startups and small and medium enterprises in Korea last year was 1,155, with a total investment amount of 6.5724 trillion won. The VC analyzed, "Given the nature of unlisted investments and considering undisclosed investment information, while the total investment amount maintained the 2024 level, the number of deals plummeted by more than 30%."

Early-Stage Investment Shrinks... Pre-IPO Round Remains Active

First, polarization across the venture investment market became more pronounced. The average investment amount last year was 9.26 billion won, up 47.3% from the previous year, surpassing the level seen before the investment downturn in 2022. The median investment amount also doubled from the previous year to 4 billion won.

Number and Amount of Investments in Korean Unlisted Startups and Small and Medium Enterprises in 2025. The VC

Number and Amount of Investments in Korean Unlisted Startups and Small and Medium Enterprises in 2025. The VC

By investment round, the contraction of early-stage investments stood out. While investment amounts in mid- and late-stage rounds increased compared to the previous year, early-stage investment amounts declined by nearly 30%. The proportion of early-stage investments in the total investment amount also shrank by almost 10 percentage points.

On the other hand, buoyed by expectations for a recovery in the initial public offering (IPO) market, the number of pre-IPO equity investments increased by more than 30%. The recent announcement by the Financial Services Commission to expand the customized technology special listing system-previously applied to the bio sector-to key technology fields such as artificial intelligence (AI), space industry, and energy, is also seen as a factor raising expectations for the IPO market.

AI Remains Strong... Investment in Content and Games Plummets

By industry, the mega-trend of AI continued to stand out. With large-scale investments concentrated in AI semiconductor companies such as Rebellions and FuriosaAI, the share of AI investments in the total investment amount expanded from 9.4% in 2022 to 23.6% last year. As the share of AI investments in the global venture capital market is expected to exceed half, the domestic market is also seeing venture capital funds increasingly shift toward AI.

By sector, semiconductors and bio maintained their strength, and investments in startups in shopping and financial sectors targeting overseas markets also increased. In contrast, content and game sectors saw a significant decrease in investment due to changing investor preferences and profitability concerns, highlighting stark differences across industries.

A representative from The VC stated, "Although funding conditions have improved somewhat thanks to the end of global monetary tightening, expectations for interest rate cuts, and expanded tax incentives for private venture fund-of-funds, external uncertainties persist. In reality, investments were concentrated in a small number of verified companies in deep tech fields such as AI, semiconductors, and bio, showing a mild easing but strong concentration throughout the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)