A Series of New Owners for KFC and Five Guys

Selective Deals Struck Amid Valuation Adjustments and Market Stabilization

The domestic food service and food & beverage (F&B) mergers and acquisitions (M&A) market, which had slowed down until the first half of this year, became increasingly active in the second half. After a period when listings piled up but transactions stalled, a series of ownership changes is now reversing the mood in the F&B sector. Despite a market environment dampened by high interest rates and sluggish consumption, deals are being struck again, particularly for brands with strong performance records.

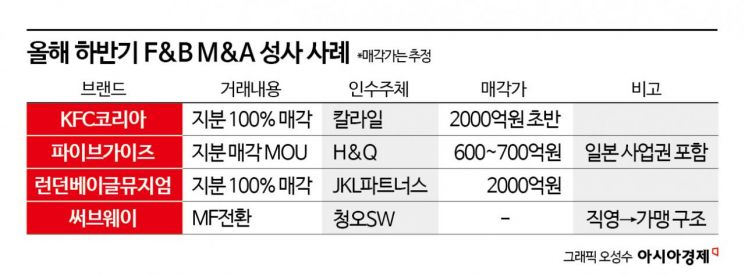

According to industry sources on December 31, KFC Korea recently welcomed a new owner as global private equity firm Carlyle acquired a 100% stake. While the official transaction amount was not disclosed, industry estimates put it at around 200 billion won. The previous majority shareholder, Orchestra PE, had acquired KFC Korea for about 70 billion won in 2023 and successfully exited the investment in just two years.

KFC Korea shifted away from a company-operated store model to actively expand its franchise business, reducing fixed costs and saving on labor expenses by upgrading kiosk and app ordering systems. As a result, operating profit, which had remained in the several billion won range at the time of acquisition, recently surpassed 40 billion won, setting a new record high.

KFC Korea operates around 200 stores nationwide under a master franchise (MF) agreement with global food service franchise company Yum! Brands. Through the acquisition of KFC, Carlyle is expected to expand its portfolio, previously centered on cafes, to the broader food service sector and enhance corporate value. The company had previously acquired Twosome Place, a cafe brand with over 1,700 stores nationwide, in 2021.

FG Korea, the domestic operator of the American premium burger brand Five Guys, also recently signed a memorandum of understanding (MOU) with private equity firm H&Q Equity Partners for a stake sale. This comes two and a half years after Kim Dongseon, Executive Vice President of Hanwha Galleria and the third son of Hanwha Group Chairman Kim Seungyeon, brought Five Guys to Korea in June 2023.

Five Guys, which currently operates eight stores in Korea, turned a profit last year with an operating profit of 3.3 billion won. The expected sale price is between 60 billion and 70 billion won, meaning the company's valuation has nearly tripled compared to the cumulative investment of around 20 billion won. H&Q Korea is said to have highly valued the structure, which includes not only domestic store operations but also exclusive business rights in Japan.

There have also been cases where the restructuring of global headquarters’ business models has led to domestic M&A. Sandwich brand Subway recently switched its Korean operations from a company-operated model to a master franchise (MF) system and signed an MOU with Cheong-O SW, an affiliate of Cheong-O DPK, which operates Domino’s Pizza, as the local operator. Cheong-O SW will take over the overall operation and franchise management of Subway stores in Korea.

LBM, which operates the London Bagel Museum, also welcomed private equity firm JKL Partners as its new largest shareholder. The transaction amount for a 100% stake is about 200 billion won, and the company’s valuation, considering last year’s EBITDA and other factors, is estimated at around 170 billion won.

The concentration of such deals in the second half of the year is attributed to the growing perception that the food service industry has passed through its worst phase. Unlike the first half, when high inflation and high interest rates led to a sharp contraction in consumption, the second half has seen a slowdown in sales declines and the emergence of brands with stabilized profitability per store. For investors, improved earnings visibility has created an environment where risks can be more clearly assessed.

The fact that valuation adjustments have effectively reached their final stage is also a key factor in the success of these deals. Controversies over overvaluation based on growth expectations have been resolved, and consensus between buyers and sellers has formed around realistic prices based on cash generation metrics such as EBITDA. With the IPO market subdued, the need for private equity funds to exit investments and their capacity for new investments have combined to accelerate negotiations.

However, not all F&B assets have resulted in transactions. Burger King, Pizza Hut Korea, Richbeam (Pizza Nara Chicken Gongju), Norang Food (Norang Tongdak), Myeongryundang (Myeongryun Jinsa Galbi), and nine dining and dessert brands from E-Land Eats (Bangung, Steak Us, Tero, etc.) have all been put on the market but have yet to find new owners. In particular, Norang Food, the operator of Norang Tongdak, attempted to sell a 100% stake held by its largest shareholders, Q Capital Partners and Koston Asia, and entered into negotiations with Philippine food service company Jollibee Group, but the deal ultimately fell through due to a failure to narrow differences in price expectations.

An industry insider commented, "It is true that transactions have increased in the second half of the year, but this is selective at best. Assets without solid performance or those with unresolved legal or operational risks still face significant hurdles in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)