Management Strategies Focus on Control Amid Dual Burden of Exchange Rates and Domestic Demand

Efficiency Emerges as a Common Keyword Across Industries Despite Strategic Differences

Executives in the distribution and consumer goods sectors have identified the exchange rate and sluggish domestic demand as the biggest variables in next year's business environment. With the value of the won having dropped significantly this year, the price of imported food raw materials has risen, which in turn has stimulated inflation and inevitably affected the real purchasing power of domestic consumers.

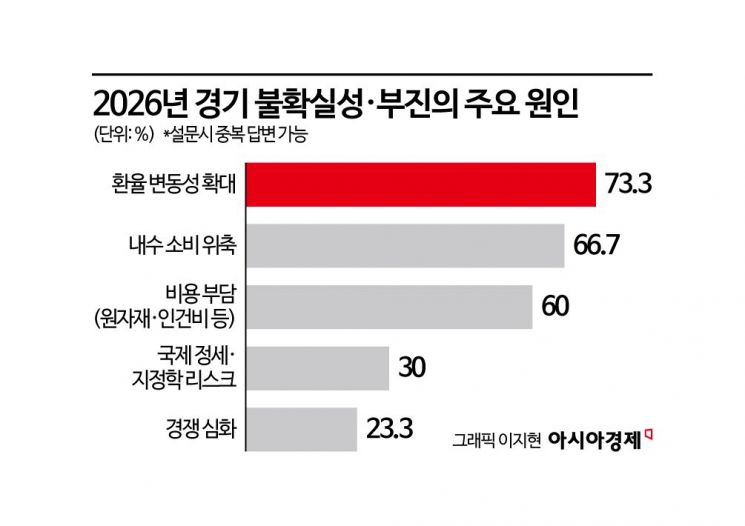

In a survey conducted by The Asia Business Daily of executives from 30 distribution and consumer goods companies, 73.3% of respondents cited "exchange rate volatility" as the greatest management risk for next year. This figure exceeds concerns over shrinking domestic consumption (66.7%) and cost burdens such as labor and raw materials (60.0%). The risk posed by exchange rates was commonly mentioned regardless of industry or business structure.

On the 26th, amid the government's strong response, the won-dollar exchange rate is rapidly declining, as shown on the electronic board displaying rates on the currency exchange street in Myeongdong, Jung-gu, Seoul. 2025.12.26 Photo by Dongju Yoon

On the 26th, amid the government's strong response, the won-dollar exchange rate is rapidly declining, as shown on the electronic board displaying rates on the currency exchange street in Myeongdong, Jung-gu, Seoul. 2025.12.26 Photo by Dongju Yoon

Concerns Over Prolonged High Exchange Rates and a Growing Conservative Outlook

Companies view exchange rate volatility as a key variable that goes beyond simple foreign exchange costs, affecting cost structures, pricing policies, and investment decisions across the board. This is evidenced by the fact that not only food and consumer goods companies with a high proportion of imported raw materials, but also domestically focused distribution companies with little overseas business, have identified the exchange rate as a major risk.

Indeed, the won-dollar exchange rate exhibited significant volatility this year. Based on weekly closing prices, the annual average exchange rate of the won against the dollar was 1,422 won, surpassing the level seen during the foreign exchange crisis in 1998 (1,394.97 won) and reaching a record high. The highest closing price was 1,484.1 won on April 9, and the lowest was 1,350.0 won on June 30. By quarter, the average exchange rate was highest in the first quarter at 1,452.66 won, dropped to 1,404.04 won in the second quarter and 1,385.25 won in the third quarter, then rebounded to 1,450.98 won in the fourth quarter. On December 30, the last trading day of the year, the won-dollar exchange rate closed at 1,439 won.

The market attributes the weakness of the won primarily to the prolonged interest rate gap between Korea and the United States, as well as increased demand for dollars due to expanding overseas investments by individuals and companies. As a result, the prevailing view is that exchange rate volatility will remain significant next year. Major financial institutions predict that the won-dollar exchange rate is likely to fluctuate around 1,400 won in the coming year.

Concerns Over Weakening Domestic Consumption: "Tightening Belts Further"

Among respondents, 66.7% pointed to weakening domestic consumption as the key uncertainty in next year's business environment. It appears that companies are more concerned about the speed and sustainability of consumption recovery than about the overall direction of the economy itself.

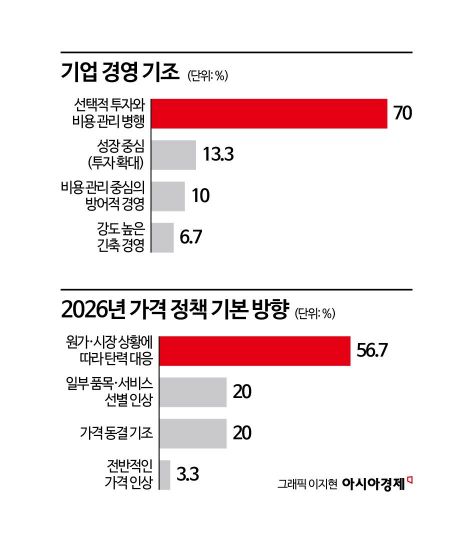

As a result, companies are generally moving toward more conservative pricing policies and investment strategies. Only 3.3% of companies indicated a general price increase as their basic direction. In contrast, the most common response, at 56.7%, was to "respond flexibly depending on costs and market conditions," followed by price freezes (20.0%) and selective increases for certain products or services (20.0%).

Management strategies also reflected a focus on control. Seventy percent of respondents chose "selective investment combined with cost management" as their management approach for next year. Only 13.3% opted for growth-oriented investment expansion, while 16.7% selected defensive or austerity management focused on cost control.

When companies considering austerity or efficiency-driven management were asked about their main focus, the most frequently cited areas were strengthening inventory and operational efficiency management (56.7%) and cost reduction and organizational streamlining (53.3%). While drastic measures such as workforce restructuring or large-scale business reorganization were found to be limited, the analysis suggests that management strategies are shifting toward enhancing overall operational efficiency.

Differences in Response Strategies by Industry

By industry, there were differences in perceptions and response strategies regarding next year's business environment. While domestic demand and exchange rate burdens were common variables, the priorities and approaches varied by sector.

Offline distribution companies, such as department stores and large supermarkets, identified both weakening domestic consumption and exchange rate volatility as burdens. With delayed consumption recovery and the burden of fixed costs, these companies are focusing more on improving the efficiency of existing stores and businesses rather than making new investments. E-commerce and convenience store sectors cited intensified competition and cost burdens as key variables. Although growth continues, rising labor and logistics costs and margin pressures from promotional competition have led many companies to respond that they will defend profitability by enhancing operational efficiency and inventory management.

Food companies recognized exchange rates and rising raw material prices as the most direct risks. Given their high proportion of imported raw materials, exchange rate fluctuations immediately translate into cost pressures. However, in terms of pricing policy, a cautious stance toward overall price hikes was evident due to concerns about weakened consumption.

The fashion and cosmetics sectors cited domestic market slowdown and uncertainties in overseas markets as major risks. In addition to exchange rate volatility, intensified local competition and non-tariff barriers were mentioned as burdens. However, compared to other sectors, a relatively higher proportion of these companies chose growth-oriented investments, reflecting their intention to continue seeking growth opportunities based on brand competitiveness and overseas demand.

Nevertheless, more than half of the companies (56.6%, or 17 companies) expected sales to increase next year. Of these, 23.3% (7 companies) anticipated growth of "over 5%," while 33.3% (10 companies) expected an increase of "1-4%." Responses indicating sales would remain similar to this year accounted for 30.0% (9 companies), while only 13.3% (4 companies) expected a decrease. Operating profit forecasts were similar.

Among respondents, 63.4% (19 companies) projected that operating profit would improve next year. Of these, 46.7% (14 companies) expected "1-4% improvement," and 16.7% (5 companies) anticipated "over 5% improvement." The proportion expecting operating profit to remain similar to this year was 23.3% (7 companies), while those forecasting a decline accounted for 13.3% (4 companies). While expectations for an economic and consumption recovery are not high, many companies believe that results can be defended through cost management and operational efficiency. Notably, there were no responses anticipating a "sharp deterioration" in sales or operating profit. Despite heightened caution regarding the business environment, this suggests that the potential for significant volatility in performance is seen as limited.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)