Record-High Exports for Food and Cosmetics

United States Becomes Largest Market; Growth Accelerates in Europe and the Middle East

The food and cosmetics industries are emerging as new growth engines for South Korea's exports. In a year when South Korea's exports have reached a record high of $700 billion for the first time, the export structure, which had been heavily concentrated on certain manufacturing sectors such as semiconductors and automobiles, is gradually diversifying toward consumer goods. Despite U.S. tariff barriers and a global economic slowdown, K-Food and K-Beauty continue to grow, forming a key pillar of South Korea's export performance.

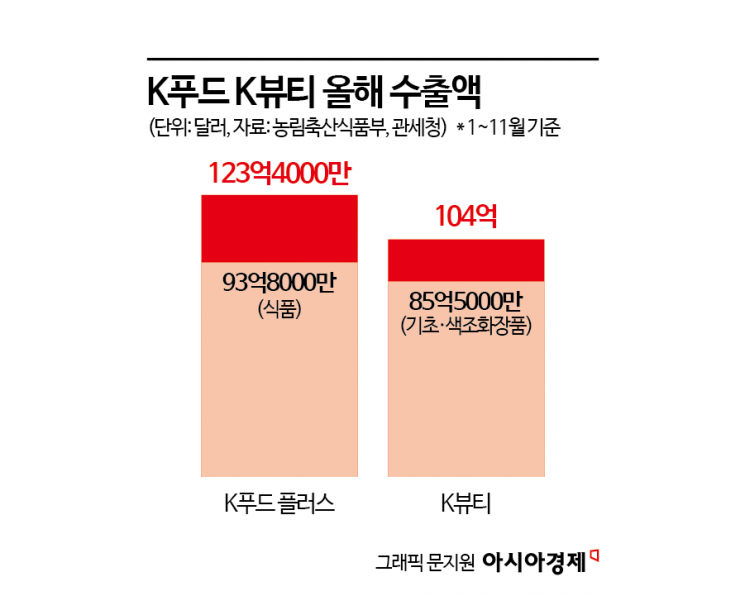

According to the Ministry of Agriculture, Food and Rural Affairs and the Korea Customs Service on December 30, provisional K-Food Plus exports from January to November this year amounted to $12.34 billion, up 4.6% from the same period last year. On an annual basis, exports are expected to reach around $13.5 billion.

During this period, agricultural and food exports totaled $9.38 billion, an increase of 4.7%. By country, the United States accounted for the largest share at $1.65 billion, up 14.0% year-on-year. This was followed by China with $1.46 billion and Japan with $1.21 billion.

By product, instant noodles (ramyeon) are the clear leader. Ramyeon has established itself as a flagship item for Korean food exports. From January to November this year, ramyeon exports reached $1.38 billion, already surpassing last year's annual figure. In Korean won terms, exports exceeded 2 trillion won for the first time ever. This marks the eleventh consecutive year of record-breaking exports since 2015.

Ice cream and grapes also showed remarkable growth. Ice cream exports reached $110 million, up 20.8% from the previous year, while grape exports increased by 51.3% to $65 million. The expansion of overseas demand for ready-to-eat meals and desserts is believed to have contributed to the growth of related export items.

The growth of K-Food is seen as having moved beyond a trend to become firmly established in local consumer cultures. Analysts attribute this to a combination of rising brand awareness fueled by the popularity of Korean content in the United States and Europe, increased demand for ready-to-eat meals, and growing interest in Korean food culture, especially its spicy flavors.

The growth of the cosmetics industry has been even steeper. By November this year, cumulative cosmetics exports reached $10.4 billion, an 11.4% year-on-year increase and an all-time high. Exports of basic skincare and color cosmetics alone totaled $8.55 billion, nearly matching last year's annual performance.

By country, the United States overtook China for the first time this year to become the largest export market for K-Beauty. From January to November, cosmetics exports to the United States totaled $1.61364 billion, up 13.6% year-on-year. K-Beauty brands have ramped up their efforts in the U.S. market, expanding beyond online-focused distribution to enter well-known multi-brand stores such as Ulta Beauty and large retail channels like Costco, thereby increasing their offline presence. Product lines are also diversifying from basic skincare to color cosmetics and hair products. During the same period, exports of hair care products to the United States soared to $95 million, a 28% increase from the previous year.

On the 13th, a foreigner carrying a shopping bag full of cosmetics is browsing cosmetics at a cosmetics store in Myeongdong, Seoul. Photo by Younghan Heo younghan@

On the 13th, a foreigner carrying a shopping bag full of cosmetics is browsing cosmetics at a cosmetics store in Myeongdong, Seoul. Photo by Younghan Heo younghan@

The regions with the most notable export growth rates were Europe and the Middle East. Exports to Poland, where K-Beauty distribution platform Silicontwo’s European logistics center is located, reached $224.14 million, a 125% increase from the previous year. This was followed by the United Kingdom ($165.7 million, up 37.2%), France ($107.64 million, up 77.7%), and the Netherlands ($89.94 million, up 24.5%). In the Middle East, exports to the United Arab Emirates (UAE), where Silicontwo has a logistics hub, reached $234.28 million, up 65% year-on-year.

The government has announced plans to expand support for consumer goods exports, designating them as a next-generation growth engine. The goal is to increase consumer goods exports by 64% over the next five years to reach $70 billion by 2030. To this end, the government will expand trade insurance for consumer goods companies to 25 trillion won by 2030. Insurance premiums will be discounted by up to 30%, and new low-interest loans will be introduced for K-Beauty and food companies. The government also plans to provide export marketing and raw material procurement funds at annual interest rates in the 2% range.

Lee Eunhee, a professor of consumer studies at Inha University, said, "This year, K-Food and K-Beauty gained attention thanks to the popularity of Korean content," adding, "While exports may continue to grow next year, in the long term, the focus should shift from promoting individual brands to promoting the industry as a whole."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)