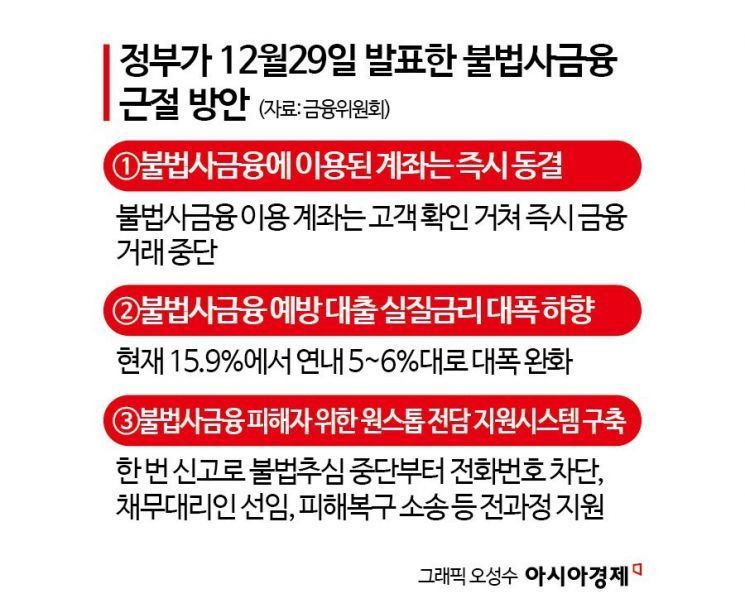

Strengthening Systems to Eradicate Illegal Private Lending

Immediate Suspension of Financial Transactions for Reported Accounts

Effective Interest Rate for Illegal Private Loan Prevention Loans to Be Significantly Reduced from 15.9% to Around 5%

One-Stop Comprehensive Support System to Provide Swift Assistance to Victims

On the morning of the 29th, Eokwon Lee, Chairman of the Financial Services Commission, inspected the performance of illegal private loan countermeasures at the Seoul Financial Welfare Counseling Center Central Branch in Dongjak-gu, Seoul. He listened to opinions from field experts and related organizations and announced additional institutional improvement plans to eradicate illegal private loans. Financial Services Commission

On the morning of the 29th, Eokwon Lee, Chairman of the Financial Services Commission, inspected the performance of illegal private loan countermeasures at the Seoul Financial Welfare Counseling Center Central Branch in Dongjak-gu, Seoul. He listened to opinions from field experts and related organizations and announced additional institutional improvement plans to eradicate illegal private loans. Financial Services Commission

The government is moving forward with measures to swiftly freeze accounts used in illegal private financial transactions in order to completely eradicate illegal private lending. For funds frozen in these accounts, the government will also support victims in reclaiming their money quickly by assisting with return lawsuits. In addition, the effective interest rate for illegal private loan prevention loans, which previously reached as high as 16%, will be significantly reduced to around 5-6%.

Accounts Reported for Illegal Private Lending Victimization to Be Immediately Suspended

On the morning of the 29th, Eunok Lee, Chairman of the Financial Services Commission, announced these plans during a field meeting titled "Eradicating Illegal Private Lending Through Strengthened Roles in the Financial Sector" held at the Seoul Financial Welfare Counseling Center in Dongjak-gu, Seoul.

According to the Financial Services Commission, if a victim reports illegal private lending to the Financial Supervisory Service, or if the Financial Supervisory Service becomes aware of an account used for illegal private lending through a tip-off, the use of the account will be suspended immediately. Afterwards, the financial institution will verify the legitimacy of the account through enhanced due diligence (EDD). If the account is confirmed to be legitimate, transactions will be restored; if it is found to have been used for illegal private lending, transactions will be blocked.

Chairman Lee stated, "If the Financial Supervisory Service receives a report about an account into which victims have transferred money for interest, principal, late fees, extension fees, or other purposes, the Service will notify the relevant bank. The bank will then verify the actual ownership of the account, the purpose of the transactions, and the source of the funds." He added, "Until this customer verification is complete, no financial transactions will be allowed." He further explained, "For criminal funds frozen in these accounts, we will also support victims with free return lawsuits through the Korea Legal Aid Corporation, so that they can reclaim their money based on the results of police investigations."

The Financial Services Commission explained that, under current law, victims must file a civil lawsuit to recover criminal funds. Lim Hyungjun, Director of Household Finance at the Financial Services Commission, said, "To recover their money, it is important for victims to identify the illegal lender and file a lawsuit. Under this plan, the Financial Supervisory Service will receive the results of police investigations and forward them to the Korea Legal Aid Corporation to support victims."

There are concerns that the government's aggressive push to eradicate illegal private lending may lead to a balloon effect, with illegal collection methods diversifying, such as using the debtor's check card or exploiting gift cards. Regarding this, Director Lim said, "It is true that various methods are emerging, such as using check cards that are difficult to trace," and added, "We are discussing with financial institutions ways to block such loopholes."

The effective interest rate for illegal private loan prevention loans, currently at 15.9%, will also be lowered. These loans, supplied at an annual scale of about 200 billion won, are available even to financially excluded groups such as those with overdue payments, but due to low recovery rates, the interest rates have been high. Starting this year, the government will lower the interest rate for these products to 12.5% per year, and introduce a payback system that returns 50% of the interest paid upon full repayment, reducing the effective interest rate burden to around 6.3%. In particular, for socially disadvantaged groups such as basic livelihood security recipients, the near-poor, and self-support workers, the interest rate will be reduced to 9.9% per year, and the effective interest rate burden upon full repayment will be lowered to around 5%.

One-Stop Dedicated Support System to Provide Swift Assistance to Victims

A one-stop dedicated support system will also be established for victims of illegal private lending. Previously, even if victims reported to the government or related agencies, it was difficult to understand the roles and procedures of each institution, and there were criticisms about insufficient updates and post-management after reporting. Going forward, once a victim reports illegal private lending, a comprehensive system will be in place to support all recovery procedures at once, including stopping illegal collection, blocking related phone numbers and accounts, appointing a debtor representative, requesting a police investigation, and filing lawsuits for the return of unjust enrichment.

The Financial Services Commission plans to assign a dedicated staff member from the Integrated Support Center for Inclusive Finance when a victim reports a case to the Financial Supervisory Service, providing assistance throughout the entire process of reporting, investigation requests, and legal relief, which can be difficult for victims to handle alone. Chairman Lee emphasized, "Previously, the procedures for reporting illegal private lending victimization were complicated, and many victims gave up midway due to lack of updates and insufficient post-management. From now on, regardless of the reporting channel, a dedicated staff member at the Integrated Support Center for Inclusive Finance will assist throughout the entire recovery process."

Initial response measures will also be strengthened to ensure that harm from illegal collection activities is stopped immediately. Currently, before a debtor representative is appointed (which takes about 10 days), the Financial Supervisory Service sends a warning text to illegal collectors, notifying them of the appointment of a representative and impending legal action. In the future, however, Financial Supervisory Service staff will directly call and verbally warn illegal collectors. In addition, if a loan contract is deemed anti-social and subject to nullification of principal and interest, the Financial Supervisory Service will issue a nullification confirmation letter in its name to notify the illegal lender.

Measures will also be implemented to prevent consumers from being exposed to illegal private lending through online loan brokerage sites, banner advertisements, and similar channels. In the past, the process of transferring a borrower's phone number to certain lenders through online loan brokerage or advertisements has resulted in exposure to illegal private lending. From now on, the use of a safe number within loan brokerage sites will be mandatory to ensure that borrowers' phone numbers are not transferred or exposed to lenders.

Meanwhile, the Financial Services Commission and the Journalists Association of Korea announced "Reporting Standards for Preventing Damage from Illegal Private Lending and Excessive Debt" on the same day. The reporting standards prioritize the protection of victims' human rights and interests.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)