Foreign Investors Net Buy Over 4 Trillion Won in KOSPI This Month

Turn to Net Buying After Selling 14 Trillion Won Last Month

Institutions Also Purchase Over 5 Trillion Won This Month

Both Foreign Investors and Institutions Focus Net Buying on Semiconductors

Foreign investors and institutions are continuing their net buying, driving the year-end rally in the stock market. Both foreign investors and institutions are focusing their net purchases on semiconductor stocks. There is an outlook that if the exchange rate stabilizes, foreign investors, who have turned to net buying after a month, will continue their buying momentum.

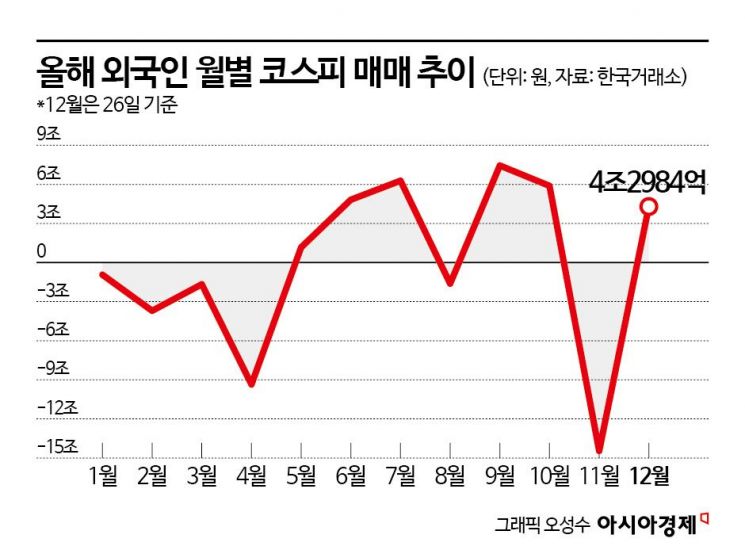

According to the Korea Exchange on December 27, foreign investors have maintained net buying for four consecutive days in the KOSPI market. Over these four days, they purchased a total of 4.3678 trillion won. Considering that their total net buying for this month stands at 4.2984 trillion won, it appears that a strong influx of buying has occurred in the past four days.

Institutions have also continued net buying for five consecutive days in both the KOSPI and KOSDAQ markets. Over the past five days, institutions net bought 3.4038 trillion won in the KOSPI market and 730.3 billion won in the KOSDAQ market.

This month, foreign investors and institutions have supported the index with their continued net buying. Foreign investors turned to net buying after a month. Last month, they recorded the largest net selling of the year, offloading more than 14 trillion won. Institutions have net bought 5.4694 trillion won this month. While individuals sold approximately 9.8 trillion won this month, foreign investors and institutions absorbed these sales, leading the index higher. The KOSPI rose 5.17% this month. Although the 4,000-point level broke at the end of last month, the buying by foreign investors and institutions this month helped the index settle above the 4,100-point mark.

Both foreign investors and institutions concentrated their buying on semiconductor stocks. This month, foreign investors bought 2.104 trillion won worth of SK Hynix, making it their largest purchase, followed by a net purchase of 1.8707 trillion won in Samsung Electronics. The combined net buying of these two stocks surpassed the total net buying in the KOSPI market for the month, indicating a strong focus on SK Hynix and Samsung Electronics. Institutions net bought 1.8821 trillion won of Samsung Electronics, making it their top purchase, followed by 1.3661 trillion won of SK Hynix.

This concentration of buying in semiconductors by foreign investors and institutions is attributed to eased concerns about artificial intelligence (AI) following Micron's recent earnings announcement. Thanks to the buying by foreign investors and institutions, Samsung Electronics surged 5.31% on December 26, closing at 117,000 won, marking an all-time high. Lim Jeongeun, a researcher at KB Securities, stated, "Samsung Electronics soared more than 5% to a record high, driven by multiple positive factors, including the favorable impact from Micron, an optimistic industry outlook, and expectations of policy benefits." She added, "On this day, the net buying of the electrical and electronics sector by foreign investors and institutions amounted to about 1.7 trillion won, exceeding the total net buying in the KOSPI market."

There is analysis that the sustainability of foreign investors' buying depends on the stability of the exchange rate. Due to strong verbal intervention by the foreign exchange authorities and news of the National Pension Service resuming its strategic currency hedging, the won-dollar exchange rate closed at 1,440.3 won on December 26, down 9.5 won from the previous trading day. During the session, it even fell below 1,430 won. Lee Sunghoon, a researcher at Kiwoom Securities, commented, "If expectations grow that the previously high upward pressure on the exchange rate will stabilize downward, this could serve as a trigger for the inflow of foreign capital into the domestic stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)